EUR/USD Forecast: Euro struggles to stretch higher after ECB

- EUR/USD moves sideways in a narrow range above 1.1350 on Friday.

- The pair is likely to remain quiet on Easter Friday.

- The ECB lowered key rates by 25 bps after the April policy meeting.

EUR/USD trades in a narrow channel at around 1.1370 after closing in negative territory on Thursday. With major financial markets remaining closed in observance of the Easter Holiday on Friday, the pair is likely to extend its sideways grind heading into the weekend.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.04% | -1.38% | -1.10% | -0.14% | -1.31% | -2.55% | -0.06% | |

| EUR | 0.04% | -0.83% | -0.62% | 0.36% | -0.81% | -2.08% | 0.42% | |

| GBP | 1.38% | 0.83% | 0.62% | 1.18% | 0.02% | -1.26% | 1.26% | |

| JPY | 1.10% | 0.62% | -0.62% | 0.95% | -0.46% | -0.92% | 1.17% | |

| CAD | 0.14% | -0.36% | -1.18% | -0.95% | -1.30% | -2.41% | 0.00% | |

| AUD | 1.31% | 0.81% | -0.02% | 0.46% | 1.30% | -1.27% | 1.24% | |

| NZD | 2.55% | 2.08% | 1.26% | 0.92% | 2.41% | 1.27% | 2.58% | |

| CHF | 0.06% | -0.42% | -1.26% | -1.17% | -0.00% | -1.24% | -2.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The European Central Bank (ECB) announced on Thursday that it lowered key rates by 25 basis points (bps) following the April policy meeting. This decision came in line with the market expectation and failed to trigger a noticeable market reaction.

While speaking at the post-meeting press conference, ECB President Christine Lagarde adopted a cautious tone, noting that the Eurozone's economic outlook is clouded by uncertainty.

In the meantime, the data from the US showed that the weekly Initial Jobless Claims declined to 215,000 from 224,000 in the previous week. The US Dollar (USD) held its ground following this data and made it difficult for EUR/USD to gain traction.

Early Friday, ECB policymaker Francois Villeroy de Galhau argued that the inflation risk from trade tensions seems weak and could even be downward, per Reuters.

The economic calendar will not feature any high-tier data releases on Friday.

EUR/USD Technical Analysis

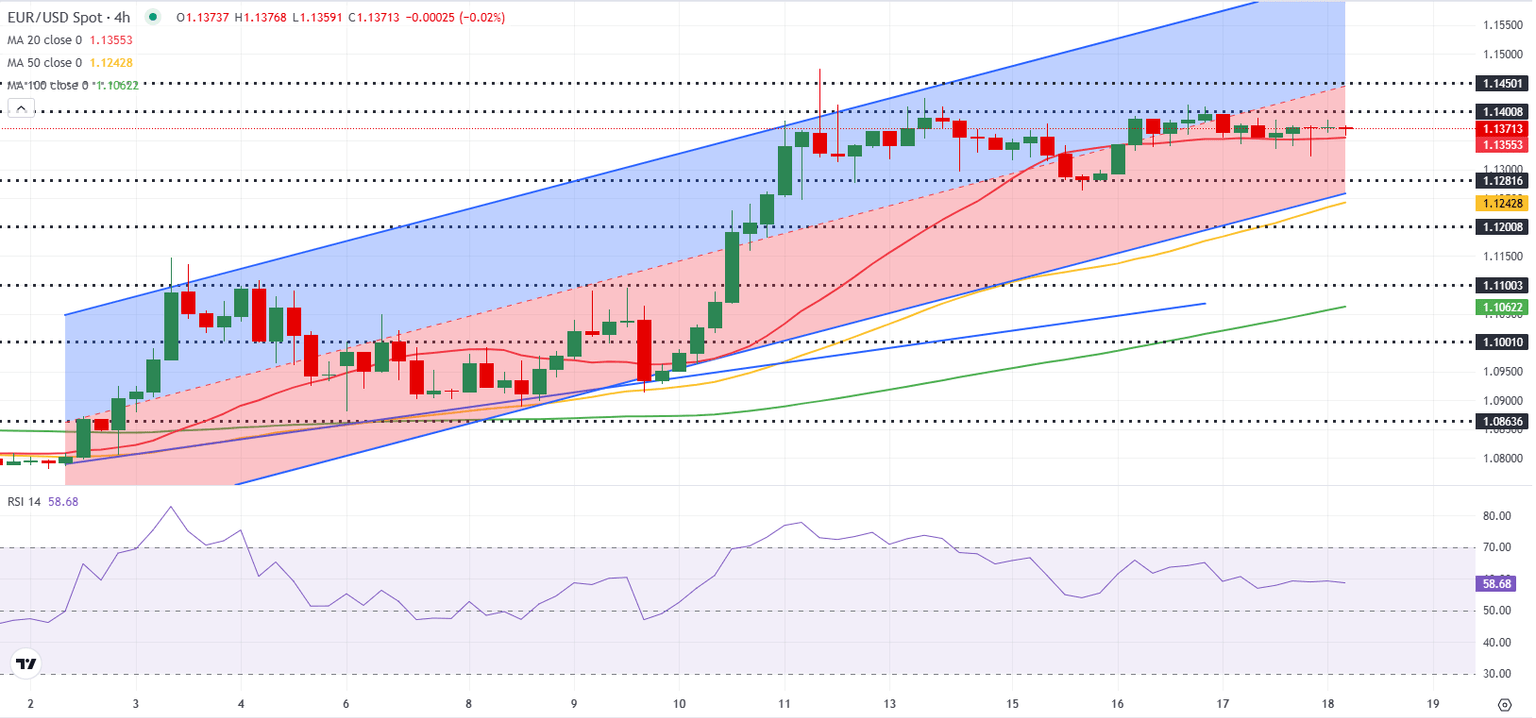

The Relative Strength Index (RSI) indicator on the 4-hour chart moves sideways slightly below 60, suggesting that the bullish bias remains intact but lacks momentum.

On the downside, immediate support is located at 1.1350 (20-period Simple Moving Average) before 1.1280 (static level) and 1.1250 (lower limit of the ascending channel). Looking north, resistances could be spotted at 1.1400 (static level), 1.1470 (midpoint of the ascending channel) and 1.1500 (round level).

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

(The story was corrected on April 18 at 08:16 GMT to say in the first bullet point that EUR/USD moves sideways above 1.1350 on Friday, not Thursday).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.