EUR/USD outlook: Recovery picks up and boosts optimism

EUR/USD

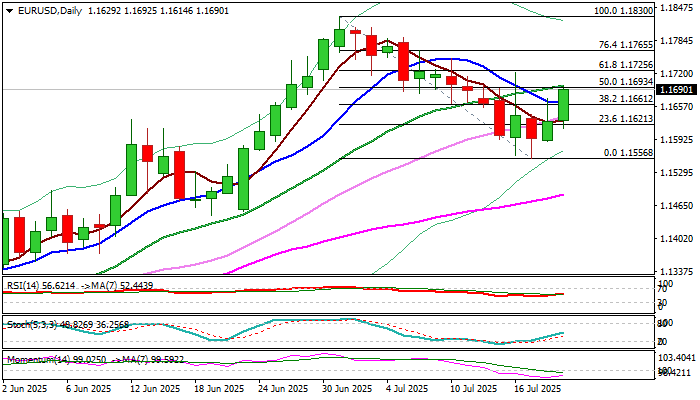

EURUSD regained traction and extended recovery on Monday, signaling formation of higher base at 1.1560 zone) and generating initial signal that correction from new 2025 peak (1.1830, posted on July 1) might be over.

Break above first trigger at 1.1661 (10DMA / Fibo 38.2% of 1.1830/1.1556) improves near term outlook, with daily close above this level, needed to validate signal and open way for extension above 1.1700 mark (1.1725 is Fibo 61.8%).

Technical picture on daily chart has improved, but more work at the upside is needed to strengthen near term structure, as north-heading 14-d momentum is still in negative territory.

Traders focus on key economic events this week – ECB rate decision and releases of Eurozone July manufacturing and services PMI’s.

While the ECB is widely expected to keep rates unchanged that would be supportive for Euro, PMI data will be closely watched for more hints about the situation in the bloc’s economy.

Market participants are also concerned about the outcome of US-EU tariff negotiations as Trump’s Aug 1 deadline nears.

Res: 1.1725; 1.1765; 1.1800; 1.1830

Sup: 1.1661; 1.1638; 1.1600; 1.1556

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.