Euro risk ahead – The main risks for euro weakness

European summit on the weekend

German bunds are currently trading at -0.43% on the 10-year chart which is around 10bps lower than a Bloomberg modeled curve mentioned on the Bloomberg Live Blog yesterday. Investors are positioning themselves ahead of the European Council’s summit.

On Friday and Saturday this week EU policymakers will meet to discuss the proposed €750 billion recovery plan. The main issue is whether nations like Austria, Denmark, Sweden, Netherland, and Finland will block the plan. These aforementioned countries are opposed to the idea of large handouts in the form of grants. They would prefer the idea of low-interest loans than just the hand out of a grant.

Pressure is on for the ‘frugal four’ to accept the recovery plan

The pressure is mounting for these countries concerned about the ideas of grants rather than loans to approve this proposed fund. This is because they will not want to be seen as being difficult at such a time of humanitarian crisis as we are experiencing in the COVID-19 pandemic. Positively, on July 10 we had a German official state that Netherlands is unlikely to block the EU recovery fund. Expect any further positive news about the fund being accepted by the frugal four to boost the Euro heading into the weekend.

ECB rate meeting on Thursday

Thursday is the ECB rate meeting with little change expected. With the PEPP program increasing by €600 billion euros last month it is unlikely that we see any changes to the PEPP program on Thursday as the ECB will wait for the latest addition in funds to bed down. However, any surprise decision here will impact the Euro as no changes are anticipated.

The main risk for Euro weakness

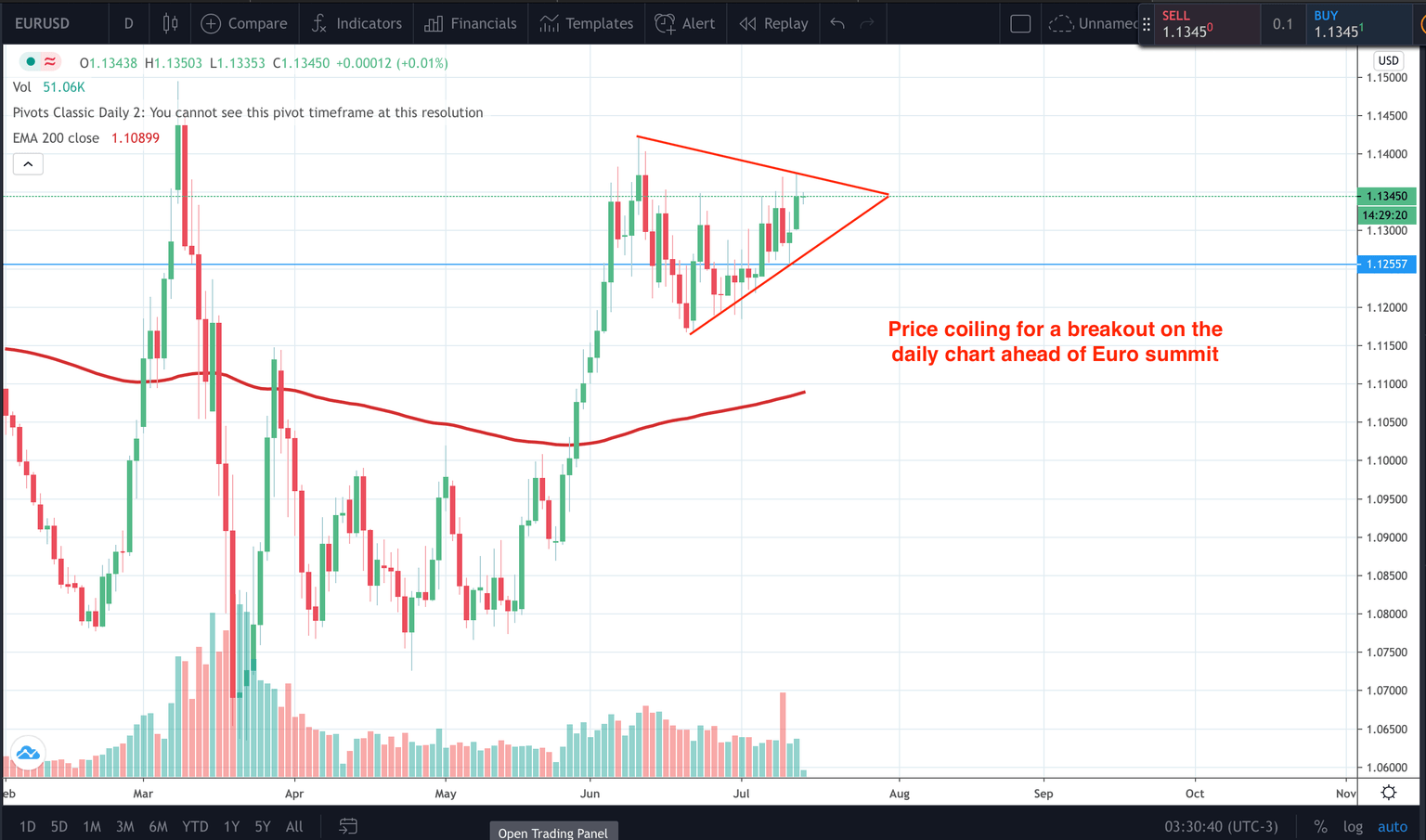

If the recovery fund is rejected by the frugal four expect immediate downside for the EUR. However, note that that the second day of the meeting is taking place over the weekend so this is going to be a weekend risk for the EUR. Take a look at how price is coiling up on the daily chart ready for an explosive move higher or lower. Expect technical buyers or sellers depending on which way it breaks.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.