EUR/USD Forecast: Dollar catches momentum with upbeat Retail Sales

EUR/USD Current Price: 1.2033

- US Treasury yields at fresh one-year highs providing support to the greenback.

- US Retail Sales soared by 5.3% in January, far better than anticipated.

- EUR/USD is technically bearish and at risk of breaking lower.

The EUR/USD pair has fallen sharply throughout the first half of the day, accelerating its slump after the release of US Retail Sales, which rose in January 5.3%, much better than anticipated. The core reading, Retail Sales Control Group, jumped from -2.4% to 6%, also beating expectations. Also, the country published the January Producer Price Index, which was up 1.7% yearly basis.

US Treasury yields are still the main support for the greenback, as they soared to their highest since February last year, with the yield on the 10-year Treasury note at around 1.33%. Stock, on the other hand, trade with modest losses in Europe, weighing on US indexes. Later today, the country will unveil Industrial Production figures and the latest FOMC Meeting Minutes.

Earlier today, the EU published December Construction Output, which was down by 3.7% in the month and by 2.3% when compared to a year earlier.

EUR/USD short-term technical outlook

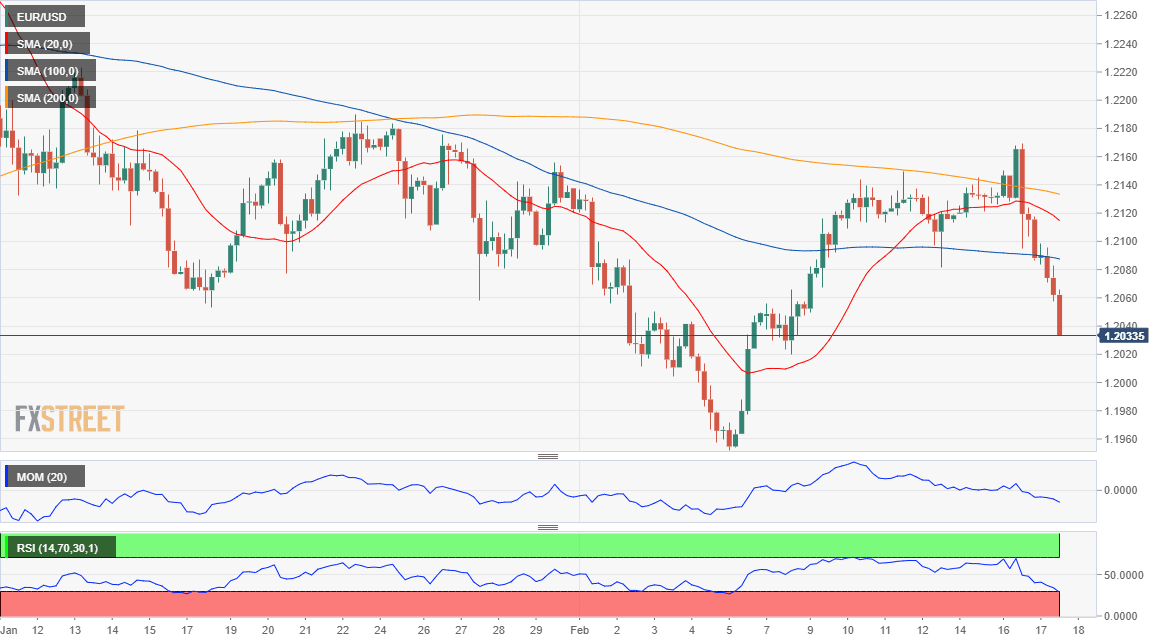

The EUR/USD pair is trading near a daily low at 1.2030 and is poised to extend its slump in the near-term. The pair is developing below the 1.2060 price zone, the 38.2% retracement of its November/January slump. In the 4-hour chart, the pair has broken below all of its moving averages, while technical indicators head firmly lower within negative levels. A steeper decline could be expected on a break below 1.2015 the immediate support.

Support levels: 1.2015 1.1970 1.1925

Resistance levels: 1.2065 1.2100 1.2145

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.