EUR/USD Forecast: Euro rebounds but remains fragile

- EUR/USD trades near 1.0400 at the beginning of the week.

- Markets await preliminary February inflation data from the Euro area.

- Geopolitical headlines could influence the US Dollar's valuation and drive the pair's action.

EUR/USD clings to modest daily gains near 1.0400 after closing the previous week in negative territory. The pair's technical outlook is yet to point to a buildup of recovery momentum in the near term.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.31% | -0.16% | -0.15% | -0.08% | -0.15% | -0.03% | -0.08% | |

| EUR | 0.31% | 0.04% | -0.06% | 0.05% | 0.06% | 0.09% | 0.05% | |

| GBP | 0.16% | -0.04% | 0.02% | 0.01% | 0.02% | 0.06% | 0.00% | |

| JPY | 0.15% | 0.06% | -0.02% | 0.28% | 0.04% | 0.16% | 0.05% | |

| CAD | 0.08% | -0.05% | -0.01% | -0.28% | 0.08% | 0.05% | -0.01% | |

| AUD | 0.15% | -0.06% | -0.02% | -0.04% | -0.08% | 0.03% | -0.02% | |

| NZD | 0.03% | -0.09% | -0.06% | -0.16% | -0.05% | -0.03% | -0.05% | |

| CHF | 0.08% | -0.05% | -0.00% | -0.05% | 0.00% | 0.02% | 0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

EUR/USD registered losses for three consecutive days to end the previous week and touched its lowest level in over two weeks at 1.0360 late Friday. Escalating geopolitical tensions after US President Donald Trump cancelled the signing of a minerals deal with Ukraine following his heated argument with Ukrainian President Volodymyr Zelenskyy in the Oval Office forced investors to adopt a cautious stance.

Over the weekend, European leaders and British Prime Minister Keir Starmer held crisis talks and voiced their support for Ukraine. French President Emmanuel Macron told Le Figaro newspaper on Sunday that France and Britain are proposing a one-month truce in Ukraine to stop all air and sea conflict and attacks on energy infrastructure.

Following these developments, markets could refrain from betting on a steady recovery in the Euro, given the heightened uncertainty surrounding the EU-US relations.

Later in the European session, Eurostat will publish the preliminary Harmonized Index of Consumer Prices (HICP) data for February. In the second half of the day, the ISM Manufacturing PMI report for February will be featured in the US economic calendar. Investors are likely to ignore these data and stay focused on geopolitics. In case safe-haven flows start to dominate the action in financial markets later in the day, EUR/USD could come under renewed bearish pressure.

EUR/USD Technical Analysis

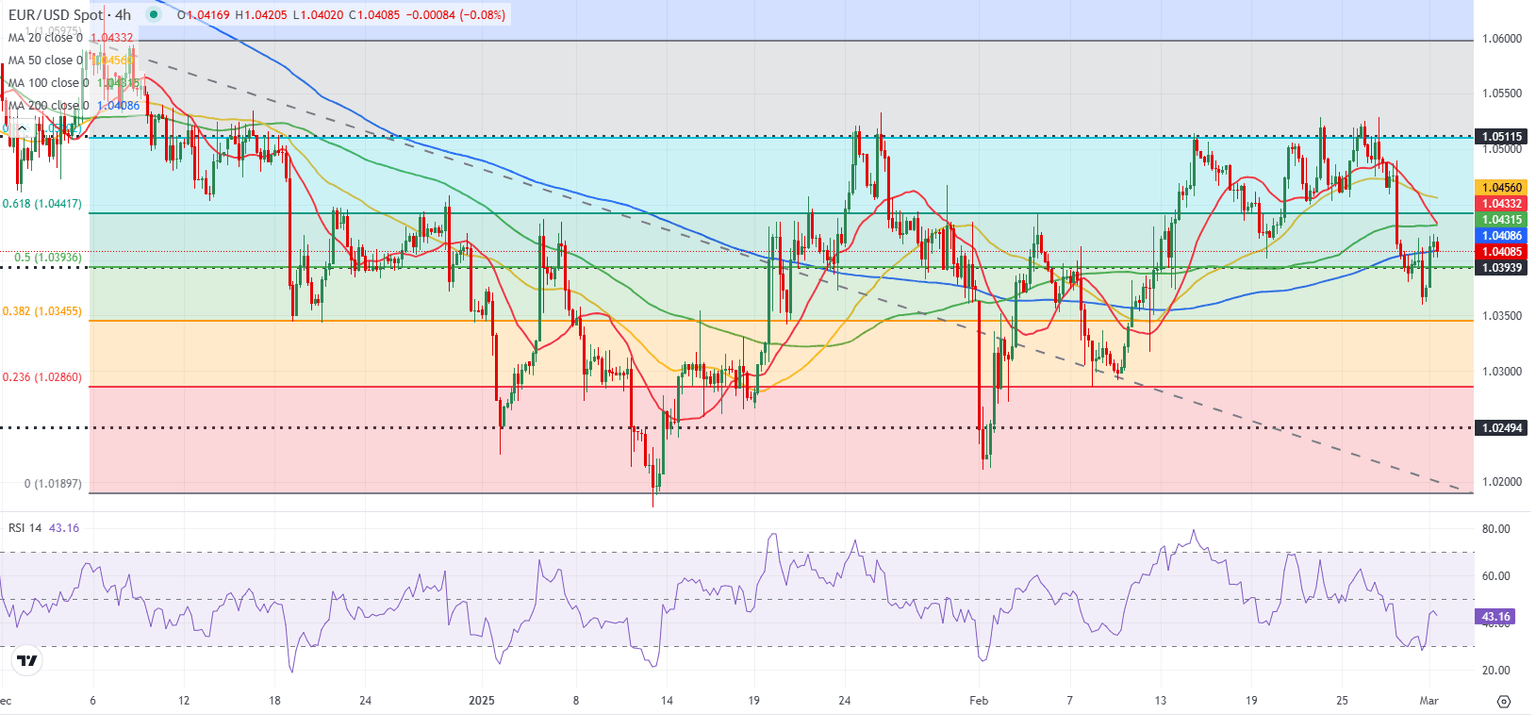

The Relative Strength Index (RSI) indicator on the 4-hour chart stays below 50 and EUR/USD trades below the 20-day Simple Moving Average (SMA), currently located at 1.0420, after closing the week below this level.

Looking south, the first support level could be spotted at 1.0350 (Fibonacci 38.2% retracement of the latest downtrend) before 1.0300-1.0290 (round level, Fibonacci 23.6% retracement) and 1.0250 (static level). In case EUR/USD makes a daily close above 1.0420, the next immediate resistance could be seen at 1.0440 (Fibonacci 61.8% retracement) ahead of 1.0500-1.0510 (Fibonacci 78.6% retracement, static level).

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.