EUR/USD Forecast: Dismal US employment data keeps pushing it higher

EUR/USD Current Price: 1.1860

- Services output in the US improved in July, but demand conditions deteriorated.

- US employment data point to a terrible Nonfarm Payroll report for July.

- EUR/USD retreated from its yearly high, but the bullish run is not over yet.

The EUR/USD pair flirted with the yearly high, trading as high as 1.1904 this Wednesday, as speculative interest kept selling the greenback. European data were mixed but didn’t affect the shared currency. The final readings of July Markit Services PMIs missed expectations, most of them suffering downward revisions. The German index came in at 55.6 from a previous estimate of 56.7. For the whole EU, services output resulted at 54.7 from a preliminary estimate of 56.7. Also, the Union reported June Retail Sales, which were up in the month 5.7%, slightly worse than anticipated.

The US published the ADP Employment Survey, which showed that the private sector added only 167,000 jobs in July, far lower than the 4.3 million it added in the previous month. June reading was upwardly revised, which only highlighted the terrible July outcome. The Markit Services PMI was revised to 50 from 49.6, although the report also showed that demand conditions deteriorated in the month. The official ISM Services PMI unexpectedly rose to 58.1 but was unable to trigger interest on the greenback. Thursday will bring German Factory Orders, seen in June increasing by 10.1%, although declining 34% from a year earlier. The US will publish the usual weekly unemployment figures, relevant ahead of the Nonfarm Payroll report to be out on Friday.

EUR/USD short-term technical outlook

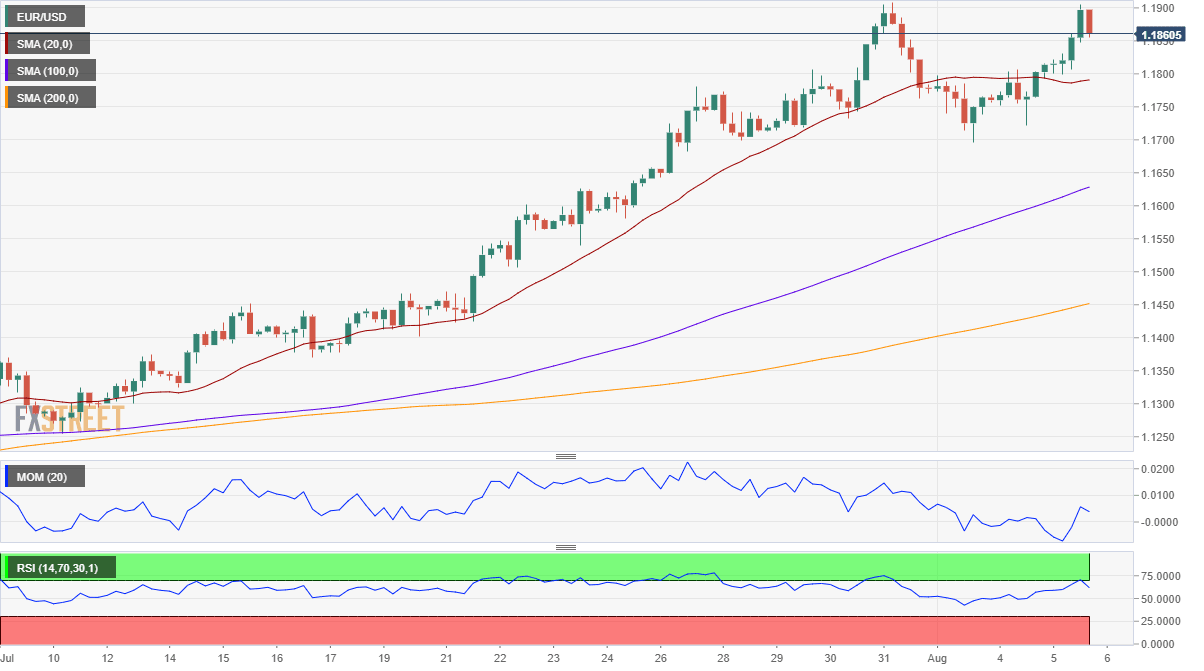

The EUR/USD pair has eased from the mentioned high, now trading in the 1.1860 price zone, retaining its bullish bias. The decline seems corrective, with bulls still in control. In the 4-hour chart, the pair is holding above a flat 20 SMA, while technical indicators retain their upward strength well into positive ground. A steeper advance is to be expected on a break above 1.1910 towards the 1.20 threshold, while retracements will continue to be seen as buying opportunities.

Support levels: 1.1835 1.1790 1.1740

Resistance levels: 1.1910 1.1950 1.1990

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.