European Central Bank Preview: Lagarde set to lift the Euro in two out of three scenarios

- Hawks at the European Central Bank desire a 50 bps hike, an instant boon for the Euro.

- A 25 bps hike is more likely, albeit with hawkish pledges, also keeping the common currency bid.

- Only a 25 bps hike without new commitments would be bearish.

Inflation has peaked, but will it fall? The European Central Bank (ECB) faces the same uncertainty as its peers worldwide – making policymaking harder and more interesting for currency traders.

Here is the preview of the European Central Bank decision on May 4, at 12:15 GMT.

Core inflation is too high, and so is fragmentation

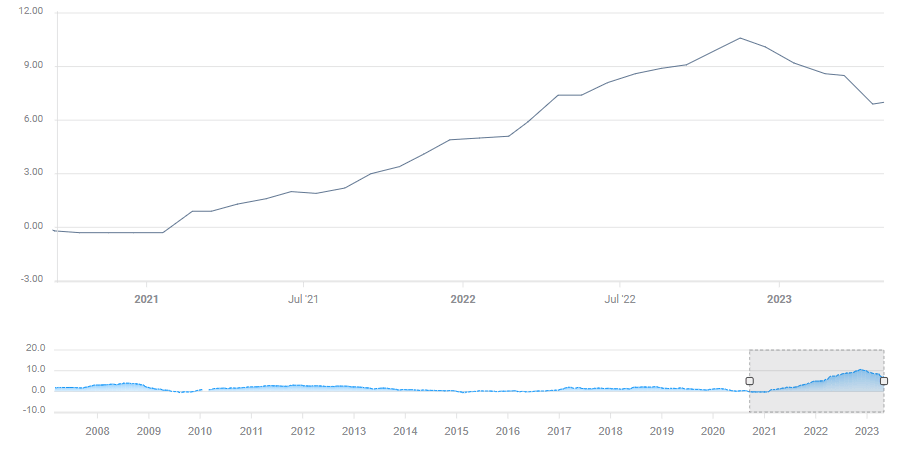

The ECB officially has a "single needle in the compass," – bringing the headline Consumer Price Index (CPI) to 2%. At 7%, according to the preliminary read for April, it is still failing in its mission. However, the peak in prices now appears to be in the rear-view mirror, and the recent fall is undoubtedly substantial.

Headline inflation is down but not out.

Source: FXStreet

Headline CPI is high but trending down, but Core CPI is stubbornly elevated. Underlying inflation, which excludes volatile food and energy prices, has barely retreated to 5.6%, showing how wide price rises have reached. The higher level of unionization in the eurozone means wage growth is also "stickier."

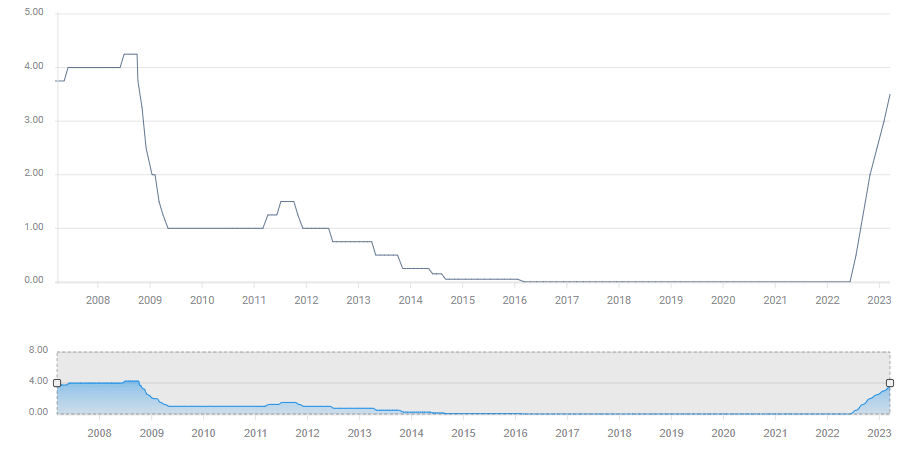

On the other hand, the Frankfurt-based institution has already raised rates from 0% to 3.5%, and the implications of these moves have yet to be fully felt. The old continent always moves slower than the US.

To further complicate matters, the Eurozone is a currency union of 20 countries with varying degrees of unemployment, growth, and inflation. While Baltic countries suffer double-digit inflation, price rises in Spain were only at 4.4% YoY in April.

The banking crisis weighing on US policymakers is less of an issue in Europe, but it may have caused some tightening of credit. It adds to uncertainty about inflation developments. Stingier bankers contribute to lowering prices.

These differences have been reflected in comments from ECB officials, with hawks demanding a fourth consecutive 50 bps hike, while others prefer a 25 bps move. Markets are leaning toward a smaller increase but leaving the door open to a bigger one.

Source: FXStreet

Apart from the decision announcement, investors will closely watch the bank's comments about future moves. Will the ECB continue hiking? How firm is such a commitment?

Here are my three scenarios

1) ECB raises rates by 25 bps, signals more to come

This outcome has the highest probability as it serves as a compromise between hawks and doves. Several months ago, the ECB announced a 50 bps increase and committed to two more such moves to appease hawks that wanted another 75 bps hike.

A similar scenario could occur now, with ECB President Christine Lagarde balancing between the need to battle inflation, and signs it is falling – in addition to the compromise between the members of her Governing Council.

In such a case, the Euro would initially fall in response to the smaller increase but would rise when Lagarde clarifies that another tightening move in June is firmly on the cards. She may be urged to signal near certainty about another move if the Fed allows further tightening. Note: I am preparing this preview ahead of the US decision.

2) ECB raises rates by 50 bps

If hawks win the argument due to sticky Core CPI or any other reason, the Euro would jump instantly and would only correct lower when traders take profits. While money markets have not ruled out such a move, it would be a bigger surprise than a 25 bps hike.

Lagarde would be unable – now willing – to reverse an upswing in the common currency due to a rate hike. A stronger exchange rate helps lower prices of imported goods.

This scenario has a medium probability.

3) ECB raises rates by 25 bps, refuses to commit to further moves

I see a low chance of such moves, as it would be a resounding victory for doves – without any reason. Inflation is still too high. If the ECB opts for a "dovish hike," investors would fear that it knows something scary about banks that markets are unaware of.

However, such a move would have higher chances if the ECB is worried about slowing growth, a potential credit crunch, or any other cause to be concerned – and this 25 bps hike would be the last one.

In this dovish scenario, the Euro would retreat at first and then plunge during Lagarde's press conference.

Final thoughts

The ECB faces hard choices as inflation and other indicators show a murkier picture. However, investors need to make choices with certainty in any environment, and an optimistic-blue-skies scenario is more likely than a not-in-this-spring decision.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.