EUR/USD Forecast: Euro stabilizes but remains fragile

- EUR/USD struggles to stage a rebound following Tuesday's decline.

- The US Dollar stays resilient against its rivals on upbeat data releases.

- The Fed will publish the minutes of the May policy meeting.

EUR/USD stays on the back foot and trades slightly above 1.1300 in the European morning on Wednesday after closing in negative territory on Tuesday. The technical outlook is yet to point to a buildup of recovery momentum.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.38% | 0.14% | 1.11% | 0.64% | 0.69% | 0.26% | 0.75% | |

| EUR | -0.38% | -0.24% | 0.77% | 0.25% | 0.31% | -0.11% | 0.37% | |

| GBP | -0.14% | 0.24% | 0.66% | 0.50% | 0.55% | 0.13% | 0.63% | |

| JPY | -1.11% | -0.77% | -0.66% | -0.47% | -0.44% | -0.91% | -0.34% | |

| CAD | -0.64% | -0.25% | -0.50% | 0.47% | 0.06% | -0.37% | 0.12% | |

| AUD | -0.69% | -0.31% | -0.55% | 0.44% | -0.06% | -0.46% | 0.08% | |

| NZD | -0.26% | 0.11% | -0.13% | 0.91% | 0.37% | 0.46% | 0.50% | |

| CHF | -0.75% | -0.37% | -0.63% | 0.34% | -0.12% | -0.08% | -0.50% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The data published by the Conference Board showed on Tuesday that consumer sentiment in the US improved in May, with the CB Consumer Confidence Index rising to 98.0 from 86.0 in April.

Assessing the survey's findings, "consumers were less pessimistic about business conditions and job availability over the next six months and regained optimism about future income prospects," said Stephanie Guichard, Senior Economist, Global Indicators at the Conference Board.

Additionally, Durable Goods Orders contracted at a slightly softer pace than expected in April. Upbeat data readings helped the US Dollar (USD) preserve its strength in the second half of the day on Tuesday.

Meanwhile, the European Central Bank reported in its latest Consumer Expectations Survey that inflation expectations for the next 12 months increased to 3.1% from 2.9% in the previous survey. This headline seems to be helping the Euro find support.

The US economic calendar will not feature any high-impact data releases on Wednesday. Later in the American session, the Federal Reserve (Fed) will publish the minutes of the May policy meeting.

The CME FedWatch Tool shows that markets virtually see no chance of a Fed rate reduction in June and price in about a 25% probability of a cut in July. In case the publication shows that policymakers are willing to wait longer to assess the impact of the new trade regime on the inflation outlook before taking the next policy step, the USD could hold its ground and cause EUR/USD to stretch lower.

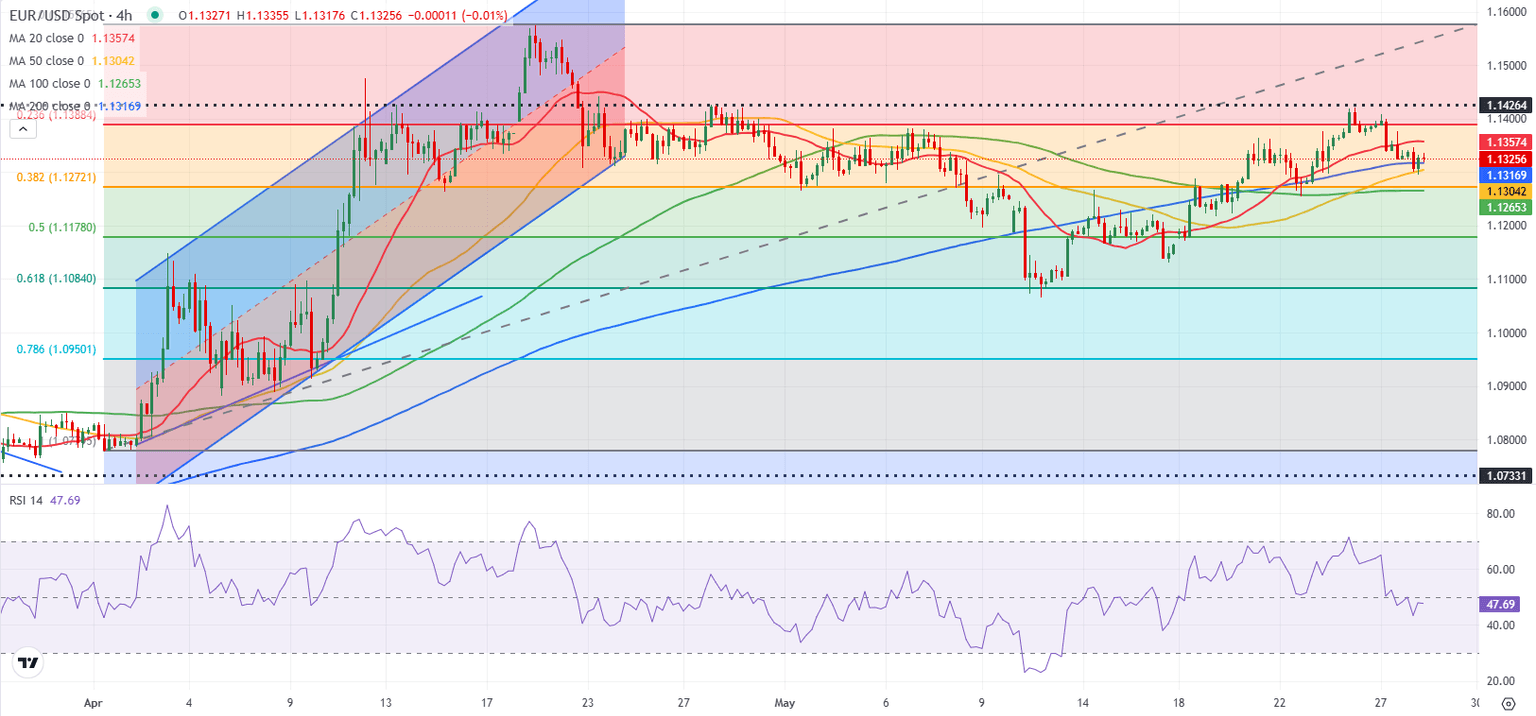

EUR/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart stays slightly below 50, reflecting a lack of buyer interest. The 200-period Simple Moving Average (SMA) aligns as immediate support at 1.1300. In case EUR/USD drops below this level, 1.1270 (Fibonacci 38.2% retracement level of the latest uptrend, 100-period SMA) could be seen as next support before 1.1180 (Fibonacci 50% retracement).

On the upside, resistance levels could be spotted at 1.1380 (Fibonacci 23.6% retracement), 1.1430 (static level) and 1.1500 (static level, round level).

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.