EUR/JPY triple top reversal at 133.12 resistance

Overview:

Watch the video for a summary of this week’s news releases and a complete top down analysis of the EURJPY. In this video I review the triple top reversal at the 133.12 monthly resistance level.

EURJPY Monthly:

Monthly support at 127.07 and 121.61, resistance at 133.12. Price is forming a triple top at the 133.12 monthly resistance level. MACD has crossed down confirming the change in trend. Long term target would be 121.61 monthly support.

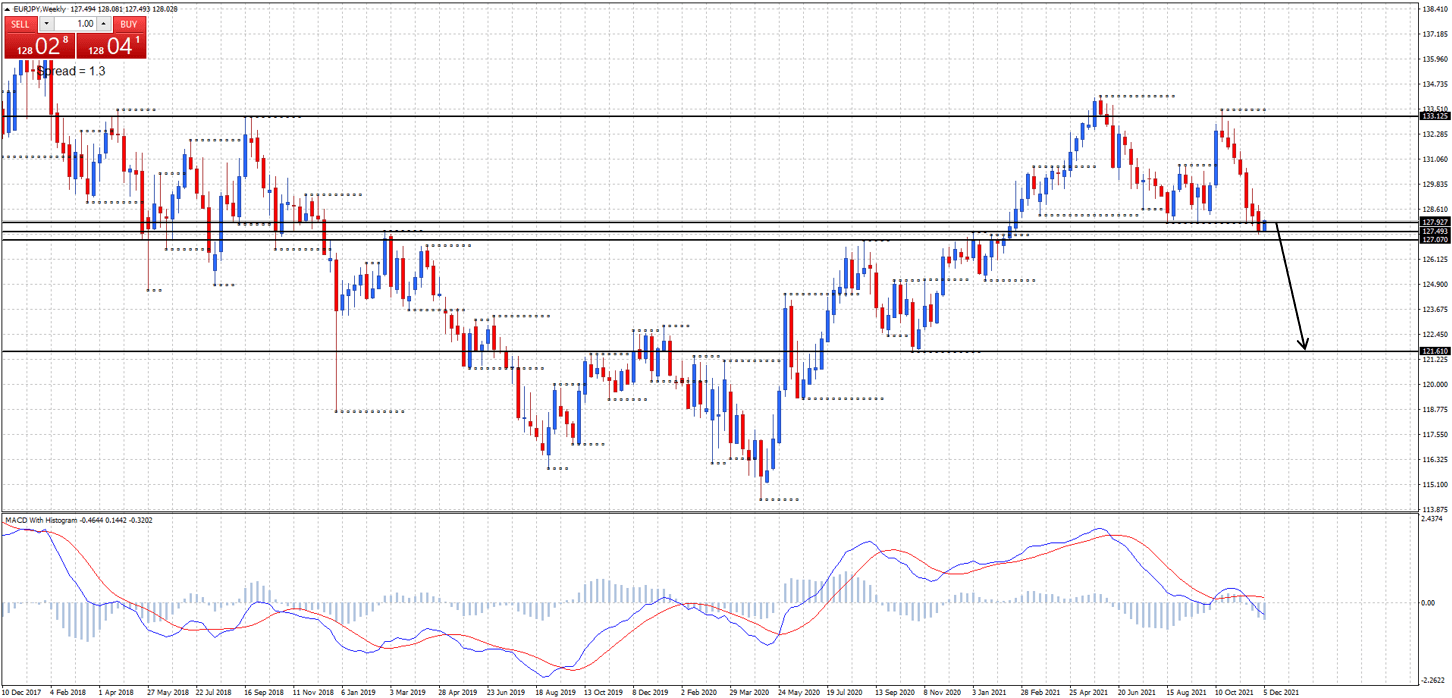

EURJPY Weekly:

Weekly support at 127.49, resistance at 127.92. Weekly chart is in a downtrend. Price has broken and closed below the 127.92 old weekly support level.

EURJPY Daily:

Daily support at 127.37, resistance at 128.32.

Daily chart is in a downtrend showing lower tops and bottoms. Looking for price to rally and fail at the 127.92 weekly resistance level. Price failing at the 127.92 weekly resistance level would present an ideal opportunity to sell for the next decline in line with the immediate downtrend.

Short term target for the next move down would be 127.07 monthly support. Long term target would be 121.61 monthly support.

Watch the video for a full break down of my analysis on how you could trade this pair to the downside based on the 4 hour chart.

Author

Duncan Cooper

ACY Securities

Duncan Cooper is a full-time trader and mentor. He has been actively trading the financial markets for more than 15 years and has traded stocks, options, futures, and the Forex Market since 2005.