EUR/USD Forecast: Reopening is a double-edged sword, bears may temporarily take over

- EUR/USD has been edging lower as US coronavirus fears outweigh improving data.

- US jobless claims and COVID-19 statistics are set to move markets.

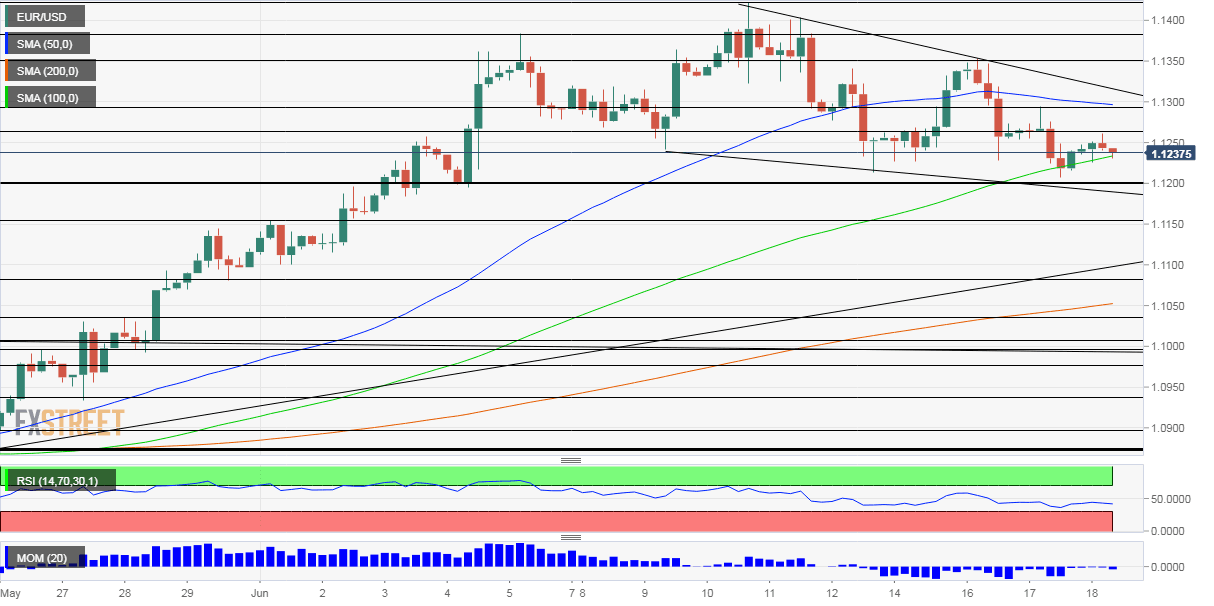

- Thursday's four-hour chart is pointing to a small advantage for bears.

Is the US still in a persistent first wave of coronavirus or has it been hit by a second wave? One thing is clear – the acceleration in hospitalizations and cases in the US Sun Belt is weighing on markets and boosting the safe-haven US dollar.

The worrying news from Texas, Florida – and also Beijing which is suffering an outbreak – has outweighed optimism from robust US retail sales figures published earlier this week. Reopening quickly may have helped the economy but it may hit it back.

Jerome Powell, Chairman of the Federal Reserve, called on Congress to provide more support at a critical point in the recovery and maintained his cautious tone in the second day of testimony on Capitol Hill. Will lawmakers listen?

Washington is busy following revelations by John Bolton, President Donald Trump's former National Security Adviser. Bolton says that the president asked his Chinese counterpart Xi Jinping for help in his reelection campaign and accused Trump of focusing only on that – not on the national interest.

There are over four months until the presidential elections, but some investors fear of clean sweep by Democrats, which would result in more regulation. For now, Trump's rival Joe Biden has a substantial lead in the polls while Republicans are set to hold onto the Senate – a result that would probably please markets.

Apart from updated coronavirus statistics, markets will likely react to weekly jobless claims due out later on Thursday. The downside trend is encouraging, yet the high number of claims – set to remain above one million – still shows the damage inflicted by the disease.

See Jobless Claims Preview: Better is still a long way to go

The euro side of the EUR/USD equation is set to remain quieter, as European countries continue reporting low COVID-19 figures and prepare to open more borders. German Chancellor Angela Merkel said she expects no final decision on the ambitious EU recovery fund in a call on Friday. That will probably wait for July.

EUR/USD Technical Analysis

Momentum on the four-hour chart is marginal to the downside and the EUR/USD is struggling to hold onto the 100 Simple Moving Average. The currency pair has been setting lower lows, as the downtrend suggests. All in all, bears have an advantage, at least in the short term.

Support awaits at the round 1.12 level, which provided support on Wednesday. It is followed by 1.1150, which was a stepping stone on the way up, and then by 1.1080, a support line from late May.

Resistance is a 1.1270, the daily high, and then at 1.1295, a swing high from earlier this week. 1.1350 and 1.1385 are next.

More Why EUR/USD may rally, where to find the key to gold move, lots more – Interview with Richard Perry

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.