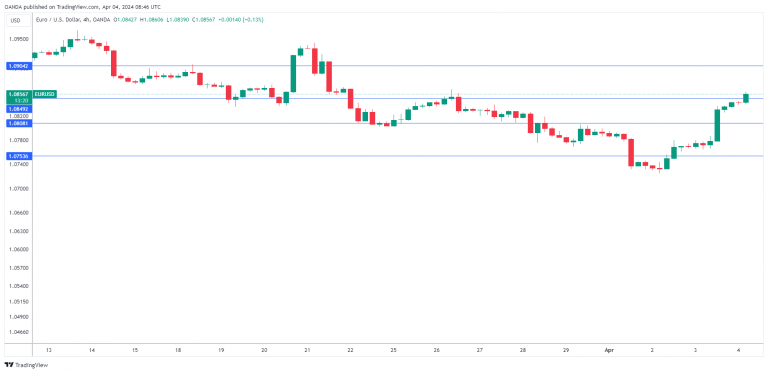

EUR/USD extends gains as Euro services PMIs improve

The euro is on a bit of a roll and has pushed slightly higher on Thursday. In the European session, EUR/USD is trading at 1.0857, up 0.19%. The euro is up for a third straight day and has climbed 0.8% since Monday.

Eurozone and German services PMIs accelerate

Business activity improved across the eurozone in March. The eurozone services PMI rose to 51.5, up from 50.2 in February. The German reading improved to a revised 50.1, up from 48.3 in February. This marks the first expansion in Germany’s services sector in six months. Spain, France and Italy all showed stronger expansion in March. The 50.0 line separates contraction from expansion.

The services sector has carried the eurozone economy as manufacturing continues to decline. The eurozone has managed to avoid a recession, but the economy remains fragile. At the same time, inflation has been falling faster than expected, and European Central Bank policy makers have the tough task of determining the appropriate time to start cutting the deposit rate, which is currently at a record high 4%.

The markets are anticipating a rate cut in June and some ECB members have publicly stated that they support such a move. ECB member Robert Holzmann, considered a hawk on rate policy, said on Wednesday that he isn’t against a June cut but would want to see more data before making a decision. Holzmann added that if the ECB lowers rates in June and the Federal Reserve stays on the sidelines, this would reduce the effectiveness of the ECB lowering its deposit rate.

In the US, employment numbers are in focus, with nonfarm payrolls on Friday. The markets are expecting a drop to 200,000 in March, compared to 275,000 a month earlier. Unemployment claims will be released later today and are not expected to show much change. The market estimate stands at 214,000, compared to the previous reading of 210,000.

EUR/USD technical

-

EUR/USD is testing resistance at 1.0849. Above, there is resistance at 1.0904.

-

1.0808 and 1.0753 are providing support.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.