EUR/USD outlook continues to drag lower in a multi-week downtrend channel [Video]

![EUR/USD outlook continues to drag lower in a multi-week downtrend channel [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/european-union-currency-5219766_XtraLarge.jpg)

EUR/USD

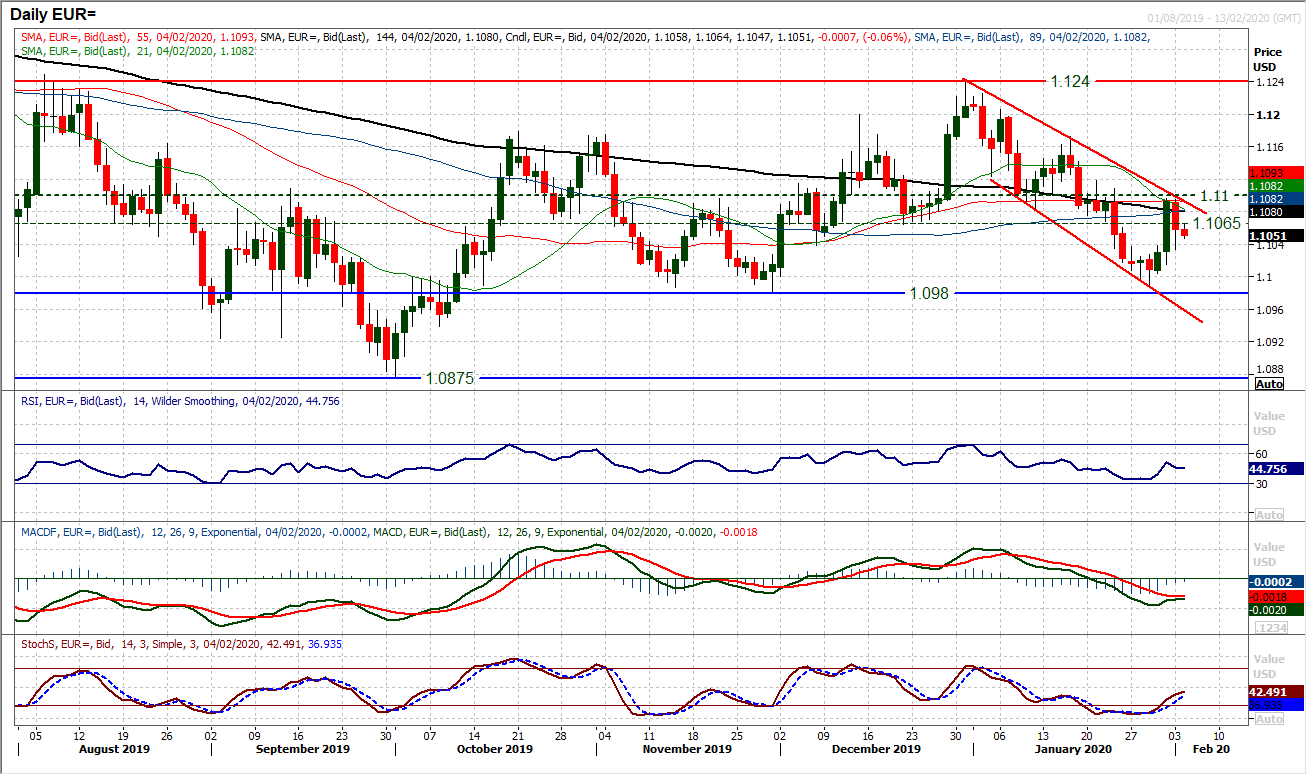

During this time of uncertainty and fluctuating risk appetite, the outlook on EUR/USD continues to drag lower in a multi-week downtrend channel. Last Friday’s sharp rebound had the potential to be outlook changing, but the overhead supply between $1.1065 (old support) and $1.1100 (old medium term pivot and confluence with the channel resistance) have seen the bears resume control again. A bull failure at $1.1095 formed a negative candle yesterday and maintains the corrective outlook. The move has left another lower key high within the downtrend channel and continues the strategy of using rallies as a chance to sell. The euro bulls are not ready to regain control quite yet. Similar to the mid-January rebound, the RSI has faltered again around 50/55 whilst unwinding recoveries on MACD and Stochastics are losing their way. We still see the $1.1065/$1.1100 as a near term sell zone, as a failed recovery is likely to be weighed down again towards $1.1000 and potentially test the key lows $1.0980/$1.0990. Initial support at $1.1035 which is a near term pivot now. A decisive close above $1.1100 would now significantly improve the outlook.

Author

Richard Perry

Independent Analyst