EUR/USD – ICT-fueled range compression signals trap before reversal

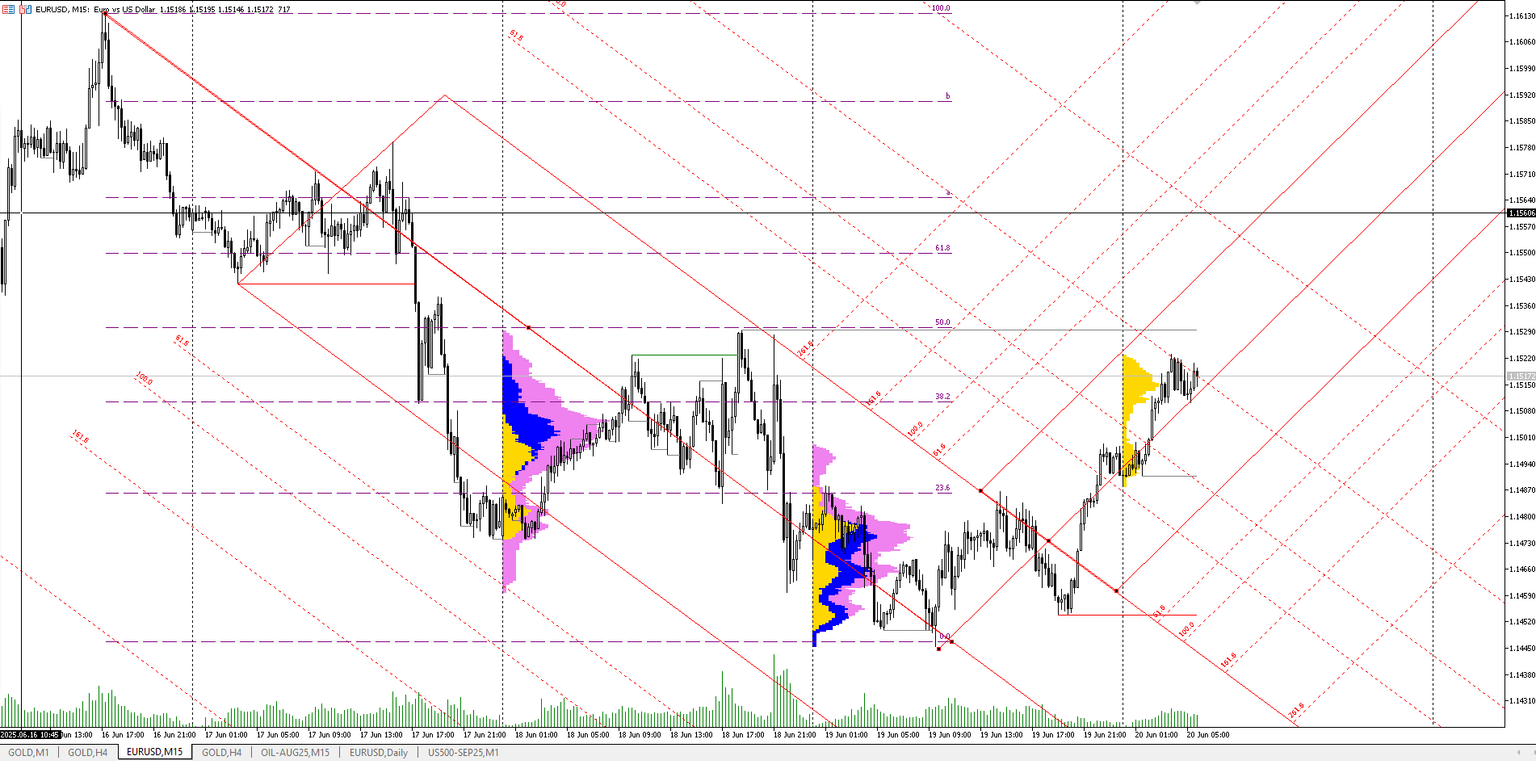

EUR/USD is currently consolidating after a sharp impulse move higher, indicating potential distributive behavior as the market compresses within a tight range. Smart Money Concepts and ICT patterns highlight a recent Break of Structure (BOS) following a swing low, alongside a clean Fair Value Gap (FVG) between 1.1650–1.1642 — a likely draw for price.

Current positioning

Market is compressing within a range after a significant impulse leg higher, showing signs of distributive behavior.

ICT patterns

- Strong Break of Structure (BOS) marked after the swing low breakout.

- A well-formed Fair Value Gap (FVG) between 1.1650–1.1642, acting as the magnetic retracement zone.

- Upper liquidity resting at 1.1682–1.1705, ideal for a Judas Swing and stop run.

- Market likely to spike into the OB cluster (1.1682–1.1692) before turning sharply lower.

- Recommended intraday long – Buy around 1.1465 with a stop at 1.1432 and a target of 1.1562.

Gann angle and Fibonacci confluence

- 45° Gann Angle: Aligned with 1.1645–1.1650 area as potential reaction zone for first target.

- 90° Gann Angle & Fibonacci Confluence: Strong reversal zone identified between 1.1685–1.1700, aligning with the 61.8% retracement of the prior leg.

Market DNA/Codon framework

Time codons for execution

Astro and Gann influences

- Mars–Neptune Square (Current): Likelihood of false breakouts and emotional swings.

- Mercury–Venus Conjunction (Impending): Transition point supporting reversal setups.

- Gann 1x1 and 1x2 angles point to a shift zone roughly aligned with 1.1685–1.1695, making this a critical area for initiating shorts.( 4hCharts).

Higher timeframe outlook (daily)

- The daily trend maintains higher highs and higher lows, making short positions tactical retracements within an ongoing long‑term bullish trend.

- Strong daily FVG rests between 1.1307, suggesting this area as a long‑term swing buy zone upon significant retracement.

- Bull trend only invalidated if price closes below 1.12300.

Fundamental context

- Fed’s shift from 6 rate cuts down to 4 by 2027 denotes a hawkish undertone, supporting short‑term USD strength.

- ECB commentary (Lagarde) lacks clarity, hinting at a dovish tilt and supporting retracement dynamics.

- Geopolitical tensions (Middle East) and U.S. election narratives (Trump) continue to fuel risk‑off volatility, making EURUSD susceptible to sharp swings.

Trade plan

Best execution times

- London Open (07–10 GMT) for Liquidity Raid.

- New York Session (13–15 GMT) for Follow‑Through Break.

The EUR/USD presents a strong short‑side setup in the short term, relying on a high‑probability liquidity run into the 1.1682–1.1705 zone before a sharp reversal. The longer‑term trend structure (daily) remains bullish, making this ideal as a tactical retracement rather than a long‑term reversal.

Watch closely for CHoCH/BOS confirmation in lower timeframes (1‑min / 5‑min) to trigger short entries. Maintain tight risk management due to potential high‑volatility news and astro‑event confluence.

Author

Faysal Amin

Mind Vision Traders

Faysal Amin is a seasoned financial analyst and market strategist with over a decade of experience in global markets, including equities, forex, and commodities.