EUR/USD Price Forecast: Corrective slide not enough to spook buyers

EUR/USD Current price: 1.0906

- Geopolitical woes take centre stage with focus on Russia, Ukraine and the Middle East.

- German encouraging headlines helped EUR/USD reach a fresh 2025 high.

- EUR/USD finding near-term buyers around 1.0900, corrective slide at sight.

The EUR/USD pair peaked at 1.0954 on Tuesday, a fresh 2025 high. However, the pair retreated ahead of the American session opening and struggles to retain the 1.0900 mark.

Tensions revolve around geopolitical woes. On the one hand, United States (US) President Donald Trump and Russian President Vladimir Putin are meant to speak about the normalization of the two countries' relationship and the end of the Russia-Ukraine war. On the other hand, the Middle East war resumed. Hamas rejected the US proposal for extending the ceasefire, leading to fresh Israel military operations.

Headlines also came from Germany. The head of the Social Democratic Party (SDP) Lars Klingbeil addressed the Bundestag to unlock up to €1 trillion in new spending to boost the country’s defence and invest in infrastructure. He referred to Russian brutality in Ukraine and the unpredictability of the US government, claiming the need to defend European freedom.

Additionally, Germany released the ZEW Survey on Economic Sentiment, which improved in March to 51.6 from the previous 26, also beating the 48.1 expected. Sentiment in the Eurozone (EU) in the same period surged to 39.8 from 24.2 in February. However, the assessment of the German current situation remained in the red, printing at -87.6, worse than the -80.5 anticipated.

Across the pond, the US released some housing figures and other minor data. Building Permits were down 1.3% in February, while Housing Starts rose 11.2% in the same month. At the same time, the Export Price Index increased 0.1%, while the Import Price Index was up 0.4% in the same period. The upbeat figures gave the Greenback a near-term boost.

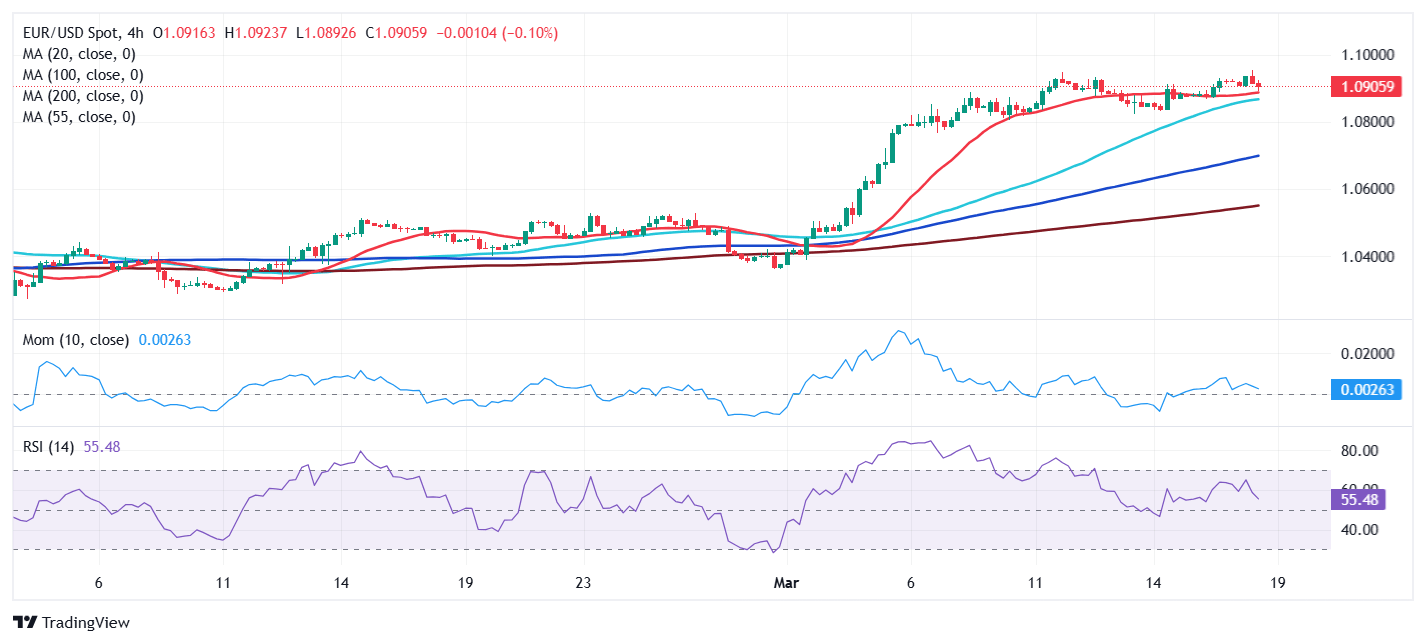

EUR/USD short-term technical outlook

From a technical point of view, the EUR/USD pair retains its dominant bullish stance. The daily chart shows it made a higher high and a higher low despite shedding some modest intraday ground. At the same time, technical indicators consolidate within overbought levels without signs of bullish exhaustion. Additionally, EUR/USD develops above all its moving averages, with a firmly bearish 20 Simple Moving Average (SMA) extending its advance above a flat 100 SMA and about to conquer ground above a flat 200 SMA.

In the near term, and according to the 4-hour chart, the EUR/USD is on the brink of starting a corrective slide. The pair is barely holding above its 20 SMA, which turned flat, providing dynamic support at around 1.0885. The 100 and 200 SMAs, in the meantime, maintain sharp upward slopes far below the shorter one. Finally, technical indicators have turned firmly south, albeit still holding above their midlines.

Support levels: 1.0895 1.0830 1.0790

Resistance levels: 1.0925 1.0960 1.1000

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.