EUR/USD Outlook: Ascending trend-channel favours bulls, US GDP awaited

- EUR/USD holds steady below a 13-month high touched on Wednesday.

- The fundamental backdrop seems tilted firmly in favour of bullish traders.

- Investors now look to the Advance US Q1 GDP report for a fresh impetus.

The EUR/USD pair regained strong positive traction on Wednesday and shot to a 13-month high amid the emergence of heavy selling around the US Dollar (USD). Concerns about banking contagion risks in the United States (USD) resurfaced after the First Republic Bank reported more than $100 billion in customer withdrawals during the first quarter. This, along with the debt ceiling standoff and fears that the US economy is heading towards recession, revive speculations about an imminent rate cut by the Federal Reserve (Fed) later this year. This, in turn, weighed heavily on the Greenback and remained supportive of the pair's overnight strong move up.

The shared currency, on the other hand, drew support from improving consumer sentiment in Germany - the Eurozone's largest economy. The German Gfk Consumer Confidence improved from -29.3 to -25.7 in May. This marked the seventh increase in a row and indicated that consumer sentiment is gathering momentum. Adding to this, income Expectations rose from -24.3 to -10.7 and returned to the level before the start of the war in Ukraine for the first time. Apart from this, expectations for more rate hikes by the European Central Bank (ECB) in the coming months provided an additional boost and pushed the EUR/USD pair closer to the 1.1100 mark.

The USD bulls, meanwhile, failed to gain any respite from the upbeat release of US Durable Goods Orders, which surpassed even the most optimistic estimates and rose 3.2% in March. Excluding transportation, new orders increased by 0.3% during the reported month, as against market expectations for a 0.2% fall and the 0.3% decline in February. However, the US Treasury bond yields moved higher in reaction to the better-than-expected US macro data. This, along with the risk-off impulse, extended some support to the safe-haven Greenback, which, in turn, kept a lid on any further gains for the EUR/USD pair and led to a late pullback of over 50 pips.

Spot prices, however, attracted fresh buying on Thursday and held steady around mid-1.1000s during the Asian session as traders now await the release of the Advance Q1 GDP report from the US. The growth in the world's largest economy is expected to have slowed to a 2.0% annualized pace during the January-March period from 2.6% in the previous quarter. Even a slight disappointment will prompt fresh selling around the USD and allow the EUR/USD pair to capitalize on its recent upward trajectory witnessed since mid-March. The focus will then shift to the flash German CPI and the US Core PCE Price Index - the Fed's preferred inflation gauge - on Friday.

Technical Outlook

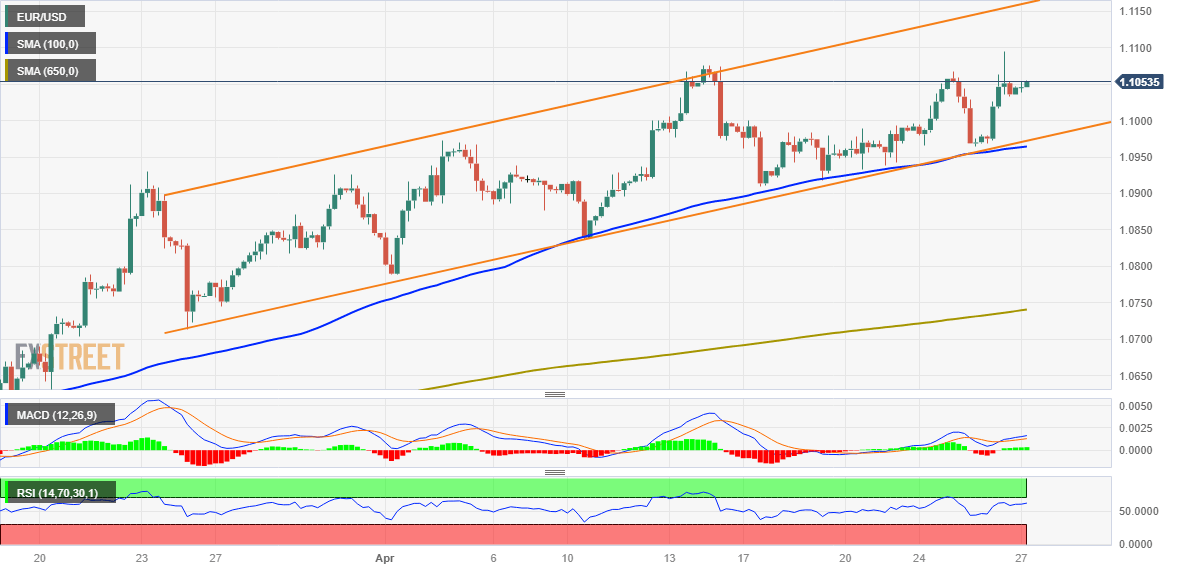

From a technical perspective, the EUR/USD pair has been scaling higher along a one-month-old ascending channel, which points to a well-established short-term bullish trend. The lower end of the channel, currently around the 1.0980-1.0970 region, coincides with the 100-period Simple Moving Average (SMA) on the 4-hour chart and should act as a strong support. A convincing break below will negate the positive outlook and prompt aggressive selling. Spot prices might then accelerate the fall towards the 1.0900 mark before eventually dropping to the 200-period SMA on the 4-hour chart, currently around the 1.0870 area. Some follow-through selling will shift the bias in favour of bearish traders and pave the way for a deeper corrective pullback.

On the flip side, bulls might now wait for a sustained strength beyond the 1.1100 round figure before positioning for further gains. The EUR/USD pair might climb to challenge the ascending trend-channel resistance around the 1.1155 region. The latter should act as a pivotal point, which, if cleared decisively, will be seen as a fresh trigger for bullish traders and set the stage for an extension of the upward trajectory.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.