EUR/USD Forecast: Euro could test upper limit of weekly range after US data

- EUR/USD has been fluctuating in a narrow channel since the beginning of the week.

- PCE inflation data from the US will be looked upon for fresh impetus.

- The pair could test 1.0680 in case the US Dollar weakens after US data.

EUR/USD has managed to stage a rebound during the Asian trading hours and climbed above 1.0600 after having registered small losses on Thursday. The near-term technical outlook doesn't provide any directional clues for the time being but the inflation data from the US could trigger a market reaction ahead of the long weekend.

On Thursday, the US Bureau of Economic Analysis (BEA) announced that it revised the annualized Gross Domestic Product (GDP) growth for the third quarter to 3.2% from 2.9% in the previous estimate. The US Dollar gathered strength against its major rivals on the upbeat data and forced EUR/USD to edge lower. Additionally, the sharp decline witnessed in Wall Street's main indexes provided an additional boost to the US Dollar and didn't allow the pair to regain its traction.

Nevertheless, EUR/USD failed to gather enough momentum to make a decisive move in either direction amid thinning trading conditions into the Christmas holiday.

In the second half of the day, the BEA will release the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's preferred gauge of inflation, for November.

Investors expect the Core PCE Price Index to decline to 4.7% on a yearly basis from 5% in October. The impact of this data on EUR/USD should be straightforward forward with a weaker-than-forecast print weighing on the US Dollar and helping the pair push higher and vice versa.

Pre-Christmas US Data Preview: Core PCE and Durable Goods may extend US Dollar retreat.

The US economic docket will also feature Durable Goods Orders and New Home Sales but market participants are likely to stay focused on the inflation report. It's also worth noting that the pair's volatility could increase toward the London fix and trigger some sharp fluctuations.

EUR/USD Technical Analysis

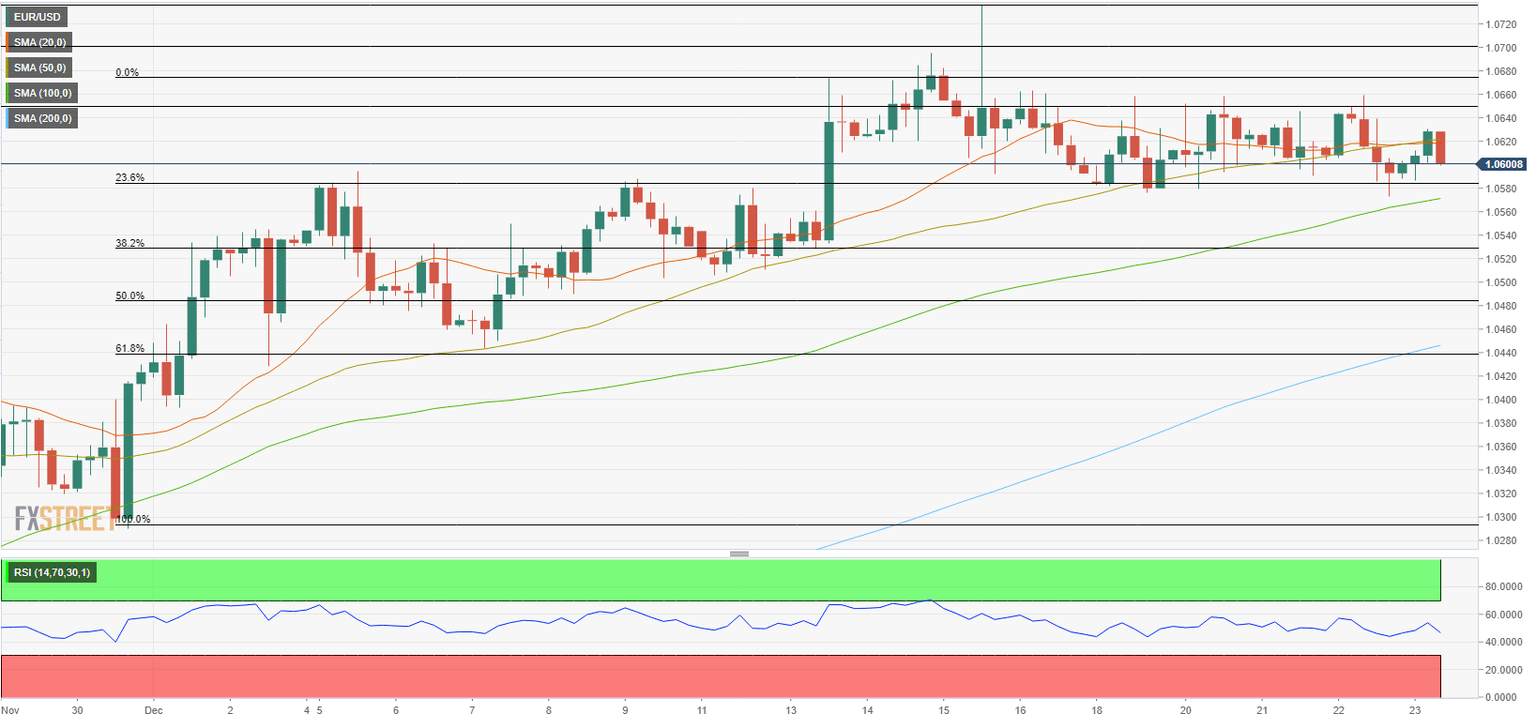

The pair faces strong support at around 1.0580, where the Fibonacci 23.6% retracement of the latest uptrend and the 100-period Simple Moving Average (SMA) on the four-hour chart align. Below that level, 1.0530 (Fibonacci 38.2% retracement) could be seen as the next support before 1.0500.

On the upside, the pair could target 1.0680 (end-point of uptrend) and 1.0700 (psychological level) could be tested once EUR/USD rises above 1.0620 (20-period SMA, 50-period SMA) and confirms it as support.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.