EUR/USD Forecast: Bulls could take action on a soft US jobs report

- EUR/USD holds steady early Friday, trades below 1.0400.

- Nonfarm Payrolls in the US are forecast to rise by 170,000 in January.

- The pair's near-term technical outlook shows a lack of directional momentum.

EUR/USD struggled to hold its ground on Thursday closed the day marginally lower, snapping a three-day winning streak. Early Friday, the pair trades in a narrow range below 1.0400 as investors refrain from taking large positions ahead of the highly-anticipated employment data from the US.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.16% | -0.34% | -2.03% | -2.67% | -1.22% | -1.49% | -1.03% | |

| EUR | 0.16% | 0.22% | -0.60% | -1.24% | -0.61% | -0.05% | 0.43% | |

| GBP | 0.34% | -0.22% | -1.89% | -1.46% | -0.82% | -0.27% | 0.21% | |

| JPY | 2.03% | 0.60% | 1.89% | -0.66% | 0.99% | 1.47% | 1.67% | |

| CAD | 2.67% | 1.24% | 1.46% | 0.66% | 0.39% | 1.21% | 1.69% | |

| AUD | 1.22% | 0.61% | 0.82% | -0.99% | -0.39% | 0.56% | 1.04% | |

| NZD | 1.49% | 0.05% | 0.27% | -1.47% | -1.21% | -0.56% | 0.48% | |

| CHF | 1.03% | -0.43% | -0.21% | -1.67% | -1.69% | -1.04% | -0.48% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The cautious market stance helped the US Dollar (USD) stay resilient against its rivals and didn't allow EUR/USD to build on its weekly gains.

Nonfarm Payrolls (NFP) in the US are forecast to rise by 170,000 in January, following the impressive 256,000 increase recorded in December. In the same period, the Unemployment Rate is seen holding steady at 4.1%.

A positive surprise, with an NFP reading above 200,000, could support the USD with the immediate reaction and weigh on EUR/USD in the American session. On the other hand, investors could reassess the possibility of a 25 basis points (bps) Federal Reserve rate cut in March if the NFP disappoints with a print below 150,000. According to the CME FedWatch Tool, markets are currently pricing in a nearly-15% probability of a March cut. In this scenario, EUR/USD could extend its weekly uptrend heading into the weekend.

EUR/USD Technical Analysis

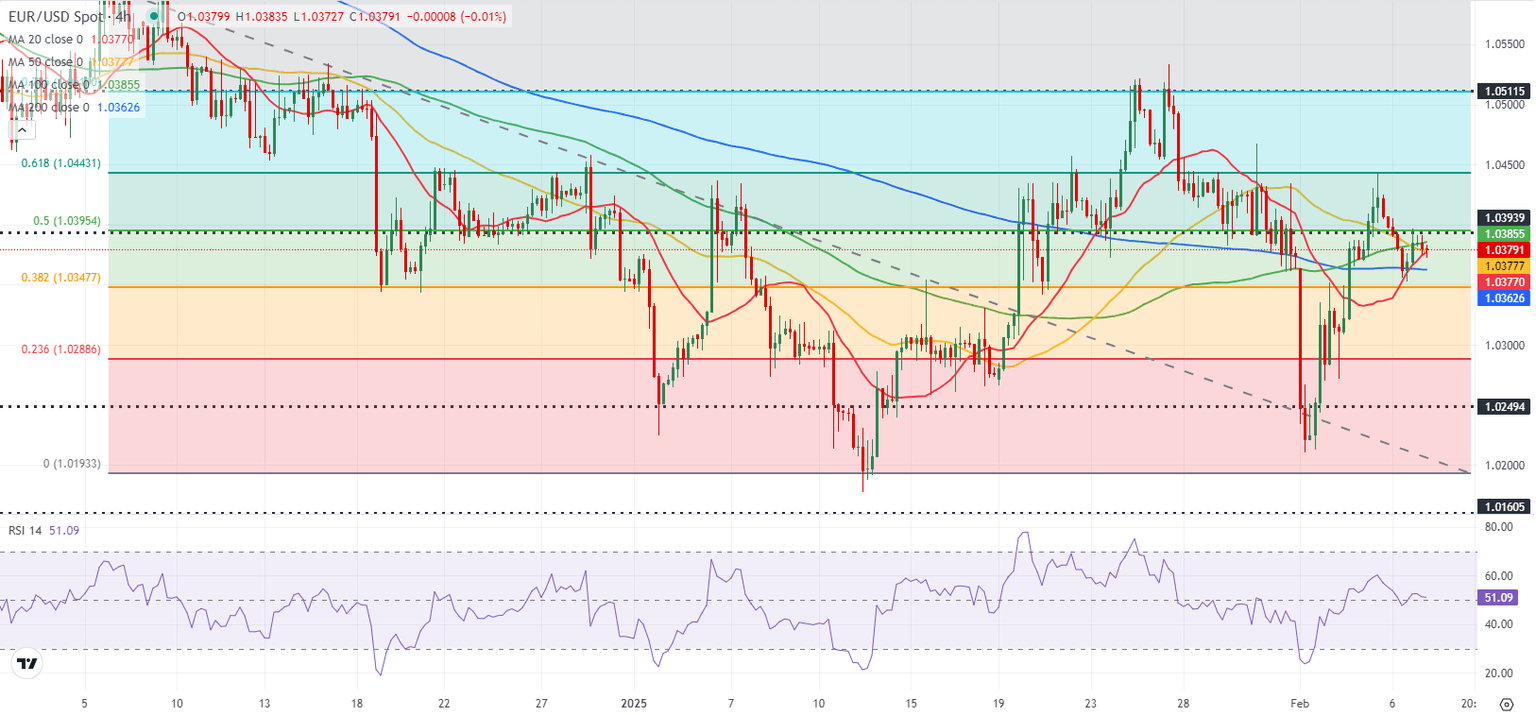

The Relative Strength Index (RSI) indicator on the 4-hour chart stays flat at around 50, reflecting a lack of directional momentum in the near term.

On the downside, a strong support area seems to have formed at 1.0350-1.0360, where the 200-period Simple Moving Average (SMA) meets the Fibonacci 38.2% retracement of the latest downtrend. If this support fails, 1.0290-1.0300 (Fibonacci 23.6% retracement, round level) could be seen as next support before 1.0250 (static level).

On the upside, 1.0400 (Fibonacci 50% retracement) aligns as immediate resistance before 1.0440 (Fibonacci 61.8% retracement) and 1.0500 (static level, round level).

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.