EUR/USD Forecast: Euro selloff to take a breather amid holiday trading

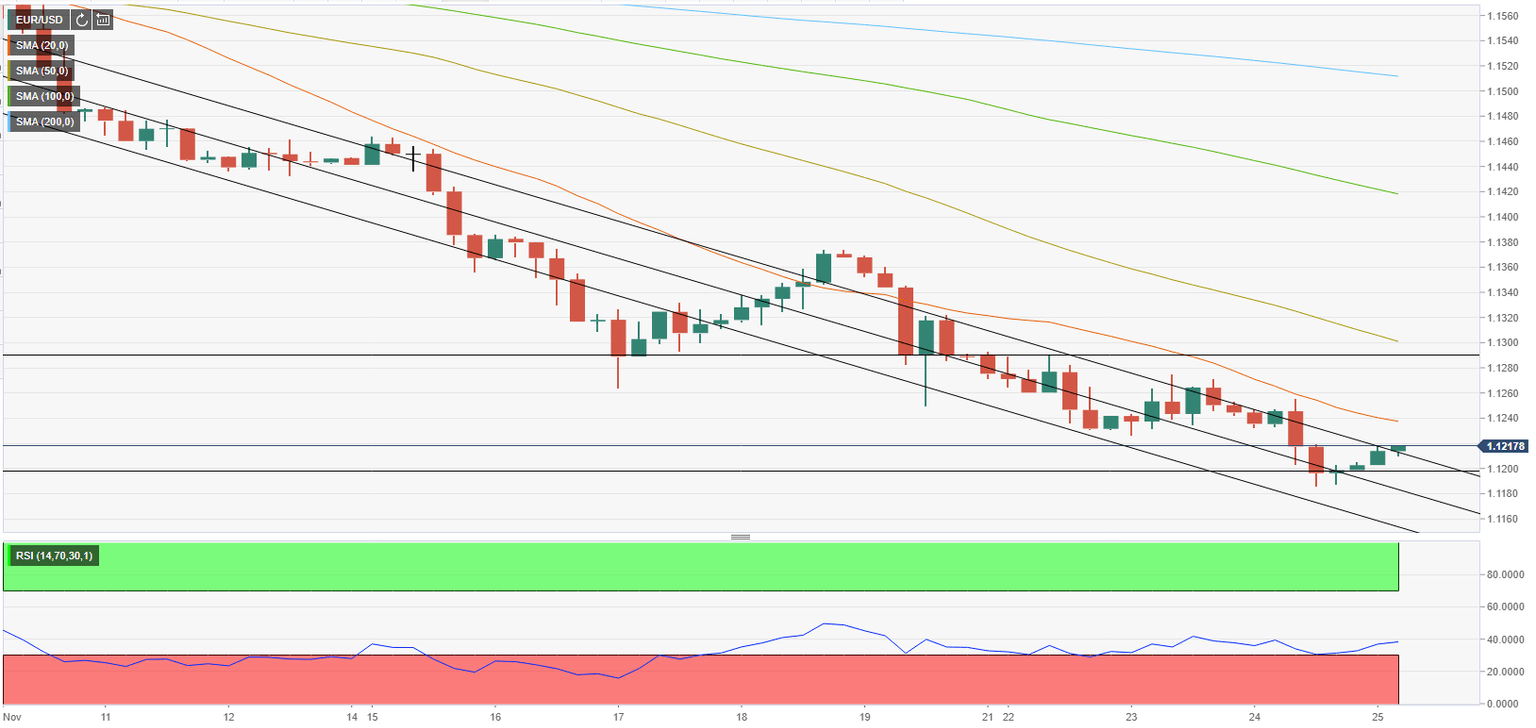

- EUR/USD has been moving within a descending channel.

- Thin trading conditions could open the door for a technical correction.

- The pair could turn neutral in the near term with a daily close above 1.1300.

EUR/USD has touched its weakest level since June 2020 at 1.1185 on Wednesday but managed to rebound above 1.1200 in what seems to be a technical correction of this week's decline. Markets are likely to remain calm for the remainder of the day due to the Thanksgiving holiday in the US and the shared currency could stay resilient against the greenback.

The Personal Consumption Expenditures (PCE) Price Index data from the US confirmed on Wednesday that inflation continues to run hot into the last quarter of the year. The 10-year US Treasury bond yield edged higher toward 1.7% and allowed the dollar to outperform its rivals. Furthermore, San Francisco Fed President Mary Daly, who earlier in the month said that the Fed should stay patient in the face of high inflation, noted that she sees a case for speeding up the asset taper.

Later in the session, the European Central Bank will release its Monetary Policy Meeting Accounts. At this point, it wouldn't be a surprise if the publication reiterated that the ECB's forward guidance does not point to a rate hike in 2022. Hence, the common currency's losses are likely to remain limited even if the ECB sticks to its dovish narrative. Several ECB policymakers, including President Christine Lagarde, will be delivering speeches on Thursday as well.

In the meantime, the data from Germany showed that consumer confidence is expected to deteriorate further in December. Additionally, Destatis reported that the German economy expanded by 2.5% on a yearly basis in the third quarter as expected.

EUR/USD Technical Analysis

On the four-hour chart, EUR/USD is trading above the descending regression channel coming from November 9. The Relative Strength Index (RSI) indicator on the same chart is holding near 40, suggesting that sellers are staying on the sidelines for the time being.

On the upside, initial resistance is located at 1.1240 (20-period SMA) ahead of 1.1300 (psychological level, 50-period SMA). Only a daily close above the latter could convince investors that the pair has turned neutral in the near term.

Supports are located at 1.1200 (psychological level), 1.1185 (2021-low) and 1.1140 (static level, former resistance).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.