EUR/USD Price Forecast: Gains remain in place above the 200-day SMA

- EUR/USD failed to extend gains beyond the 1.1400 barrier.

- The US Dollar traded in a volatile mood amid steady tariff jitters.

- President Trump eased some tariffs on China, benefiting electronics.

On Monday, the Euro (EUR) failed to extend its recent bounce and succumbed to alternating trends among investors. That said, EUR/USD came under pressure soon after hitting daily highs around 1.1420, receding after to the 1.1300 zone, where it met some decent contention.

The pair’s price developments came in tandem with the irresolute price action surrounding the US Dollar (USD), which kept the US Dollar Index (DXY) under some modest pressure south of the 100.00 barrier.

The daily knee-jerk in spot also came along with shrinking US Treasury yields and a pullback to multi-week lows in Germany’s 10-year bund yields.

Trade jitters remain far from over

President Trump ignited fresh fears of a global trade war by imposing a broad 10% duty on all US trade partners effective April 5, along with additional tariffs of 10% to 50% on specific countries and regions.

While the European Union (EU) was hit by a 20% rate, the White House followed up later last week by confirming China would face tariffs as high as 145%.

Trump did announce a temporary 90-day pause on new tariffs for nations that opt not to retaliate, although EU President Ursula von der Leyen warned that Brussels is ready to respond if necessary.

However, Trump said on Sunday that smartphones and computers will be excluded from the newly announced tariffs on China, offering some respite for the risk complex.

Central banks under the microscope

The Federal Reserve (Fed) left interest rates unchanged, citing concerns that higher tariffs might stoke inflation just as economic growth shows signs of slowing. In later comments, Fed Chair Jerome Powell reiterated his cautious stance before resuming the bank’s easing cycle. Following Thursday’s weaker-than-expected US inflation data, traders began pricing in a full percentage point of Fed easing by year’s end.

Over in Europe, the European Central Bank (ECB) lowered its key interest rate by 25 basis points and voiced its readiness to respond if economic conditions deteriorate further. While policymakers predict modest near-term growth and slight inflation pressure through 2026, President Christine Lagarde cautioned that a deepening trade conflict with the US could slice off 0.5% of Eurozone GDP. Some ECB officials have hinted at further policy shifts if tensions escalate.

Shifting market sentiment

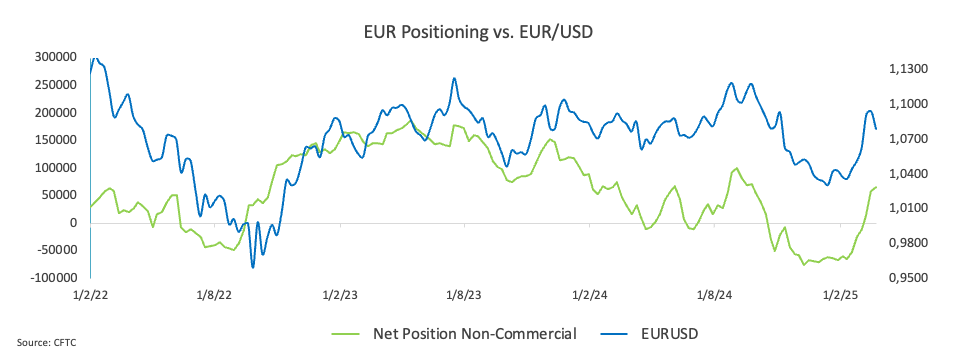

Speculative net longs in the Euro (EUR) climbed to two-week highs near 60K contracts, while hedge funds and other commercial participants boosted their net shorts to around 90.5K contracts, also reaching two-week peaks. Open interest simultaneously surged to multi-week highs of nearly 700K contracts.

Technical overview

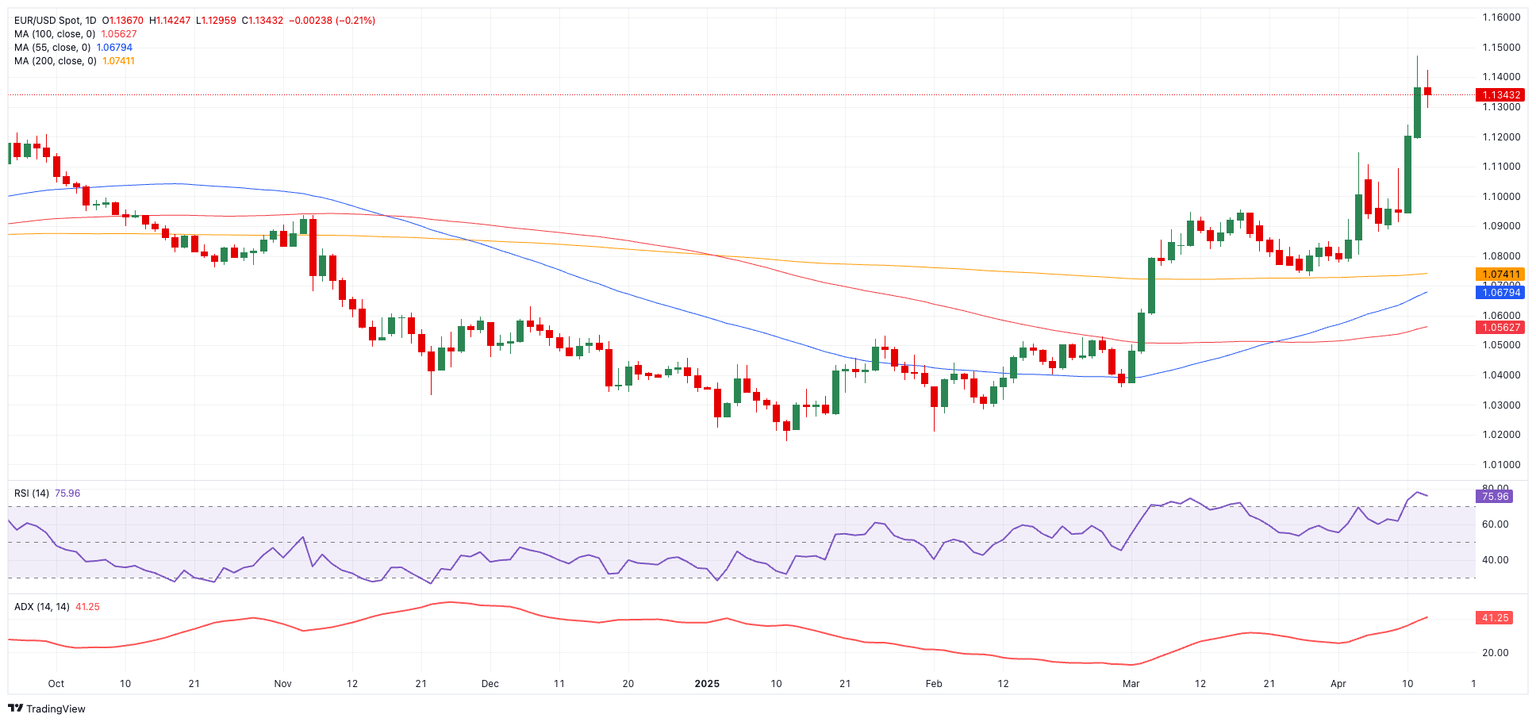

Upside targets suggest that the first hurdle sits at the 2025 high of 1.1473 (April 11). A decisive break above this level could open the door toward the 2022 top of 1.1498 (February 19), just ahead of the 1.1500 round level.

On the downside, key support hovers at the 200-day Simple Moving Average (SMA) at 1.0746, followed by the weekly low of 1.0732 (March 27) and the transitory 55-day SMA at 1.0680.

As for momentum indicators, the RSI hovers around 74, still well in the overbought region, while the ADX past 41 suggests a moderately strong trend that could support the ongoing bullish bias.

EUR/USD daily chart

Bottom Line

With the US Dollar losing its footing, the Euro has found renewed strength—even as global trade frictions intensify. Central banks on both sides of the Atlantic are navigating uncharted waters, with policymakers closely watching inflation, growth signals, and fresh tariff announcements. While EUR/USD looks set to maintain its upward trajectory in the near term, shifting risk sentiment and ongoing trade developments could spark volatility.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.