EUR/USD Forecast: Euro bears eye 1.1000 as Russian aggression continues

- EUR/USD has failed to shake off the bearish pressure.

- Near-term support for the pair seems to have formed at 1.1080.

- EU inflation data, FOMC Chairman Powell's testimony are awaited.

EUR/USD met heavy selling pressure during American trading hours on Tuesday and touched its weakest level in 22 months below 1.1100. The pair stays on the back foot early Wednesday as markets remain risk-averse. With a drop below 1.1080, EUR/USD could target 1.1000 next.

Investors are growing increasingly concerned over the negative impact of a prolonged Russia-Ukraine war on the global economy and inflation. Ahead of the second round of peace talks, Russia continues to ramp up its aggression against Ukraine regardless of the harsh sanctions imposed by the west, weighing on hopes for a diplomatic solution.

Meanwhile, investors are scaling back European Central Bank (ECB) rate hike bets amid the heightened uncertainty over the economic outlook. Money markets are now pricing in less than 15 basis points worth of ECB hikes by December, compared to 35 bps just last week.

Eurostat will release the February inflation data for the euro area. Investors see the Harmonised Index of Consumer Price (HICP) rising to 5.4% on a yearly basis from 5.1% in January. Although a stronger-than-expected print could help the shared currency stage a recovery, EUR/USD upside is likely to remain limited unless risk flows return.

Later in the day, FOMC Chairman Jerome Powell will testify before the US House Committee on Financial Services. Powell could adopt a cautious tone but the dollar's losses are likely to remain limited as investors see little to no chance of a 50 basis points rate hike in March.

Powell Preview: Rethink because of the war? Not so fast, Fed set to remain on track, dollar to rise.

In short, the Russia-Ukraine conflict is likely to have a stronger impact on the euro area economy than the US economy and the pair is likely to remain on the back foot unless there is a solution to the crisis.

EUR/USD Technical Analysis

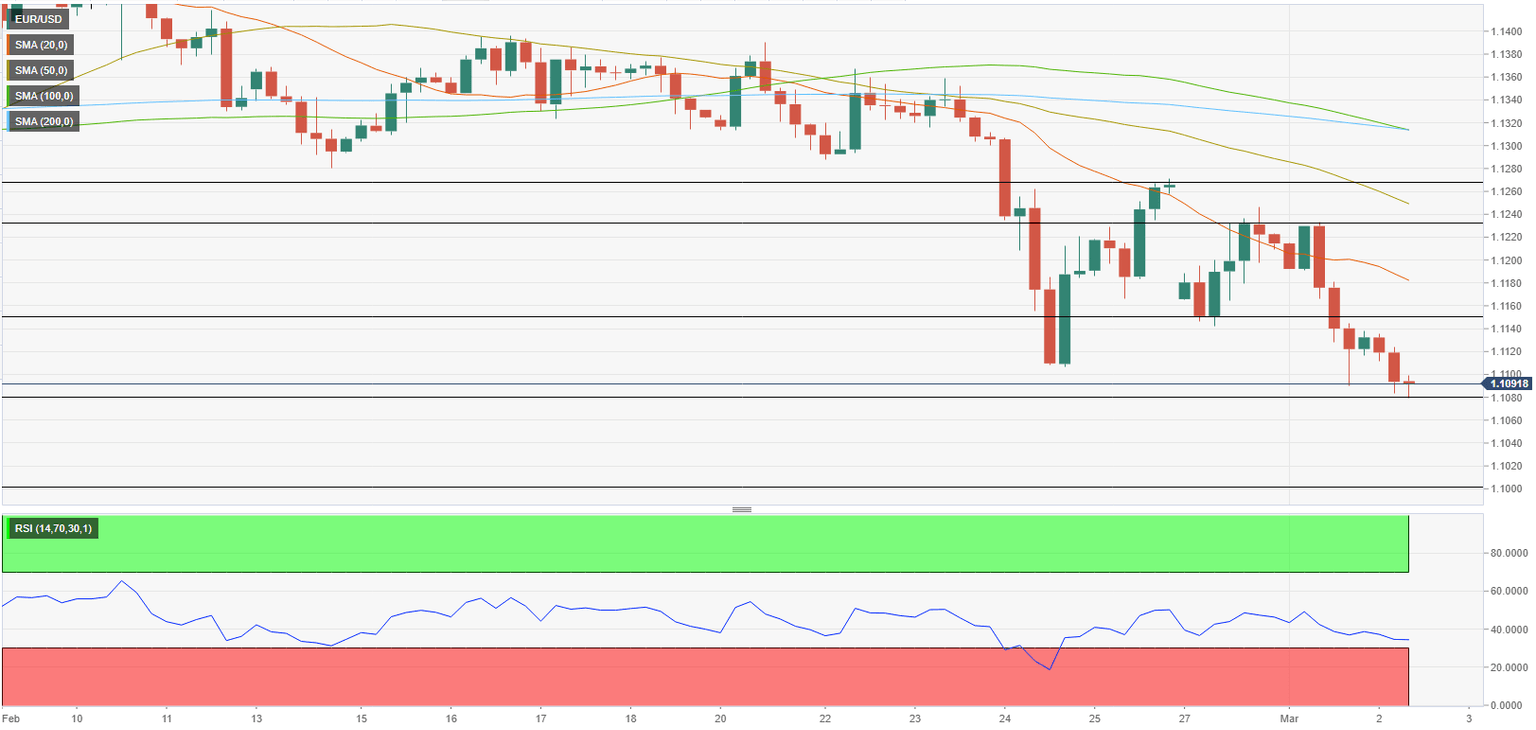

EUR/USD seems to have met interim support at 1.1080 and the pair could face renewed bearish pressure if buyers fail to defend this level. On the downside, 1.1000 (psychological level) could be seen as the next support.

In the meantime, the Relative Strength Index (RSI) indicator on the four-hour chart is still below 30, suggesting that the pair could push lower before turning technically oversold.

Resistances are located at 1.1150 (static level), 1.1180 (20-period SMA) and 1.1220 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.