EUR/USD Forecast: Bears looking for fresh monthly lows

EUR/USD Current Price: 1.0589

- Hotter-than-expected Spanish and French inflation underpinned the Euro.

- US CB Consumer Confidence shrank for a second consecutive month in February.

- EUR/USD failed around 1.0640 and aims for a downward extension towards 1.0500.

The EUR/USD pair advanced on Tuesday to reach 1.0644 early in the American session, later changing direction to end the day with modest losses around 1.0590. The Euro surged during London trading hours as hotter-than-expected Spanish and French inflation figures fueled speculation the European Central Bank (ECB) will continue hiking rates at least until early 2024. Hawkish comments from ECB officials further fueled the advance. ECB Chief Economist Philip Lane said on Tuesday that the “case for 50 bps rate hike in March remains solid,” reaffirming the well-known central bank message. Market players now see ECB’s terminal rate at 4%.

US data weighed on the Greenback, as the February CB Consumer Confidence Index fell for a second consecutive month. The index came in at 102.9, below the 108.5 expected, while the January reading was downwardly revised to 106. Additionally, the January Goods Trade Balance posted a deficit of $91.5 billion, while the Chicago Purchasing Managers’ Index declined to 43.6 in February. Finally, the Richmond Fed Manufacturing Index plunged to -16 in February from -11 previously and against the -5 expected.

On Wednesday, S&P Global will publish the final readings of its February Manufacturing PMIs for major economies, while Germany will unveil the preliminary estimate of the Harmonized Index of Consumer Prices (HICP) for the same month. Later in the day, the United States will publish the ISM Manufacturing PMI foreseen at 48 in February, up from 47.4 in January.

EUR/USD short-term technical outlook

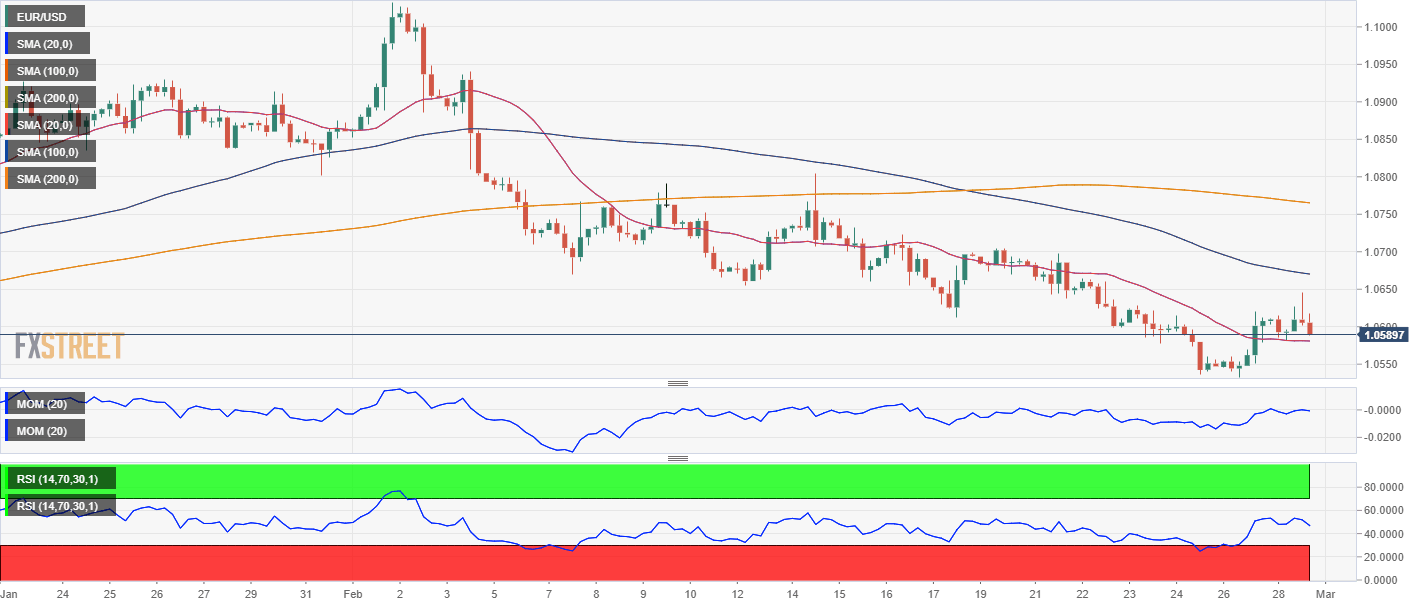

The EUR/USD pair failed attempt to regain the upside and run beyond 1.0640 has left the risk skewed to the downside. The daily chart shows that technical indicators are slowly turning south within negative levels while the pair keeps developing below a bearish 20 SMA. The 100 Simple Moving Average (SMA) retains its bullish slope at around 1.0460, providing relevant support. Ahead of it, the pair could find support at 1.0515, the 50% Fibonacci retracement of the 2022 yearly slump.

The 4-hour chart offers a neutral stance. EUR/USD is barely holding above a flat 20 SMA, while the longer moving averages continue to head south well above the current level, reflecting still strong selling interest. Finally, technical indicators hover around their midlines with divergent directional strength. The Momentum indicator heads marginally higher, but the Relative Strength Index (RSI) indicator turned south and currently stands at 47, hinting at another leg lower.

Support levels: 1.0560 1.0515 1.0460

Resistance levels: 1.0640 1.0695 1.0745

View Live Chart for the EUR/USD

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.