Euro stoxx 50 potential new upward move

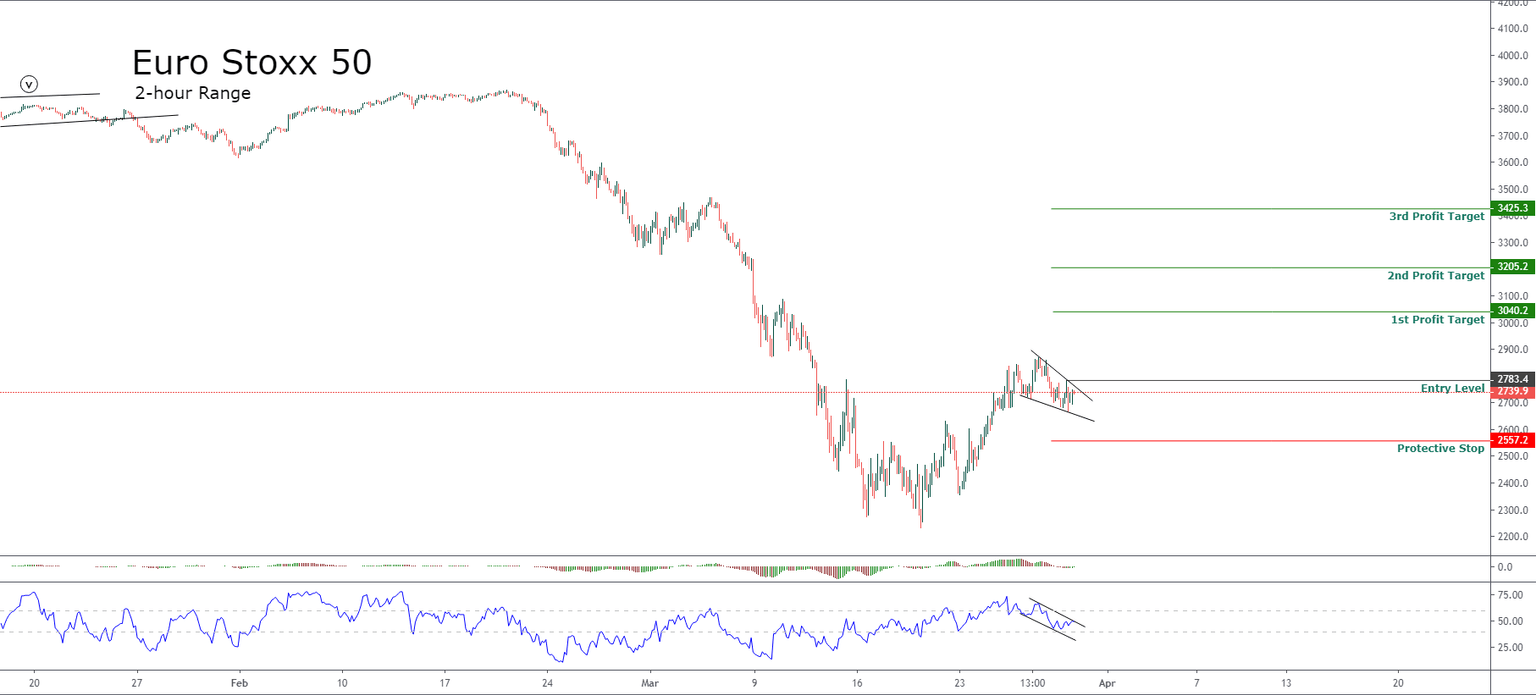

The Pan-European index Euro Stoxx 50, in its 2-hour chart, shows a consolidation formation after two bullish moves that represent the recovery of the European benchmark.

Until now, Euro Stoxx 50 has made four movements. Two are impulsive while the other two are corrective. This sequence makes us foresee that the Pan-European index is developing a bullish impulsive wave.

On the other hand, the current bullish sequence reveals that, until now, no one of the impulsive waves is extended. In consequence, according to the Elliott wave theory, the next wave section could result in an extended wave.

The breakout of the 2,783.4 pts could bring us an entry point in the long-side. In our conservative scenario, the Euro Stoxx 50 could climb to 3,040.2 pts. If the price extends its gains, the Pan-European index could advance until 3,205.2 pts and even soar till 3,425.3 pts.

The invalidation level of our bullish scenario locates at 2,557.2 pts.

Trading Plan Summary

Entry Level: 2,783.4 pts.

Protective Stop: 2,557.2 pts.

1st Profit Target: 3,040.2 pts.

2nd Profit Target: 3,205.2 pts.

3rd Profit Target: 3,425.3 pts.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and