EUR/USD outlook: Bulls are running out of steam after a six-day rally

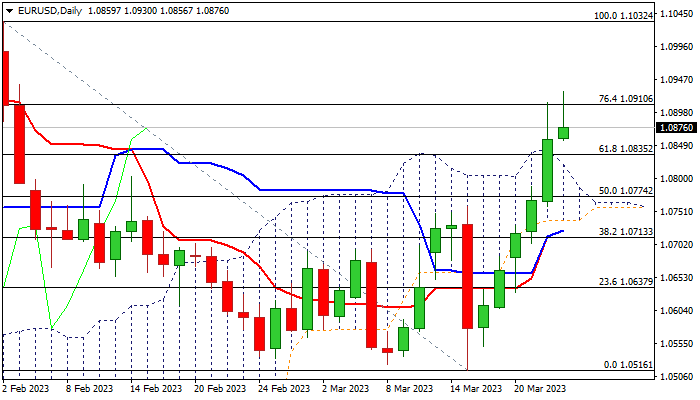

Steep ascend extends into sixth consecutive day, with strong acceleration seen in post-Fed period on Wednesday and extending to new seven-week high in late Asian / early European trading on Thursday.

However, long upper shadows on daily candles of Wednesday and Thursday, suggest that bulls are likely running out of steam and warn of rally’s stall.

In addition, bulls are facing increased headwinds, which may result in repeated failure to clearly break of Fibo barrier at 1.0910 (76.4% retracement of 1.1032/1.0516 fall) and leave a bull-trap, another negative signal.

Traders are cautious at these levels and started to take profits from the recent rally, as stochastic is overbought on daily chart and bullish momentum started to fade.

Also, the price surged above the top of daily Ichimoku cloud, with next week’s cloud twist remaining magnetic, but in opposite direction and this time attracting bears.

We look for fresh signal on today’s repeated close below 1.0910 Fibo resistance, which would increase pressure and open way for deeper correction, although this would signal a pause in larger bullish action and offer better levels to re-enter longs, as the pair is on track for strong weekly gains.

Extended dips should find firm ground above 1.0775/60 zone (broken 50% retracement / former top of Mar 15) to keep bulls in play.

Res: 1.0910; 1.0930; 1.1000; 1.1032.

Sup: 1.0856; 1.0835; 1.0760; 1.0731.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.