FOMC cuts rates, but December in doubt

- Higher inflation and flat growth data ahead of ECB meeting.

- FOMC cuts rates, but December in doubt.

- US-China deal helps ease trade fears, but earnings caution remains.

A somewhat underwhelming start to the day for European markets, with equities struggling for direction in the wake of a plethora of big ticket drivers that have occurred over the past 24-hours. From a wider perspective, the Fed rate cut and wide-reaching US-China trade agreement should provide grounds for optimism. However, with Powell warning that a December rate cut is far from a guaranteed, and both Microsoft and Meta earnings set to spark a sharp move lower at the open, there is a degree of caution ahead of a day that sees yet more Mag7 earnings and central bank decisions. From a European perspective, today has plenty to delve into without even considering the events further afield. The ECB rate decision looks like an opportune moment for Lagarde to draw a line under the easing process, with the bank likely to keep some powder dry in anticipation of future crises. This morning has provided a fresh deluge of data that saw elevated inflation rates across Spain (0.7% MoM), and a number of German regions. Meanwhile, growth figures made for somewhat dour reading after both Germany and Italy saw their economies flatline over the third quarter. Thus, with inflation on the rise, non-existent growth, and a potential hawkish ECB tone, it is no wonder why we are seeing European stocks struggle for traction today.

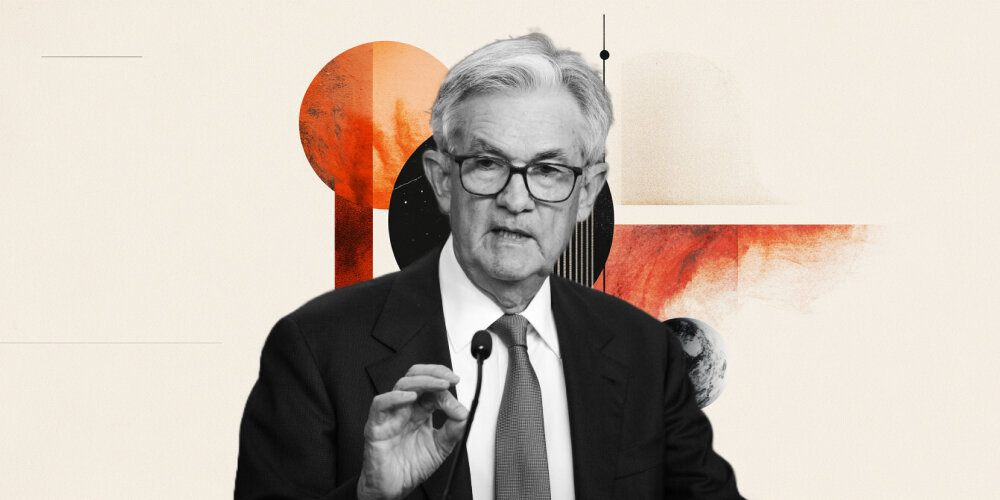

Yesterday’s FOMC meeting saw Jeremy Powell deliver the widely anticipate to 25 basis point rate cut priced in by the markets. However, we did see some push back, with Trump’s pick Stephen Miran voting for an oversized 50bp cut, while Schmid favoured no cut at all. Perhaps the most notable shift in rate expectations came thanks to the comment that there were "strongly differing views about how to proceed in December," with a final 2025 cut "not to be seen as a forgone conclusion." This shifted the market pricing for a December cut to 70%; a figure that stood at 95% just a few days ago. Aside from this, the bank warned that they remain data dependant, and with inflation at 3% it is no wonder why there is a degree of indecision. From a quantitative tightening perspective, the Fed announced that they will draw a line under that process in December, concluding the balance sheet reduction seen since the multi-year expansion during the pandemic. Markets understandably took a dive in the immediate aftermath of the meeting, with traders concerned that their assumed December rate cut may not be so certain. Meanwhile, the US dollar gained traction on the prospect of a more cautious approach to monetary easing. Ultimately this meeting served to highlight the importance of data going forward, with the eventual end to the shutdown bringing a period of relative sensitivity to the numbers given the implications they look to have on December rate cut hopes.

This morning saw the Trump-Xi meeting wrapped up, with the two leaders coming away with a wide-reaching agreement that will undoubtedly put the trade concerns on the back-burner for a while yet. The one-year agreement saw fentanyl-related tariffs cut by 10%, Chinese rare earth exports to resume, and Chinese Soybean purchases to ramp up. Crucially, the fact that we have seen tariffs dropped to 47% marks a far cry from the 145% seen back in April. This should be enough to push markets higher, but the fact that Scott Bessant largely pre-empted much of this announcement has taken some of the edge off the market reaction. Meanwhile, yesterday’s disappointment around the Meta (-8%) and Microsoft (-3%) earnings means that we have a potential drag from the big tech names as we move into a session that sees Apple and Amazon report after the close.

Author

Joshua Mahony MSTA

Scope Markets

Joshua Mahony is Chief Markets Analyst at Scope Markets. Joshua has a particular focus on macro-economics and technical analysis, built up over his 11 years of experience as a market analyst across three brokers.