EUR/USD: The euro rally is now up into a key stage

EUR/USD

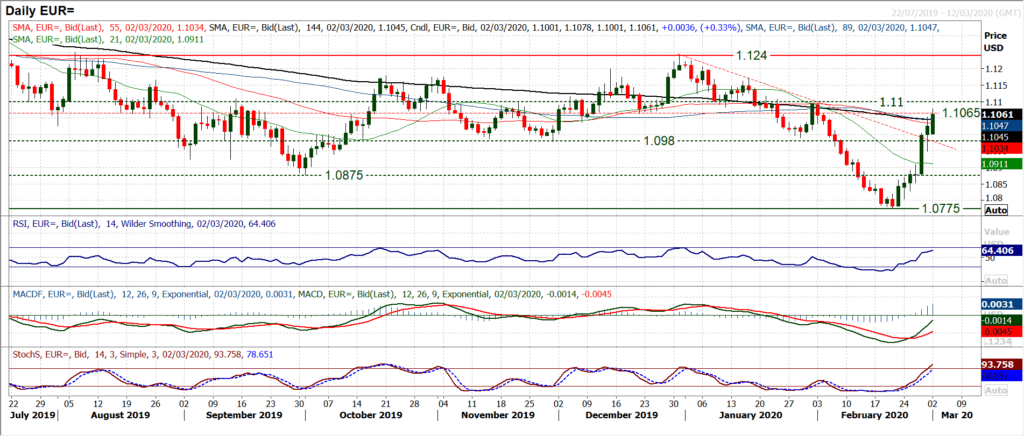

The euro rally is now up into a key stage. Having put together a seven session recovery, the market is continuing higher once more today. The move is now back around a clutch of falling moving averages between $1.1035/$1.1050, however, more importantly now testing the key resistance band $1.1065/$1.1100. This has been a key pivot area for market turning points throughout August to January and once more will be a key gauge. The euro bulls come into this phase with the wind in their sails, with MACD and Stochastics accelerating higher, whilst RSI is into the 60s and a two month high. This is very much seen as a key crossroads for the medium term outlook. Closing above $1.1100 would be a big positive development now. The bulls will be wary of what market reaction would be to breaking this series of positive candles/closes. Having moved decisively clear of $1.0980 (an old key floor) to lose this as support again would be a negative sign. For now though, the bulls are happy to keep buying, with this morning’s early low of $1.1000 initial support.

Author

Richard Perry

Independent Analyst