Euro steady ahead of US inflation

The euro is almost unchanged on Friday. In the North American session, EUR/USD is trading at 1.2190, down 0.02% on the day.

In Germany, Covid-19 cases have been declining in recent weeks, as the vaccine rollout has gathered steam. Some states have eased lockdown conditions and the reopening of the largest economy in the eurozone should continue in the coming months.

Despite this optimistic outlook, the German consumer remains in a dour mood. The GfK Consumer Climate index has been mired in negative territory for over a year, as consumers remain pessimistic about economic conditions. In May, the index came in at -7.0, weaker than the forecast of -5.3 points. The ongoing weakness in consumer confidence is in sharp contrast to business confidence levels, as companies remain optimistic about the German economy. German Ifo Business Climate rose to 99.2 in May, its highest level since April 2019.

In the eurozone, the data calendar is light. France’s data was a disappointment. Consumer Spending in April plunged 8.3%, worse than the consensus of -4.1%, marking a second straight decline. As well, GDP for the first quarter came in at -0.1%, missing the forecast of +0.4%. This is a second straight decline, which means that the eurozone’s second-largest economy is technically in a recession.

Will we see a return to inflation jitters? Investors are keeping a keen eye on the Core PCE Price Index, which will be released later on Friday (12:30 GMT). PCE is the Fed’s preferred inflation gauge, so a strong rise could reignite speculation that the Fed could tighten policy by reducing its massive stimulus programme. The consensus is for PCE to rise to 2.9% YoY in April, up from 1.8% a month earlier. If the release is within expectations, the US dollar could respond with gains.

EUR/USD technical

-

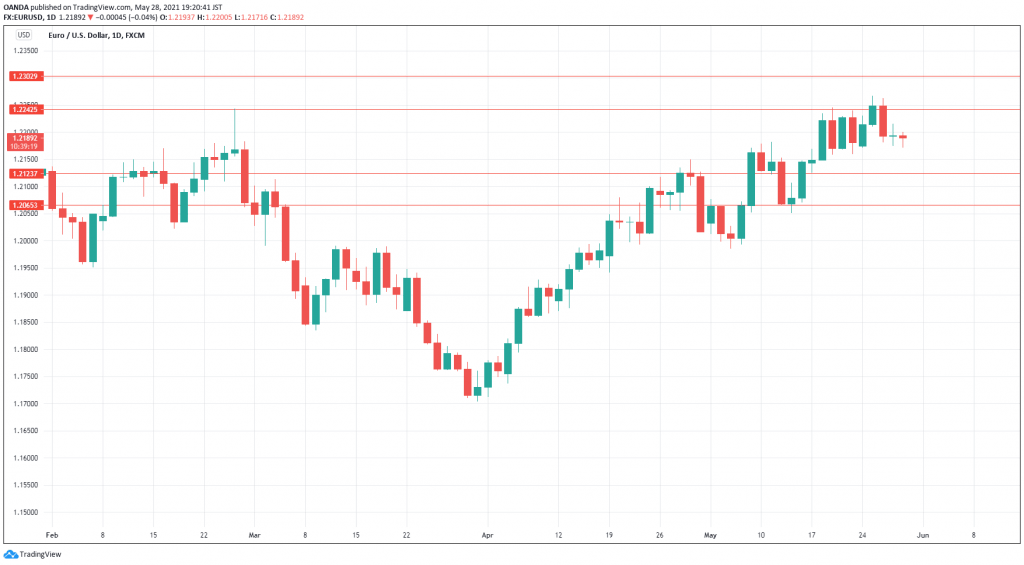

EUR/USD faces resistance at 1.2242. Above, there is resistance at 1.2303.

-

On the downside, there is support at 1.2123, followed by 1.2065.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.