EUR/USD hits the only resistance of any significance now at 1.2050/70

EUR/USD – USD/CAD

EURUSD longs at our buying opportunity at 1.1930/20 worked on the recovery to resistance at 1.2000/10. We wrote: A break above here is a very important longer term buy signal & should signal the start of a significant bull trend in to 2021.

The break triggered further gains to 1.2083.

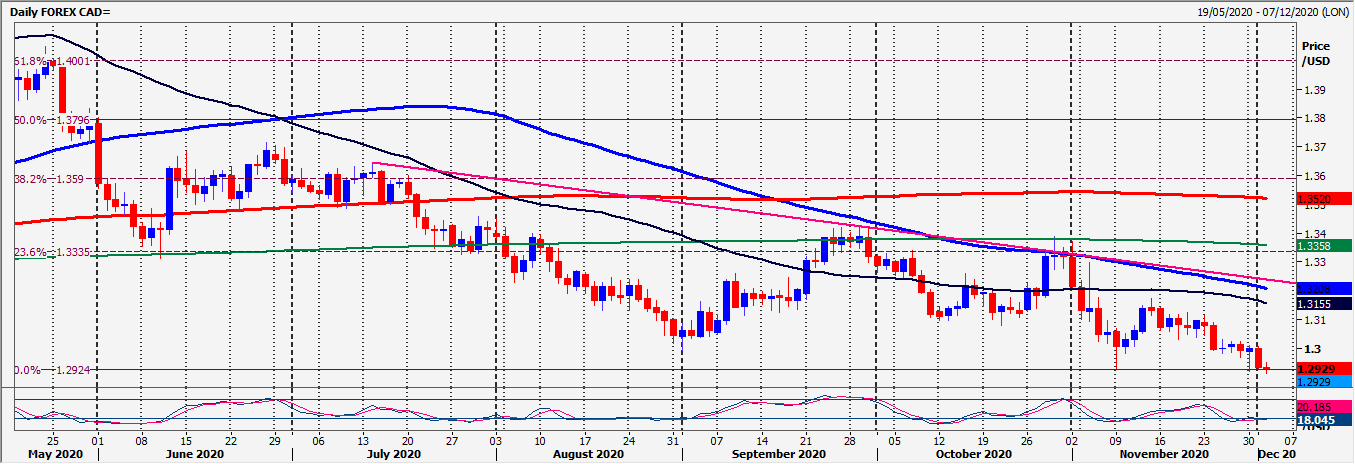

USDCAD so choppy & unable to sustain a move in any direction for more than a day. This has been the case for over 2 week. We reversed from the 1.2980/90 level to retest Monday's low at 1.2920.

Daily Analysis

EURUSD hits the only resistance of any significance now at 1.2050/70. Despite severely overbought conditions shorts are probably too risky after yesterday's strong buy signal but some profit taking in the short term is certainly possible. It could be worth easing up on some longs in case we dip to 1.2025/15. If we continue lower try longs at 1.1980/60 with stops below 1.1950.

Be ready to buy a break above 1.2090 targeting 1.2140/50 & 1.2190/1.2200.

USDCAD retests the November low at 1.2935/25. Holding here in these choppy conditions re-targets first resistance at 1.2980/90 with a high for the day likely. Try shorts with stops above 1.3010.

Be ready to sell a break below 1.2915. We are in a longer term bear trend so a break lower should trigger stops on longs initially targeting 2 year trend line support at 1.2865/55. A break below 1.2840 would be a very significant sell signal in the longer term.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk