Five signs, led by grains, say Food Prices will keep going up

Agricultural commodity prices say food price inflation has not yet peaked.

Wheat Futures chart courtesy of Nasdaq

Soybean Futures

Soybean Futures chart courtesy of Nasdaq

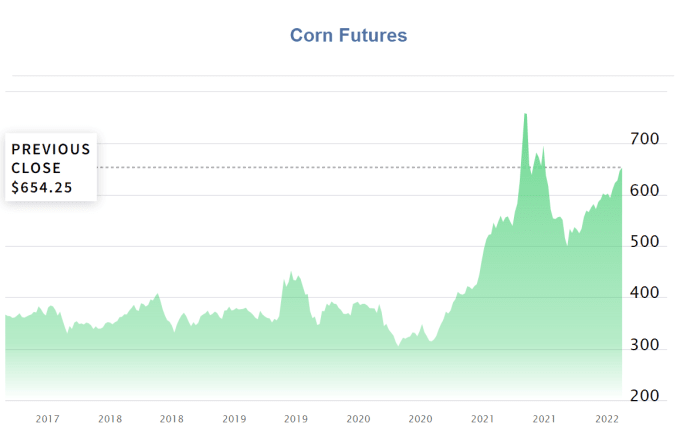

Corn Futures

Corn Futures chart courtesy of Nasdaq

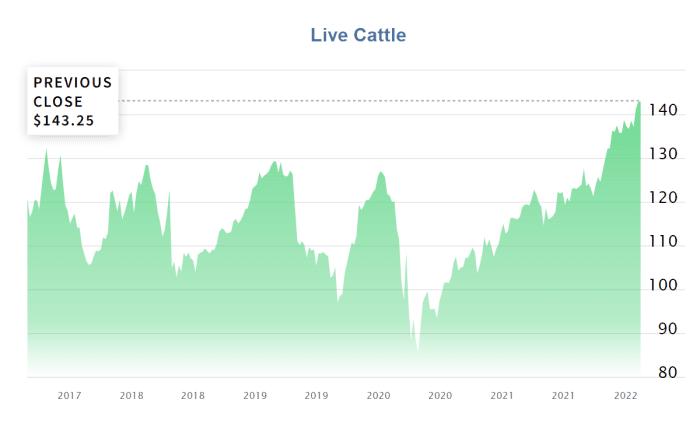

Live Cattle Futures

Live Cattle Futures chart courtesy of Nasdaq

Lean Hogs

Lean Hogs Futures chart courtesy of Nasdaq

Global Wheat Exports

The Wall Street Journal reports Russia-Ukraine Tensions Drive Global Wheat Prices Higher

The two nations combined account for 29% of global wheat exports, according to data from the U.S. Agriculture Department. The nearby Black Sea serves as a major conduit for international grain shipments and Ukraine is also among the top exporters of barley, corn and rapeseed.

The mounting tensions and growing militarization along the Russia-Ukraine border have helped drive wheat futures traded in Chicago up over 7% over the past two weeks to nearly $8 a bushel Monday—which is just below a nearly decade high of $8.50 a bushel reached last year.

Ukraine is renowned as the breadbasket of Europe, thanks in part to its nutrient-rich “black earth” soils. But its key wheat growing regions and ports lie in Ukraine’s south and east, putting them close to Russian-held territory, analysts said. Ukraine’s Kharkiv Oblast, which borders both Russia and the separatist-held regions of Luhansk and Donetsk, is Ukraine’s most productive wheat region, according to data from the USDA.

Black Sea Geoeconomics

Data from USDA chart courtesy of Aljazeera

Aljazeera comments on Russia, Ukraine and the Global Wheat Supply.

Russia is the world’s largest exporter of wheat, accounting for more than 18 percent of international exports.

In 2019, Russia and Ukraine together exported more than a quarter (25.4 percent) of the world’s wheat, according to the Observatory of Economic Complexity

Percentages are higher today.

Corn Too

Reuters reports Ukraine’s unmatched corn crop gains encroach on rival exporters

Today, Ukraine accounts for 16% of global corn exports and 12% of wheat, but the Black Sea country was nearly a non-factor in trade at the start of the century, especially for corn.

Biden Says "I Feel Your Pain", He Means His Pain in Polls

Please note Biden Says "I Feel Your Pain", He Means His Pain in Polls

Feel "My" Pain

When Biden says he feels your pain he is lying.

What he really means is he feels the pain of the upcoming midterm blowout in which Republicans take the House and Senate.

If Biden was honest he would be saying I feel "my" pain, not I "feel" your pain.

He still wants "free" education, although he reluctantly concedes it will not happen. He still has all sorts of environmental demand all of which will raise the price of energy.

And he wants to unionize everything which of course will increase prices and encourage more outsourcing.

In short, Biden is a liar and a hypocrite who feels only his pain, not yours.

That applies to politicians in general. But the person in office is the one most deserving of attack at the moment.

CPI Up Most in 40 Years

For more on the CPI, please see CPI Jumps Most Since February 1982, Up at Least 0.5% 9 Out of Eleven Months

Alleged "Benefits of Running the Economy Hot"

Meanwhile, Charles Evans, president and chief executive officer of the Chicago Fed wants to run the economy hot.

For discussion, please see Chicago Fed President Praises the "Benefits of Running the Economy Hot"

Finally, I fail to see how the Fed hiking or a sanction war will fix this.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc