EUR/USD Weekly Forecast: Trade optimism, hawkish Fed undermine momentum

- EUR/USD slipped back below 1.1200 on Friday, hitting four-week lows.

- The Greenback closed its third consecutive week of gains on easing trade jitters.

- Trade tensions remain in centre stage ahead of the upcoming US-China talks.

The Euro (EUR) managed to regain some composure toward the end of the week, sparking a daily reversal in EUR/USD after easing below the 1.1200 level, or multi-week troughs, early on Friday. The recovery, however, did not change the pair’s weekly performance, which reached the third drop in a row.

The intense sell-off in the pair, and the rest of the risk universe, came in tandem with the marked recovery in the US Dollar (USD) on the back of the resurgence of hopes on the trade front. That said, the US Dollar Index (DXY) finally managed to clear the psychological 100.00 barrier, although how sustainable this breakout is remains to be seen.

A glimmer of hope emerged on the trade front

The ongoing correction in EUR/USD remains in place following post-ECB tops around 1.1570 reached in April. The move came exclusively in response to the U-turn in the Greenback, which was in turn triggered by the absence of announcements regarding new tariffs, as well as a more constructive stance from the White House.

On the latter, President Trump announced on Thursday a trade agreement with the United Kingdom (UK). The United States (US) has agreed to reduce import tariffs on a limited number of British vehicles and allow certain steel and aluminium products to enter the country without duties, as part of a new bilateral agreement with the United Kingdom. The arrangement eases some of the pressure on key UK sectors following the reintroduction of tariffs by President Donald Trump earlier this year, although a 10% tariff will remain in place on most UK goods, limiting the overall scope of the relief.

Adding to the generalised optimism, senior US and Chinese officials will meet in Switzerland this weekend for high-level negotiations.

The ongoing trade tensions between the world’s two largest economies, alongside President Trump’s recent decision to impose tariffs on several other countries, have disrupted global supply chains, rattled financial markets, and raised concerns over a potential slowdown in global economic growth.

Policy divergence puts Euro on the defensive

Diverging central bank outlooks remain a core driver of the Euro’s underperformance. While the Federal Reserve (Fed) held its benchmark rate steady this week, it reiterated its data-dependent hawkish bias.

By contrast, the European Central Bank (ECB) delivered a 25 basis point cut last month—its second in three meetings—bringing its key rate to 2.25%. Markets are now pricing in another cut as early as June, underscoring the widening transatlantic monetary policy gap.

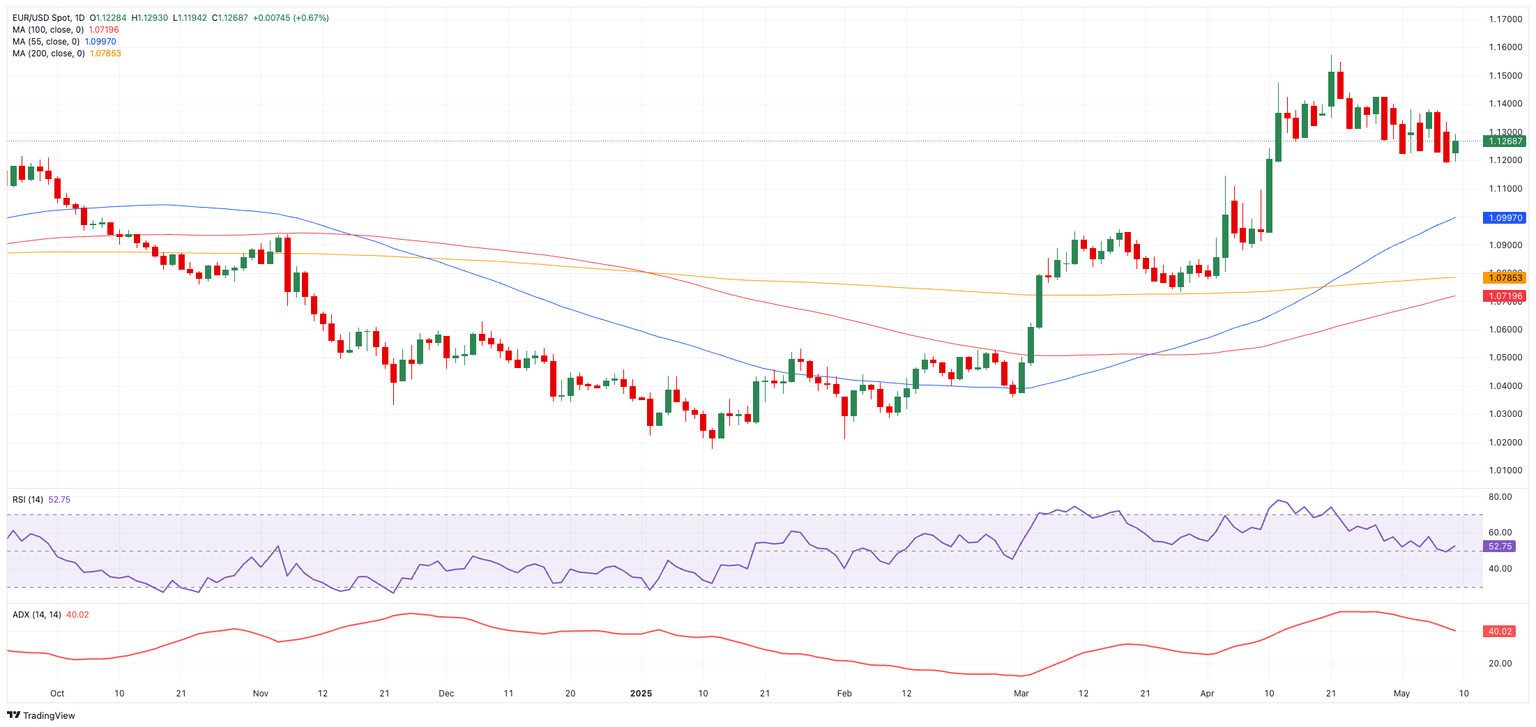

Technical outlook: Heavy resistance looms

EUR/USD remains capped beneath its 2025 high of 1.1572 (April 21). Beyond that, key resistance lies at the psychologically important 1.1600 mark and the October 2021 top of 1.1692.

On the downside, short-term support sits at the 55-day simple moving average (SMA) at 1.1005, with deeper cushions at the more significant 200-day SMA at 1.0791 and the weekly trough at 1.0732 (March 27).

Momentum indicators suggest further corrective moves may be in store. The Relative Strength Index (RSI) has eased to neutral territory near 52, while the Average Directional Index (ADX) near 41 points to strong but potentially exhausted trend momentum.

EUR/USD daily chart

Outlook: Tug-of-war?

The euro’s path forward remains clouded by competing forces. Speculative positioning and improving global trade sentiment offer support, but the widening Fed-ECB policy gap and dollar resilience could continue to weigh on the single currency. With central bank decisions and trade developments poised to drive headlines, EUR/USD is likely to remain volatile and reactive in the near term.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.