EUR/USD outlook: Bears regained control and eye key supports

EUR/USD

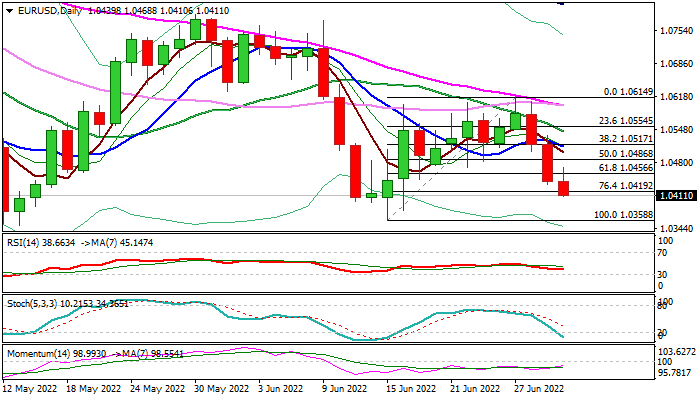

The Euro extends steep fall against the dollar into third straight day on Thursday, following a 1.3% drop in past two days, with probe through 1.0419 (Fibo 76.4% of 1.0358/1.0614 upleg) adding to signals that the corrective phase is over.

Bears eye key supports at 1.0358/49/40 (June 15 low / 2022 low / 2017 low), with firm break here to signal continuation of a larger downtrend from 2008 peak, paused for 2017/2022 consolidation.

Bearish studies on larger timeframes (day/week/month) support the scenario, though oversold conditions warn of headwinds from this critical support zone.

Fundamentals also do no work in favor of Euro as fears that slowing EU economy is likely sliding into recession are growing, with the latest data showing rise in German unemployment, adding to negative signals.

Res: 1.0435; 1.0456; 1.0486; 1.0513.

Sup: 1.0380; 1.0358; 1.0349; 1.0340.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.