EUR/USD Price Forecast: Corrective slides are likely to be short-lived; Fed decision in focus

- EUR/USD retreats from a four-year high touched on Tuesday amid a modest USD recovery.

- The divergent Fed-ECB expectations could support the pair and warrant caution for bears.

- Traders now await the pivotal FOMC interest rate decision for a fresh directional impetus.

The EUR/USD pair attracts some sellers on Wednesday, snapping a two-day winning streak and eroding a part of the previous day's strong move up to a four-year peak amid a modest US Dollar (USD) bounce. In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, stages a modest recovery from its lowest level since early July amid some repositioning trade ahead of the pivotal FOMC rate decision. Apart from this, the cautious market mood is seen as another factor benefiting the safe-haven buck, which, in turn, is seen exerting some downward pressure on the currency pair.

The upside for the USD, however, seems limited in the wake of the growing acceptance that the US Federal Reserve (Fed) will resume its rate-cutting cycle. Traders are all but certain that the US central bank will lower borrowing costs by 25 basis points (bps) and have been pricing in the possibility of two more rate cuts by the year-end to support the softening labor market. Hence, the intraday USD uptick could be solely attributed to some repositioning trade ahead of the key central bank event risk. Traders might also opt to wait for more cues about the Fed's future rate-cut path before placing aggressive bets.

This, in turn, suggests that the market focus will remain glued to updated economic projections and Fed Chair Jerome Powell's comments at the post-meeting press conference. The monetary policy outlook, in turn, will play a key role in influencing the near-term USD price dynamics and provide some meaningful impetus to the EUR/USD pair. In the meantime, diminishing odds for any further interest rate cuts by the European Central Bank (ECB) could support the shared currency and the currency pair. The ECB said last Thursday that it was not pre-committing to a specific path for interest rates.

The central bank added that it would continue to follow a meeting-by-meeting, data-dependent approach to monetary policy decisions. Adding to this, ECB Vice President Luis de Guindos said on Wednesday that the current interest rate is appropriate based on inflation developments, our projections, and the transmission of monetary policy. Separately, ECB Governing Council member Jose Luis Escriva noted that the current interest rate of 2% seems reasonable and risks to inflation are balanced. This comes on top of ECB policymaker Edward Scicluna's comments on Tuesday, saying that there was no cut already in a box and waiting to be unpacked, warranting caution before placing bearish bets around the EUR/USD pair.

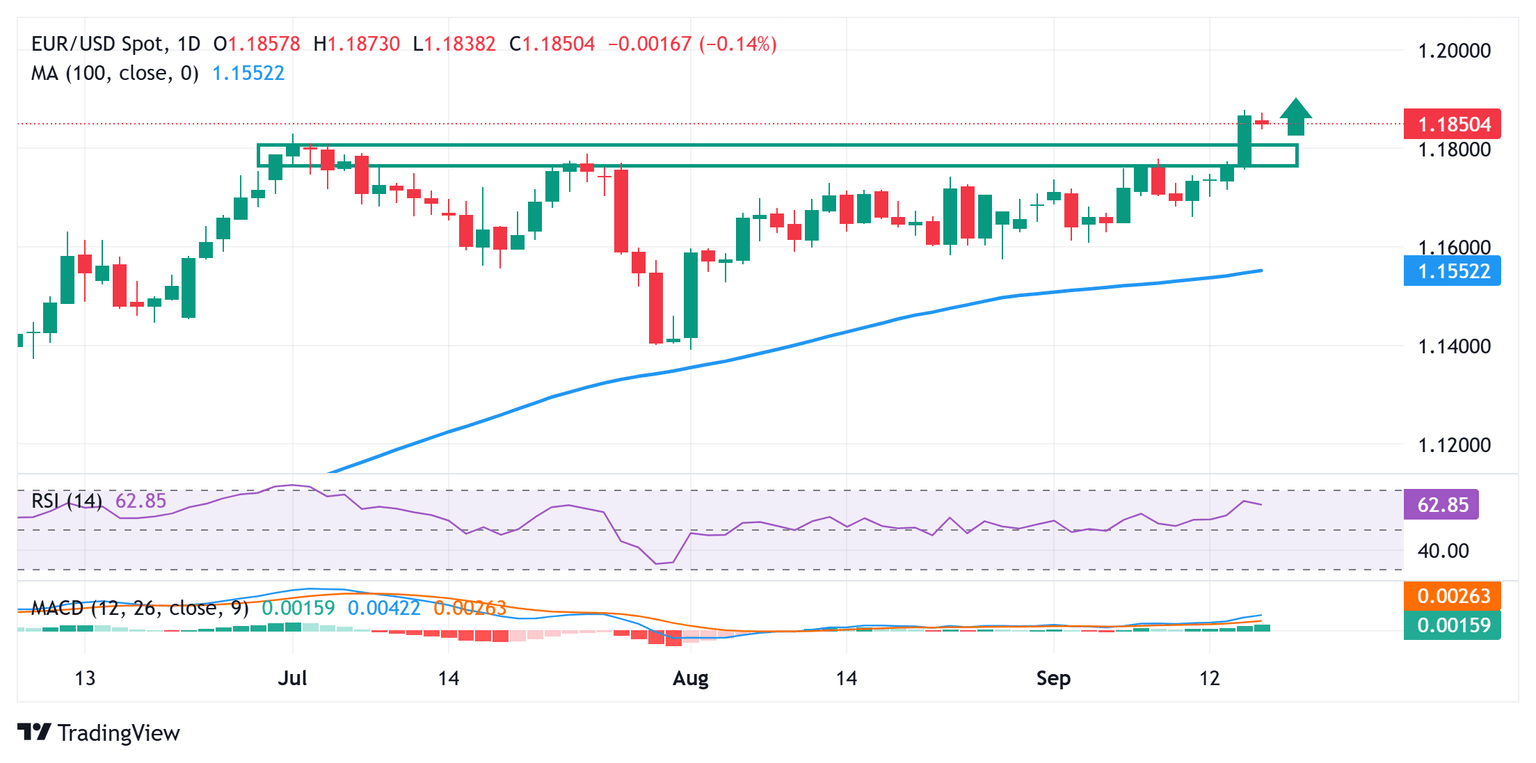

EUR/USD daily chart

Technical Outlook

The overnight breakout through the 1.1780-1.1790 hurdle and a subsequent move beyond the previous year-to-date peak were seen as key triggers for bullish traders. Moreover, oscillators on the daily chart have been gaining positive traction and are still away from being in the overbought zone, suggesting that the path of least resistance for the EUR/USD pair is to the upside. Hence, any subsequent slide could be seen as a buying opportunity and remain limited. That said, a sustained break and acceptance below the 1.1800 mark might prompt some technical selling, which could drag spot prices to the 1.1730-1.1725 intermediate support en route to the 1.1700 round figure.

On the flip side, the 1.1870-1.1880 zone, or a four-year high touched on Tuesday, now seems to act as an immediate hurdle ahead of the 1.1900 mark. Some follow-through buying will reaffirm the near-term positive outlook for the EUR/USD pair and pave the way for a move towards reclaiming the 1.2000 psychological mark for the first time since June 2021, with some intermediate resistance near mid-1.1900s.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.