EUR/USD Forecast: US inflation looks transitory, euro rally seems here to stay, levels

- EUR/USD has shot higher after US core inflation missed estimates with 4% YoY.

- Prospects of further Fed support will likely weigh on the dollar for longer.

- Tuesday's four-hour chart is showing bulls are gaining ground.

Taper out, transitory in – US core inflation has cooled down in August, a victory for those who said that price rises are only a result of the rapid reopening. The Federal Reserve's timing of tapering its bond-buying scheme has been pushed further into the future and that means more dollars printed for longer.

See US Inflation Quick Analysis: Team Transitory wins, dollar loses, why the trend may extend

The Core Consumer Price Index (Core CPI) rose by only 0.1% last month, the lowest since February. On a yearly basis, underlying inflation is up only 4% against only 4.2% expected. Fed Chair Jerome Powell is under no pressure to act, especially as it comes on top of the weak jobs report.

More dollars printed means a weaker greenback, pushing EUR/USD higher. The old continent already benefits from a better covid situation than the US and the European Central Bank announced its own tapering of sorts last week.

Overall, there is room for more short-term gains, at least until the next significant release. It is essential to note that Fed officials are currently in their "blackout period" ahead of next week's decision, and are unable to respond to the data.

EUR/USD Technical Analysis

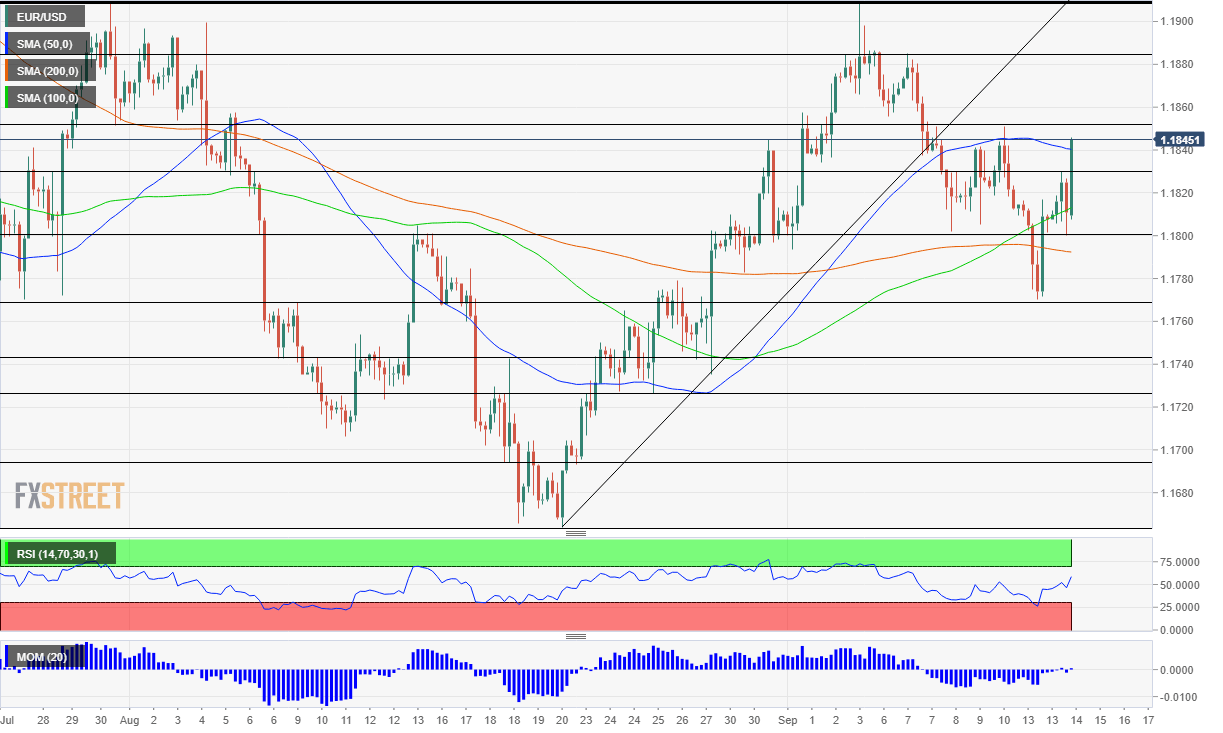

Euro/dollar has surpassed the 50 Simple Moving Average on the four-hour chart, completing a trio of victories – it had already topped the 100 and 200 SMAs. Momentum is turning positive and the currency pair faces new hurdles.

The recent top of 1.1850 is the immediate resistance line. It is followed by 1.1885, which caped a recovery attempt last week. The big prize is 1.1910, a double-top that defends the psychologically significant 1.20 level.

Some support awaits at 1.1830, a temporary cap. The pivotal 1.18 line provided support last week and it is followed by 1.1770, last week's trough.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.