Europe points lower ahead of Trump’s response

After three days of gains, European bourses are pointing to a softer start. Reopening optimism had overshadowed simmering US – China tensions across the week, despite several signals that relations were deteriorating. However, with tensions between the two powers now at boiling point, traders are no longer able to brush off the spat.

Risk sentiment drops

Risk off is dominating as investors look ahead to Trump’s response, provoked by China’s crackdown on civil liberties in Hong Kong, Asia’s financial hub. Stocks on Wall Street reversed on the announcement of Trump’s press conference, finishing the day lower. Asia also traded on the back foot, with Europe expected to follow suit as demand for riskier assets take a hit. Safe haven gold is building on gains from the previous session as tensions between the US and China mount, although the US Dollar is slipping lower, decoupling from falling stocks.

The clash over Hong Kong joins a list of other grievances between the world’s largest economies, including Huawei, human rights in Xinjiang, trade and currency wars.

Trump could announce sanctions on several Chinese individuals and remove Hong Kong’s special trade status or take other measures. It appears that the markets have found some solace in the fact that the trade deal remains intact, for now. The fear is that the US – China spat could hamper a fragile economic recovery from the coronavirus crisis.

In addition to Trump’s press conference, Fed Chair Jerome will give a speech, however given his numerous appearances over the past few weeks, his impact on the market is expected to be limited. Other indicators for April, such as personal income and spending will also be in focus.

Germany keeps spending

Signs that Germany kept spending in lockdown is boosting the EUR. German retail sales are significantly better than forecast. Retail sales in Europe’s largest economy dropped “just” -5.3% month on month in April, much better than the -12% decline forecast. Whilst the drop is a touch down from March’s -4% fall, this is expected to be the bottom. The fact that the bottom for retail sales isn’t as bad as feared has boosted he EUR which is trading above $1.11.

EZ CPI

Attention will now turn to Eurozone inflation figures. The German retail sales inspired push higher for the euro could be short lived. Expectations are for Eurozone inflation to increase at just 0.2% month on month, whilst annual inflation of just 0.8% could drag on demand for the common currency, especially ahead of next week’s ECB meeting.

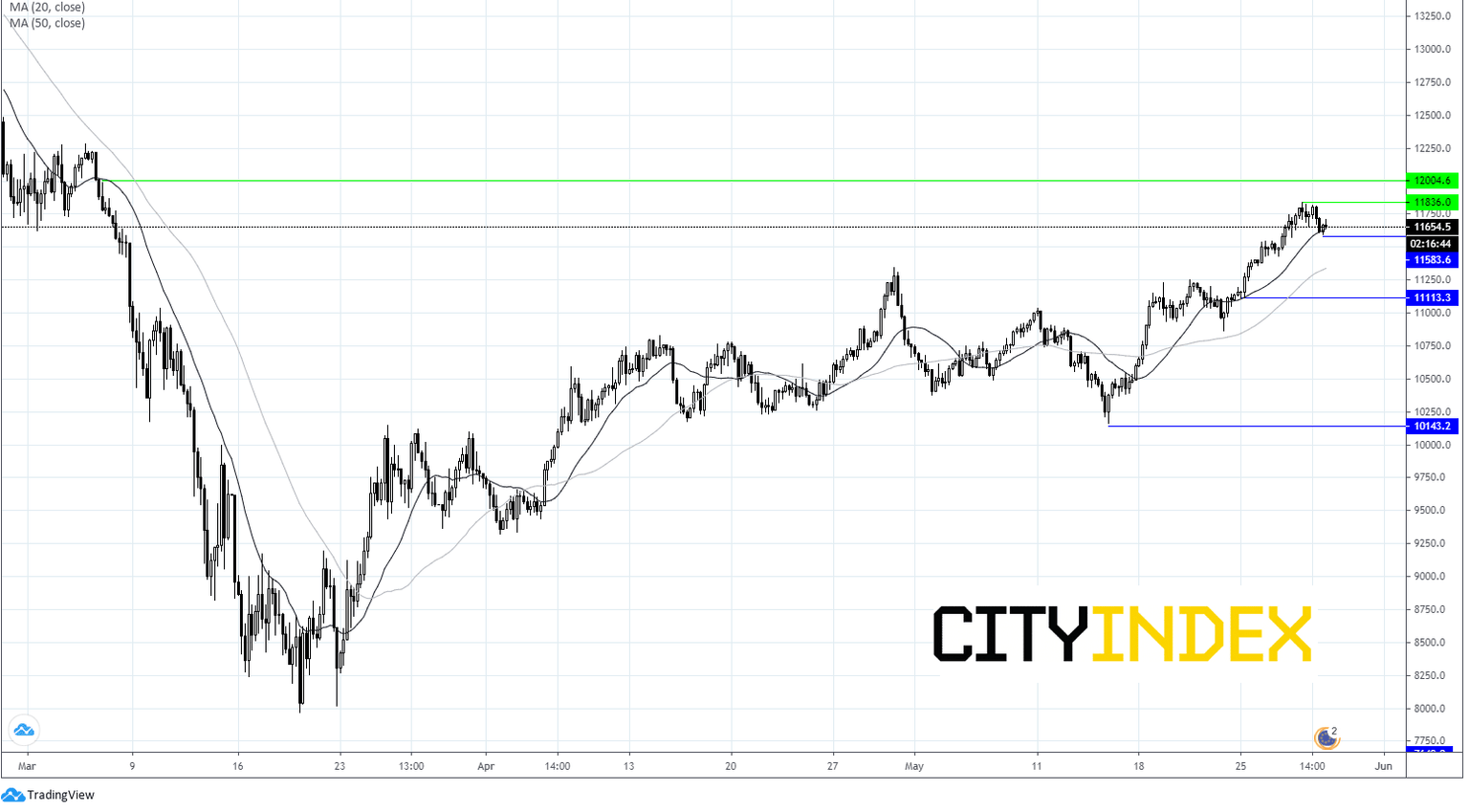

Dax Chart

Author

Fiona Cincotta

CityIndex