Five fundamentals: Markets eye trade war, Oil-related geopolitics and three US consumer figures

- Sino-American trade relations and other deals remain at the top of the agenda.

- A deal between the US and Iran and Russia-Ukraine talks could upend Oil markets.

- US Retail Sales, inflation and consumer sentiment are set to trigger significant moves.

The relentless US consumer is in the limelight when it comes to data. However, a whirlwind of diplomacy – especially regarding trade – may trigger bigger action.

1) Sino-American detente

Down by 115% – the US will impose only 30% tariffs on Chinese goods while Beijing will only place 10% duties on American ones. While the accord is for only 90 days, the news provides major relief for trade and may contribute to avoiding a recession.

In addition, both sides have set a framework for negotiations to further iron out differences. One of the options on the table is reaching purchasing agreements, where China commits to buying American goods in order to decrease the trade deficit.

The current levies are still higher than before the US President Donald Trump’s 2.0 era, and may rise after 90 days. Nevertheless, the good vibes coming out of Switzerland, where the two countries met over the weekend, could lead to further accords. In addition, the channels for discussions have been reset. Markets may cheer these moves for long days.

Apart from Sino-American relations, markets will want to see progress on other deals, such as with India, Japan, and also Switzerland. The more, the merrier, but the big prize remains China.

2) War last week, peace now?

India and Pakistan, two nuclear-armed nations, seemed to step away from the brink of an all-out war. Nevertheless, that is one geopolitical front that the world will be watching.

On the other hand, US President Trump will be visiting the Middle East, and one of his goals is to reach a deal with Iran. Both sides reported progress, and the ceasefire between the US and Yemen's Houthis is seen as a step toward an accord on Iran's nuclear facilities.

If Washington and Tehran announce an exchange of ambassadors, Oil prices would suffer. While the Islamic Republic exports Crude, it is below its capacity, suffering from chronic underinvestment.

The third and last geopolitical front is in Europe. Russian President Vladimir Putin called for direct talks with Ukraine, while Kyiv insists on a 30-day ceasefire first. Either move would be good news for Europe and would add pressure on Oil prices. Untapping Russian Crude toward Europe would lift output as well.

3) US core inflation may edge up, keeping interest rate cuts away

Tuesday, 12:30 GMT. Finally – after several years, the US core Consumer Price Index (core CPI) slipped below 3% YoY in March. While the Federal Reserve (Fed) tracks another gauge of inflation, the CPI report is released earlier and another decline would provide optimism for the central bank.

However, data for April may begin reflecting Trump's tariff announcement early last month. Economists expect an increase of 0.3% in core CPI MoM, up from 0.1% recorded in March.

Investors were irritated by the Fed Chair Jerome Powell's refusal to hint at an interest rate cut coming in June, and will dislike any bump-up in price rises. A downside surprise would reopen hopes for lower borrowing costs.

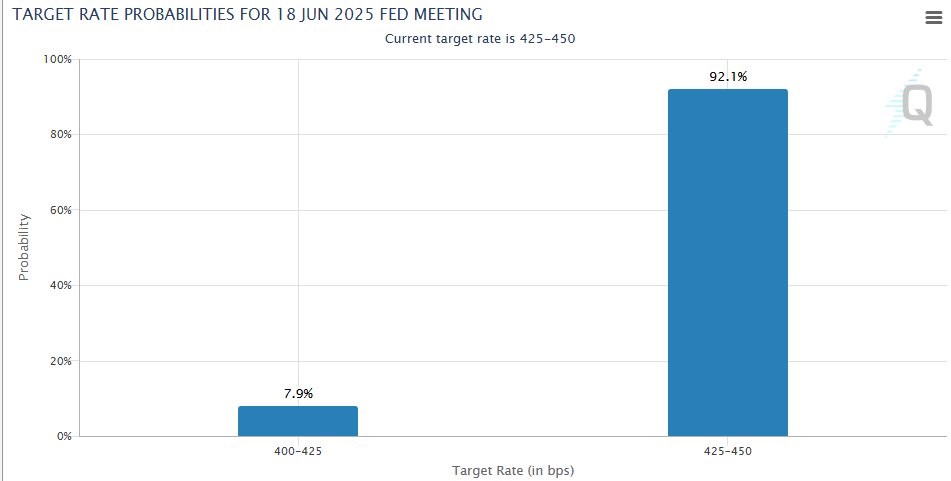

Currently, there are low chances of a rate hike in June, according to the CME FedWatch tool:

Interest rate probabilities. Source: CMEGroup.

4) US Retail Sales may be a wild card

Thursday, 12:30 GMT. Is the US consumer conveying a "business-as-usual" approach on the backdrop of tariffs? Is shopping on the rise in anticipation of higher prices? Or is it already down?

After a leap of 1.5% in headline Retail Sales in March, the economic calendar points to a modest advance of 0.1%. However, there is room for surprises on both sides.

Investors will also be eyeing the Retail Sales Control Group, which rose by 0.4% in March.

While such figures are volatile, they provide a dose of hard data on how the US economy is performing.

5) US Consumer Sentiment may extend its recovery

Friday, 14:00 GMT. The University of Michigan's Consumer Sentiment Index nearly tumbled below the 50 level in April, marking a trough unseen for long years. Fear of tariffs and also of firings at the Department of Government Efficiency (DOGE) sent sentiment down. Still, after the delay in reciprocal tariffs and other exemptions that President Trump announced, confidence picked up.

As of yet, sinking sentiment has not been echoed in hard data, such as retail sales, or evidence from credit card companies such as Visa.

Nevertheless, the magnitude of the crash in confidence has made these soft data important. The upcoming publication is the preliminary read for May.

Final Thoughts

The frenetic pace of headlines – and the fact that they can appear at any moment – means adapting quickly to new conditions is a necessity.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.