EUR/USD Forecast: Correction time? Why Fed-fueled dollar strength could end abruptly, levels

- EUR/USD has hit the lowest since November following the Fed's meeting minutes.

- Worsening economic data since the bank's last meeting and other reasons may cause a rethink in markets.

- Thursday's four-hour chart is pointing to oversold conditions.

Taper is coming – that has been the narrative coming from the Federal Reserve's meeting minutes, and it is boosting the dollar. If the Fed indeed reduces its bond-buying scheme this year and prints fewer greenbacks, the currency has room to rise. However, there are reasons to question this story and expect a reversal.

First, an announcement about cutting down purchases this year had already been on the agenda. Secondly, the minutes are from the meeting held in late July, and since then, August's consumer confidence plunged below the pandemic lows and retail sales figure badly disappointed in July. Moreover, the Delta covid variant continues spreading rapidly.

Perhaps the most significant reason to be more cheerful than the current gloom comes from comments hidden deeper in the minutes. Here is the quote:

Many participants noted that, when a reduction in the pace of asset purchases became appropriate, it would be important that the Committee clearly reaffirm the absence of any mechanical link between the timing of tapering and that of an eventual increase in the target range for the federal funds rate.

In other words, the Fed will not automatically raise interest rates when it finishes its tapering process. That distinction, supported by "many" should also prompt a rethink.

The bank's next big event is Fed Chair Jerome Powell's speech in Jackson Hole late next week. Will he hint that a tapering announcement is coming in September? Probably not.

The economic calendar features weekly US Unemployment Claims and the Philly Fed Manufacturing Index. Both are unlikely to rock the boat, unless they provide shocking news.

Apart from a potential Fed-rethink, markets are still grappling with the worrying scenes from Afghanistan, China's pursuit of its tech companies, and the rapid spread of the Delta covid variant.

On that latter front, Germany reported the highest number of active coronavirus cases since early June, something that could undermine the old continent's recovery. A new study showed that the efficacy of existing vaccines wanes over time when it comes to the highly contagious strain.

Covid concerns could limit any significant gains for the euro, but a dollar correction could be sufficient for bulls.

EUR/USD Technical Analysis

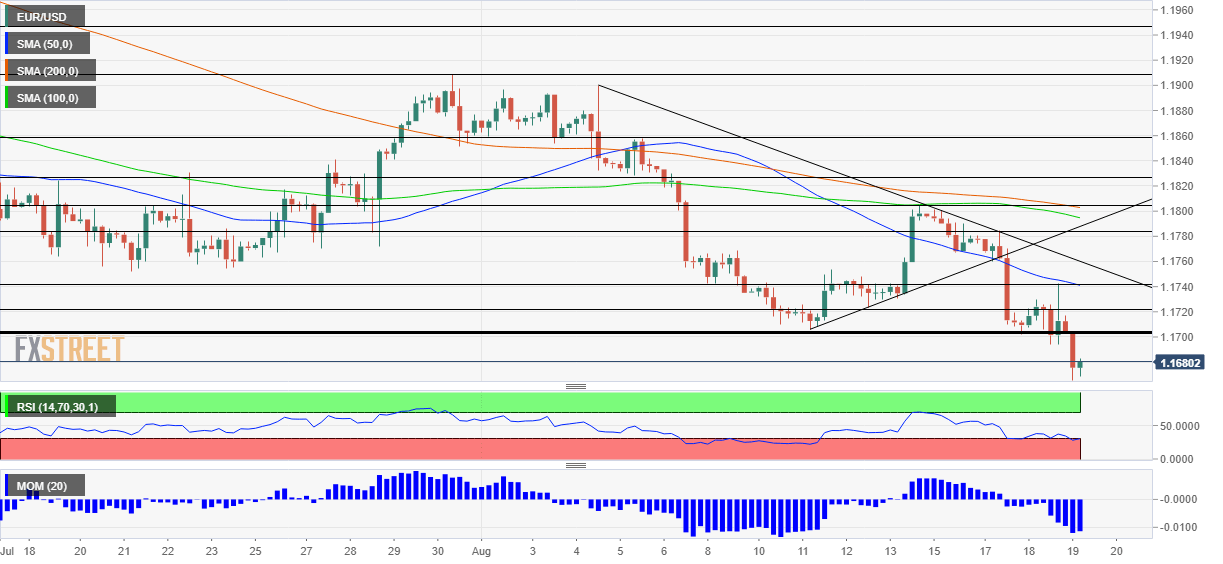

Euro/dollar is suffering from oversold conditions according to the Relative Strength Index (RSI) on the four-hour chart. The drop below 30 implies a bounce is due. Other indicators such as momentum and the Simple Moving Average are pointing lower.

Immediate support awaits at the fresh 2021 trough of 1.1665. The next level to watch is the double-bottom of 1.1610 set in late 2020. Further down, 1.15 is a noteworthy psychological barrier.

The broken 1.17 level is the first level of resistance. It is followed by 1.1720, which support EUR/USD last week, and then by 1.1740, which was Wednesday's swing high.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.