European central bank: A holding meeting

Holding the ship steady

Running up to last weeks ECB meeting German bunds had been surprisingly resilient. While COVID-19 cases were trending higher in Europe, Bund yields were moving lower as US Treasury yields were moving lower. This dynamic was supporting the EURUSD pair, but it seemed odd. The explanation? That investors were looking through the temporary raise in COVID-19 cases to an eventual fast vaccine euro area rollout just around the corner.

The risk going into the meeting was that the ECB joined in with this rhetoric. However, they decided to keep a more neutral, holding position which has been in keeping with the rising COVID-19 cases. The ECB still sees the euro area in its COVID019 crisis phase.

The headlines

The monetary policy mandate remains pretty much the same.

-

Deposit facility rate -0.50%.

-

Main refinancing rate 0.00%.

-

Marginal lending facility 0.25%.

-

PEPP purchases over the current quarter to continue to be significantly higher.

-

Reaffirms size of PEPP program at €1.85 trillion.

-

PEPP purchases to be conducted flexibly according to market conditions.

-

QE purchases will continue at a monthly pace of €20 billion.

-

ECB stands ready to adjust all of its instruments, as appropriate.

If there was any shift out of the ECB it was from sources pieces after the event. According to multiple euro sources, the word whispered out was that ECB hawks took a break at the last meeting. ECB’s Knot was singled out and it was noted that he did not repeat his call for tapering in Q3. Remember that on April 7 ECB’s Knot said the PEPP program could start to be tapered back in Q3 and finished by March 2022. That silence speaks. It says the ECB board are more aware that the eurozone is still in COVID-19 crisis mode. This was underscored by Christine Lagarde, our resident owl at the ECB, who said the Governing Council did not consider reducing PEPP purchases and that it is premature to discuss tapering. The burden was placed on the data. The reduction of PEPP is seen as data-dependent.

What this means

The euro is pretty much where it was before the ECB rate meeting, but if anything a touch more bearish. Or at least not as optimistic as expected. However, this is the tricky part. Here are some takeaways:

-

Will investors still keep looking through the current malaise to better times ahead? If they do then keep looking at the German 10-year bund yield. If that keeps rising then we may see some euro strength come in ahead of the next ECB rate meeting in June.

-

The BoC is bullish, reducing their bond purchases, so EURCAD sellers on rallies seem reasonable as long as that dynamic remains. However, keep an eye on the Bund – Canadian 10-year bond yield spread.

-

Good data = PEPP reduction. Once we see an inkling of a recovery then EUR bulls will likely grow.

-

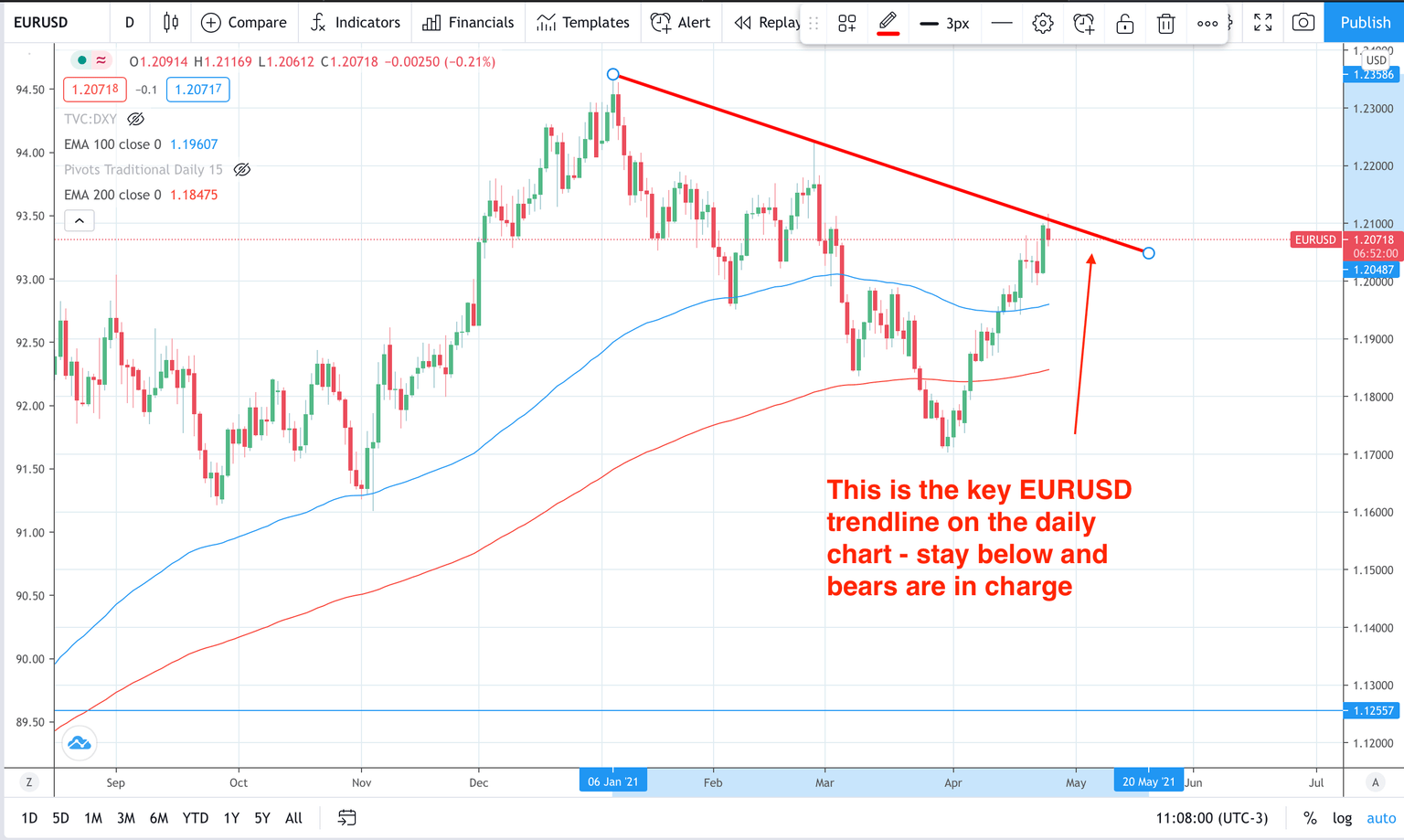

Remember the USD is key to all this with the FOMC out this week. Will they start announcing bond tapering like the BoC? It’s a key risk for the euro which is heavily influenced by the USD. EURUSD is not called the anti-dollar index for anything. See here for a helpful article on the dollar index.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.