EURUSD Forecast: Euro could extend correction toward 1.0250

- EURUSD has been fluctuating in a tight range since the beginning of the week.

- Near-term technical outlook points to a loss of bullish momentum.

- ECB President Christine Lagarde's comments failed to help the Euro.

EURUSD has been struggling to make a decisive move in either direction and fluctuating in its weekly range above 1.0300 ahead of the weekend. The near-term technical outlook shows that buyers are losing interest and the pair could extend its downward correction toward 1.0250.

While speaking at the Frankfurt Financial Conference, European Central Bank President (ECB) Christine Lagarde reiterated that they expect to raise rates further to levels needed to ensure that inflation returns to the 2% medium-term target. "It is appropriate that the balance sheet is normalized in a measured and predictable way," Lagarde added and didn't allow the Euro (EUR) to gather strength.

Later in the day, October Existing Home Sales data will be featured in the US economic docket. On Thursday, the US Census Bureau reported that Housing Starts and Building Permits declined by 4.2% and 2.4%, respectively, in October. With these figures reminding investors of the downturn in the housing market, the US Dollar (USD) lost its bullish momentum and helped EURUSD limit its losses.

Existing Home Sales are forecast to fall by 0.1%. A significant drop in this data could cause the USD to come under bearish pressure ahead of the weekend and open the door for a rebound in EURUSD.

Meanwhile, US stock index futures trade modestly lower on the day. In case Wall Street's main indexes turn south after the opening bell, EURUSD could find it difficult to gain traction and vice versa.

EURUSD Technical Analysis

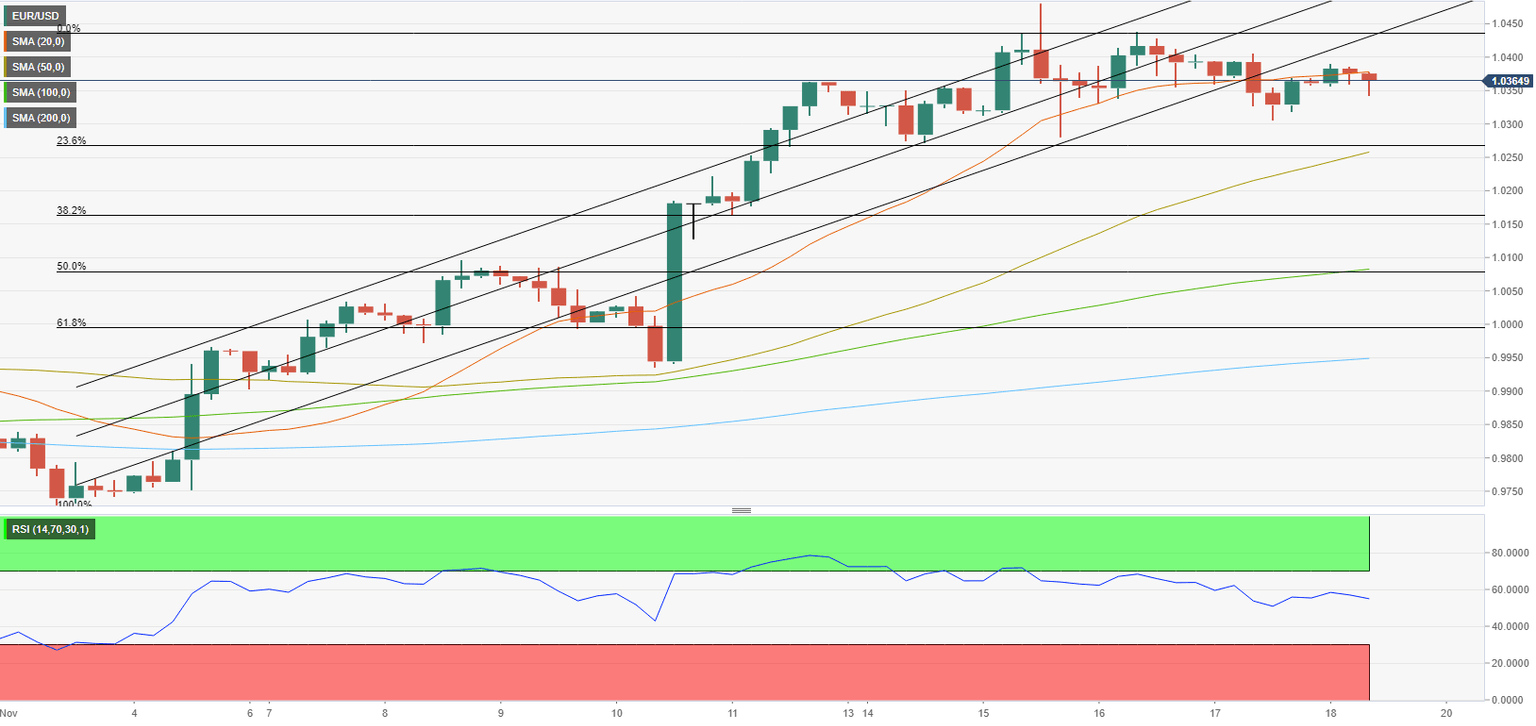

The Relative Strength Index (RSI) indicator on the four-hour chart is edging lower toward 50 and EURUSD is trading below the 20-period Simple Moving Average (SMA), suggesting that buyers are losing interest in the pair. Additionally, the pair is yet to return within the ascending regression channel after having dropped below it on Thursday.

On the downside, 1.0300 (psychological level, static level) aligns as interim support ahead of 1.0250 (50-period SMA, Fibonacci 23.6% retracement of the latest uptrend). In case the latter support fails, sellers could take action and drag the pair lower toward 1.0200 (psychological level).

Initial resistance is located at 1.0400 (psychological level, static level) before 1.0450 (end-point of uptrend) and 1.0500 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.