EUR/USD Forecast: Unable to advance beyond 1.1900 ahead of Fed

EUR/USD Current Price: 1.1850

- August US Retail Sales came in much worse than anticipated.

- The dollar is under pressure ahead of the US Federal Reserve monetary policy decision.

- EUR/USD ranging within familiar levels, the dollar lacks bullish potential.

The EUR/USD pair is holding below the 1.1900 level, despite the dollar is in sell-off mode. The American currency is down against all of its major rivals ever since the day started, as speculative interest is selling in ahead of the US Federal Reserve Monetary Policy decision. Pressure on the greenback has been exacerbated by the recently published August Retail Sales, which came in at 0.6%, below expected. Retail Sales Control Group, contracted to -0.1%, missing expectations of 0.5%.

As for the US Federal Reserve, the central bank is expected to maintain its current policy unchanged, although the market is hoping for more details on the recent shift to average inflation. Policymakers will also unveil fresh forecast on employment, inflation and growth.

EUR/USD short-term technical outlook

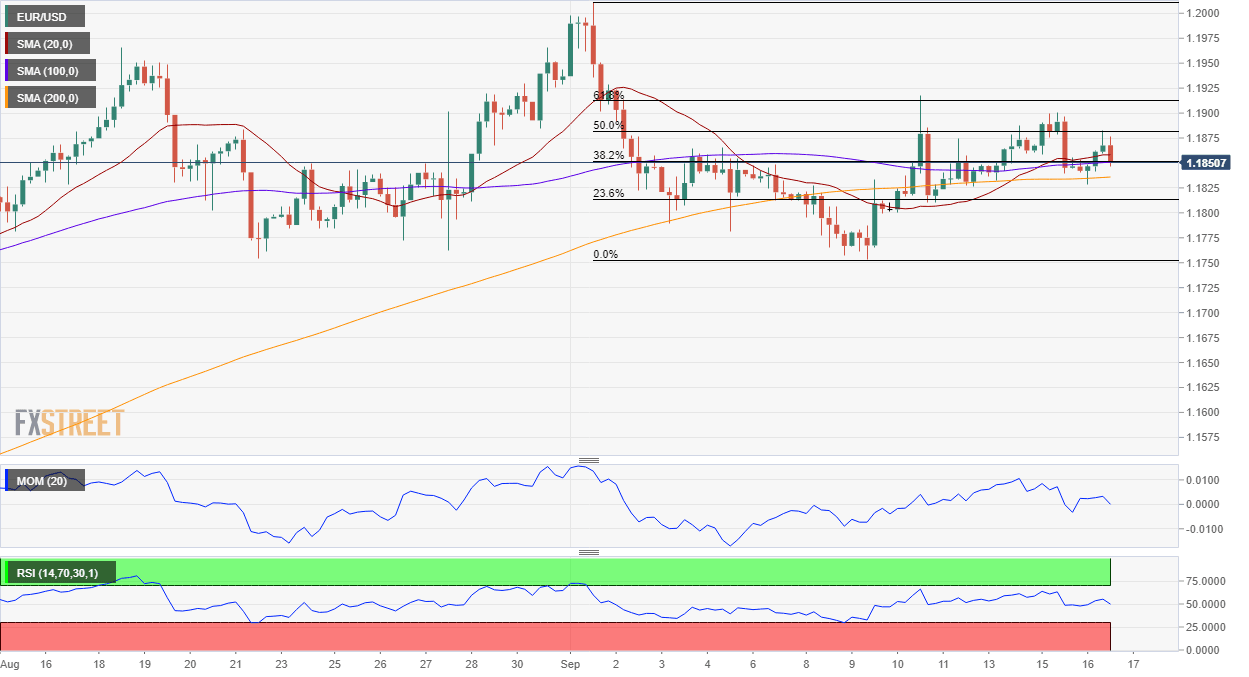

The EUR/USD pair is retreating from a daily high of 1.1882, maintaining its neutral technical stance in the short-term. The 4-hour chart shows that the pair is back to the 1.1850 price zone, hovering around directionless moving averages. Technical indicators, in the meantime, have turned lower, now standing within neutral levels. It’s all about the Fed and how the market takes the announcement. Nevertheless, the dollar has little chances of turning bullish, despite this latest pullback in EUR/USD.

Support levels: 1.1840 1.1800 1.1750

Resistance levels: 1.1915 1.1960 1.2010

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.