First majestic silver ($AG) broke higher from 10 year consolidation

First Majestic Silver (symbol: $AG) is a Canadian silver-mining company which operates in Mexico. It has 7 mines, although only 3 most cost-efficient mines are currently operating in San Dimas, Santa Elena, and La Encantada. It’s considered to be one of the purest silver mining companies with 60% of the revenue derived from Silver. If the price of Silver can continue to rise, the stock price of the company should rise along with it and likely at a higher percentage due to the multiple effect.

Most of silver produced today is a byproduct of mining copper, lead, and zinc. A pure silver mining company is pretty rare nowadays with the last 10 years bear market decimating the industry. Below is the revenue comparison of various silver miners.

First Majestic currently ranks number one in terms of the silver revenue’s contribution to the total revenue of the company. It’s a leverage play in silver if investors believe in the bullish potential of the underlying metal.

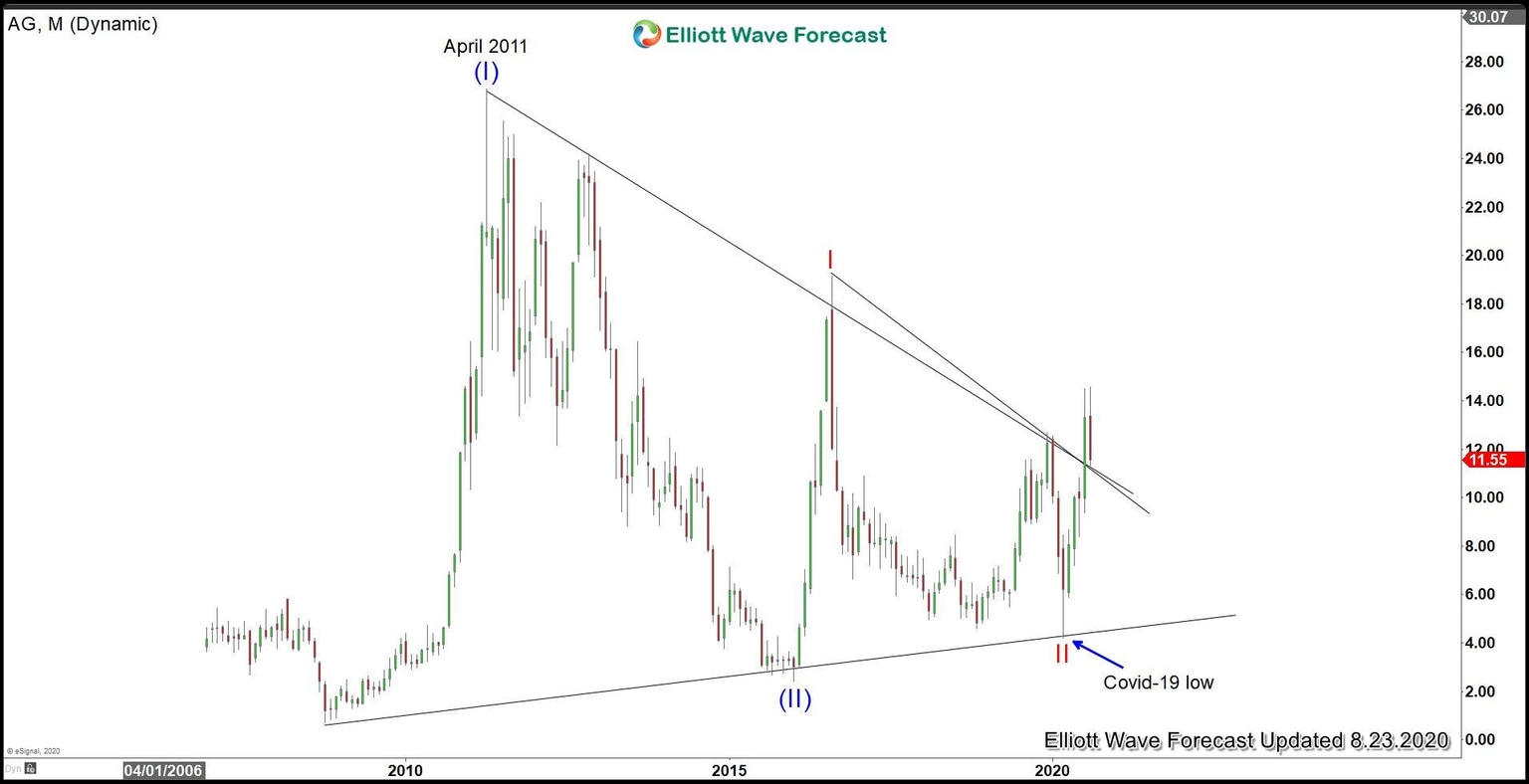

First Majestic Monthly Elliott Wave Chart

Monthly Elliott Wave chart above shows the stock has broken above 10 year consolidation. Last week price has retraced to retest the point of the breakout. As far as price doesn’t close inside the triangle again, it has chance to extend higher again. Potential Elliott Wave structure from 2009 low can be a nest where the rally to April 2011 high at $26.88 ended wave (I). Pullback to $2.4 on January 2016 low ended wave (II). Wave (III) is currently in progress where wave I ended at $19.15, and wave II ended at $4.17 during the Covid-19 selloff. Pullback from here should find support in 3, 7, or 11 swing for further upside.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com