FOMC preview: Fed on hold, as independence fears and Dollar’s demise in focus

- Fed on pause.

- A hot US economy could thwart rate cut hopes.

- A tricky economic outlook for future Fed policy.

- Fed to signal maximum flexibility.

- No rate cut expected in H1.

- FOMC can’t stem dollar decline.

- Fed independence risks heat up ahead of next chair pick.

- Why Blackrock executive should be Trump’s pick for Fed chair.

The Federal Reserve will announce its latest policy decision later today at 1900 GMT, with the chair of the Federal Reserve giving a press conference shortly afterwards. There is less than a 3% chance of a rate cut being priced by the Federal Funds Futures market and interest rates are expected to remain unchanged at 3.5% - 3.75%.

Fed on pause

It is now highly likely that the Fed has paused its rate-cutting cycle, and while the focus has been on the political crisis around Jerome Powell, several Fed officials have said that they believe US interest rates do not need to be lowered any further, after 75bps of cuts since September.

A hot US economy could thwart rate cut hopes

Since the last Federal Reserve meeting, US economic data has surprised to the upside, suggesting that the US economy is in robust health. The unemployment rate is at 4.4%, and US Q4 GDP growth is expected to top 5.4%, according to the latest forecast from the Atlanta Fed’s GDPNow model.

A tricky economic outlook for future Fed policy

The Federal Reserve will need to navigate a tricky economic outlook. On the one hand, there is a combination of strong growth and stubborn inflation, US headline CPI is 2.7%, and the core rate is 2.6%. However, above trend productivity for 2026, due to the uptake of AI, could dampen inflation pressures in the second half of this year.

Fed to signal maximum flexibility

Against this backdrop, we expect Jerome Powell to use his post-decision press conference to signal maximum flexibility when it comes to future rate decisions. The Fed wants to keep its options open, and Powell is likely to reiterate that future policy decisions will be based on the evolving economic outlook. For now, the Fed is on hold and remains in data-watch mode.

In fairness to Powell, it is extremely hard to justify further rate cuts on economic grounds. We expect the outgoing Fed chair to say that current interest rates are within the target of neutral.

No rate cut expected in H1

The Fed Funds Futures market is currently pricing in just under 2 rate cuts for this year, with the first cut not coming until late July. Interest rates are expected to end the year at 3.16%, this is 16bps higher than at the start of the year. As the US economic data has surprised on the upside, rate cut expectations have been recalibrated, with fewer cuts now expected.

Stocks surge as Dollar tumbles

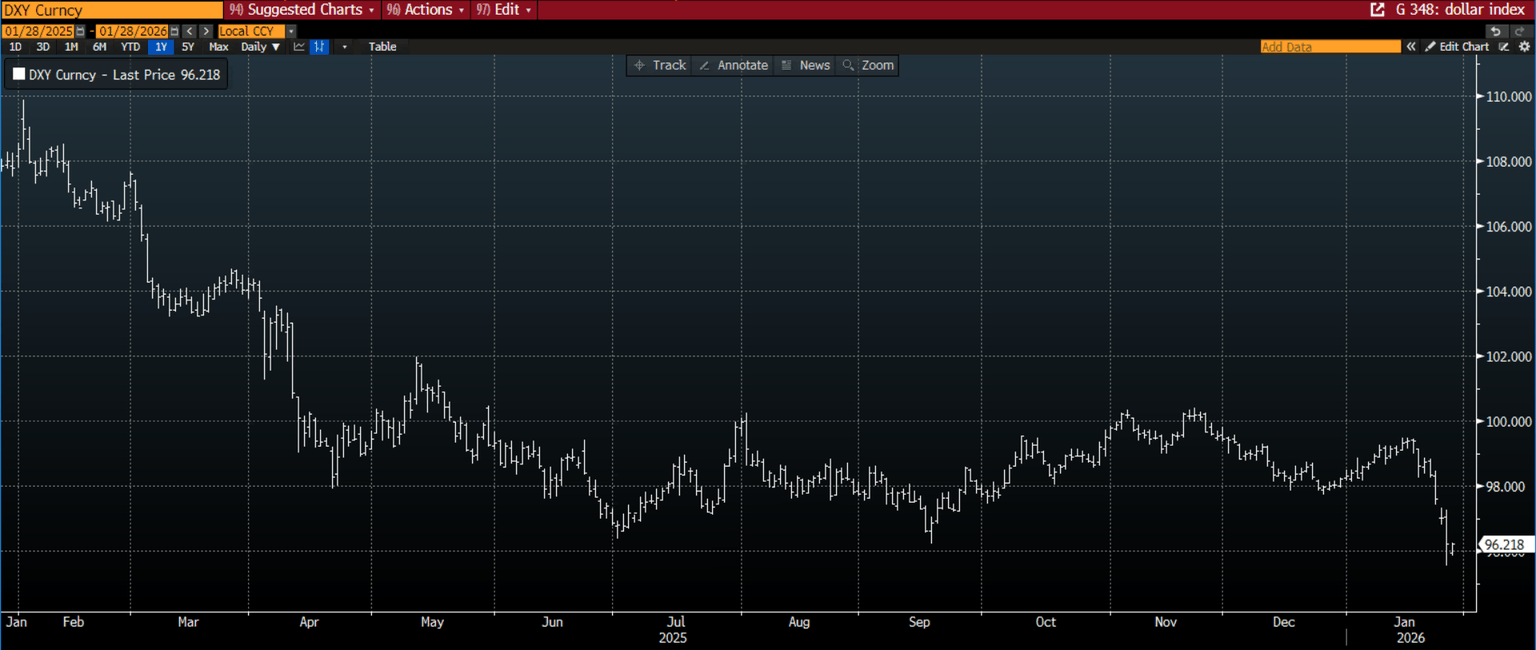

Ahead of tonight’s meeting, US stocks have reached a fresh record high and the S&P 500 breached the 7,000 level on Tuesday. The dollar has fallen 3% on a broad basis this week. The recent weakness in the dollar was down to official Japanese and US intervention to boost the yen, however, the sell off in the greenback was turbo-charged on Tuesday after Donald Trump explicitly said that he supported a weaker currency, which suggests that the dollar could fall further regardless of what the Fed does this evening.

FOMC can’t stem Dollar decline

The options market is not pricing in a big move on the back of this evening’s Fed meeting. Instead, the dollar and US equities are moving on the back of other factors, such as earnings reports and geopolitics. Even though the market has recalibrated its expectations for interest rate cuts and reduced the amount of Fed loosening it expects this year, this has not boosted the dollar. In the same way, in the past month, US Treasury yields have risen across the curve, yet this has not supported the greenback.

In the short term, the action by the Fed won’t have much impact on the dollar, but in the longer term, the FOMC may have to deal with the consequences of a weak dollar: higher input costs and inflation. Thus, as the dollar falls, we could see a further reduction in Fed rate cuts for this year, and the prospect of just one cut is a real possibility.

Fed independence risks heat up ahead of next chair pick

The dollar debasement trade is also linked to the challenge to Fed independence. Jerome Powell made it clear that pressure from the White House to lower interest rates was unacceptable. He may reiterate the importance of Fed independence at today’s press conferene, but we do not think that he will be willing to speak about his successor, Powell leaves his position as chair in May, or about the outcome of the Supreme Court case against Fed member Lisa Cook.

The bond market has reacted to the threat to Fed independence and Treasures have underperformed this year. In the coming days we expect to hear who the President will nominate as the next Fed chair. We think that any nominee will weigh on Treasuries and push up yields in the short term, as the market assumes they will be dovish regardless of the outlook for price growth.

Why Blackrock executive should be Trump’s pick for Fed chair

Rob Reider, the Blackrock executive, is the front runner to be the next Fed chair. If he is announced as Trump’s Fed chair pick, we think the market could be calmed by this. Reider has spent decades in the bond market, and is well aware of the risks, political and financial, that move Treasuries and global financial markets. Thus, he would be a prudent pick for Fed chair, in our opinion. He is also a good communicator and would have the respect of global financial markets.

If there is a whiff of a threat to Fed independence, expect the bond market to suffer, which could weigh on equities in the coming weeks.

Dollar index at a 4 year low

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.