FOMC March Minutes Preview: Will dollar rally pick up steam?

- FOMC will release the minutes of the March policy meeting on April 6.

- CME Group FedWatch Tool points to a more-than-70% probability of a 50 bps hike in May.

- US Dollar Index stays within a touching distance of multi-year highs.

The greenback has started the month of April on a firm footing on the back of the latest data releases from the US and rising odds of a 50 basis points (bps) Federal Reserve rate hike in May. The US Dollar Index (DXY), which tracks the dollar’s performance against a basket of six major currencies, is already up nearly 1% since the beginning of the month.

The Fed will release the minutes of the March policy meeting at 1800 GMT on Wednesday, April 6. On March 16, the Fed decided to hike its policy rate by 25 bps to the 0.25%-0.5% range as expected. The Summary of Economic Projections, the so-called dot plot, revealed that the median view of the Fed funds rate at the end of 2022 was raised to 1.9% from 0.9% back in December. According to the dot plot, policymakers see the Fed hiking its policy rate by 25 bps at every meeting for the rest of the year.

Since the March meeting, however, conditions have changed and investors started to evaluate the prospects of double-dose rate hikes.

The US Bureau of Economic Analysis reported on March 31 that the annual inflation, as measured by the Personal Consumption Expenditures (PCE) Price Index, climbed to 6.4% in February. More importantly, the Core PCE Price Index, the Fed’s preferred gauge of inflation, rose to 5.4% from 5.2% in January. It’s worth noting that the latest PCE inflation data do not reflect the impact of the Russia-Ukraine conflict and the coronavirus-related lockdowns in China on price pressures. It would be plausible to assume that inflation has more room to rise before finally starting to retreat.

Additionally, the March jobs report revealed that the labor market conditions continued to tighten. Nonfarm Payrolls rose by 431,000, the Labor Force Participation Rate stayed virtually unchanged at 62.4% and the annual wage inflation climbed to 5.6% from 5.2% in February.

At the post-FOMC press conference, FOMC Chairman Jerome Powell acknowledged that it was possible for the Fed to move rates up more quickly to tame inflation.

Several Fed policymakers, including Cleveland Fed President Loretta Mester and St. Louis Fed President James Bullard, voiced their willingness to frontload rate increases to preserve the Fed’s credibility and ease price pressures. As it currently stands, the CME Group FedWatch Tool shows that markets are pricing in a 74.4% probability of a 50 bps rate hike in May.

Hawkish scenario

The Fed may have backed itself into a 25 bps hike by dismissing the possibility of a 50 bps hike in its pre-meeting communication in March. In case the minutes show that policymakers considered a bigger rate increase but ended up voting for a 25 bps one to avoid a big market reaction, US Treasury bond yields could continue to rise and provide a boost to the dollar.

Market participants will also pay close attention to details surrounding the Fed’s plan to shrink the balance sheet. Powell noted that they will need to reduce the $8.9 trillion balance sheet to make sure high inflation does not become entrenched and NY Fed President John Williams said they could start doing that as early as May. The greenback could continue to find demand if the publication unveils that policymakers are willing to make large cuts to the balance sheet in the second half of the year.

Dovish scenario

Policymakers are worried about a prolonged Russia-Ukraine conflict weighing on global economic activity. Powell, however, explained that they were more concerned about the impact of the crisis on inflation rather than growth.

A cautious language on future rate increases amid heightened uncertainty could be seen as a dovish development and trigger a dollar selloff.

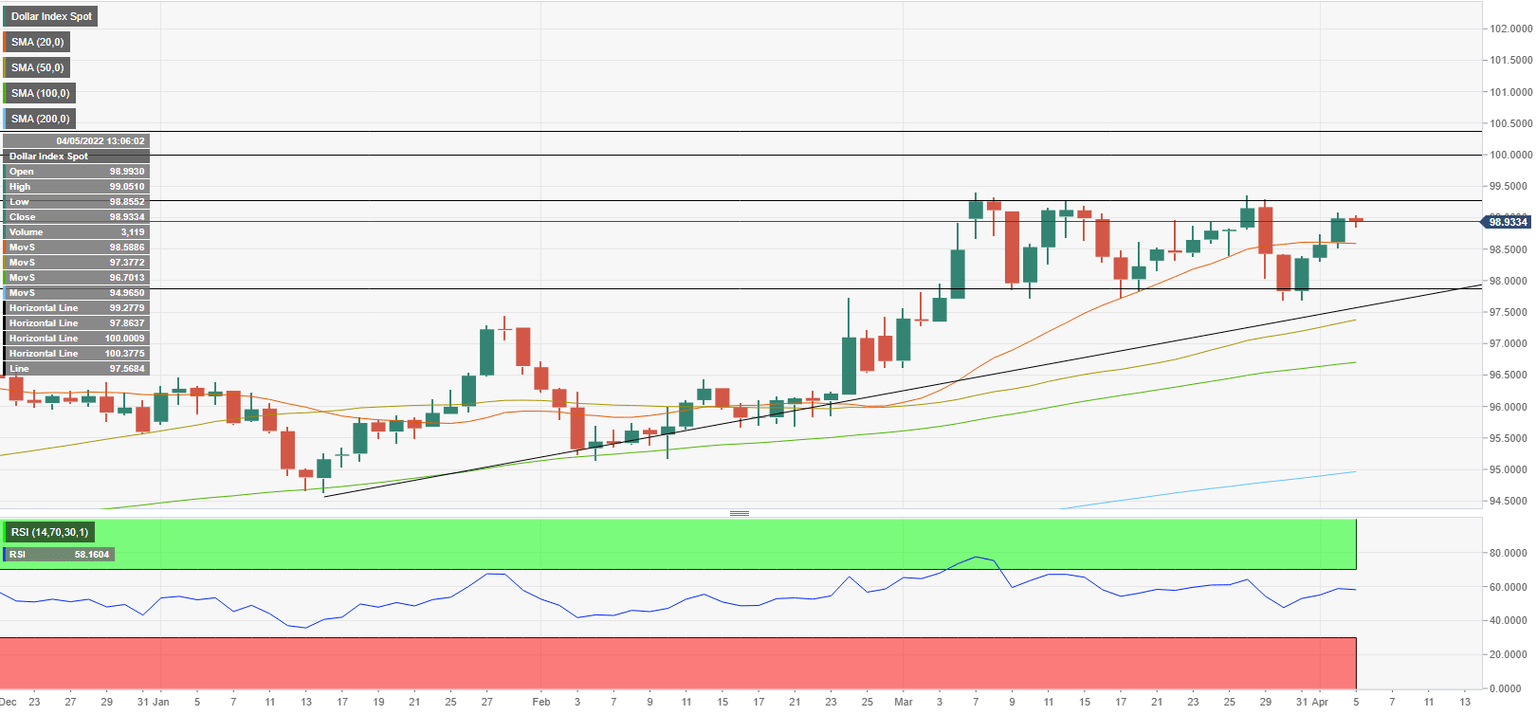

DXY Technical Outlook

DXY closed above the 20-day SMA on Monday after staying below that level in the previous three trading days. Confirming the bullish shift in the near-term technical outlook, the Relative Strength Index (RSI) indicator advanced to 60.

On the upside, 99.40 (static level, multi-year high set in early March) aligns as first resistance. With a daily close above that level, the index could target 100.00 (psychological level) and 100.40 (static level).

In case the dollar faces selling pressure on a dovish surprise, DXY could drop to 97.80 (static level). If sellers manage to flip that level into resistance, further losses toward 97.30 (50-day SMA) and 96.70 (100-day SMA) could be witnessed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.