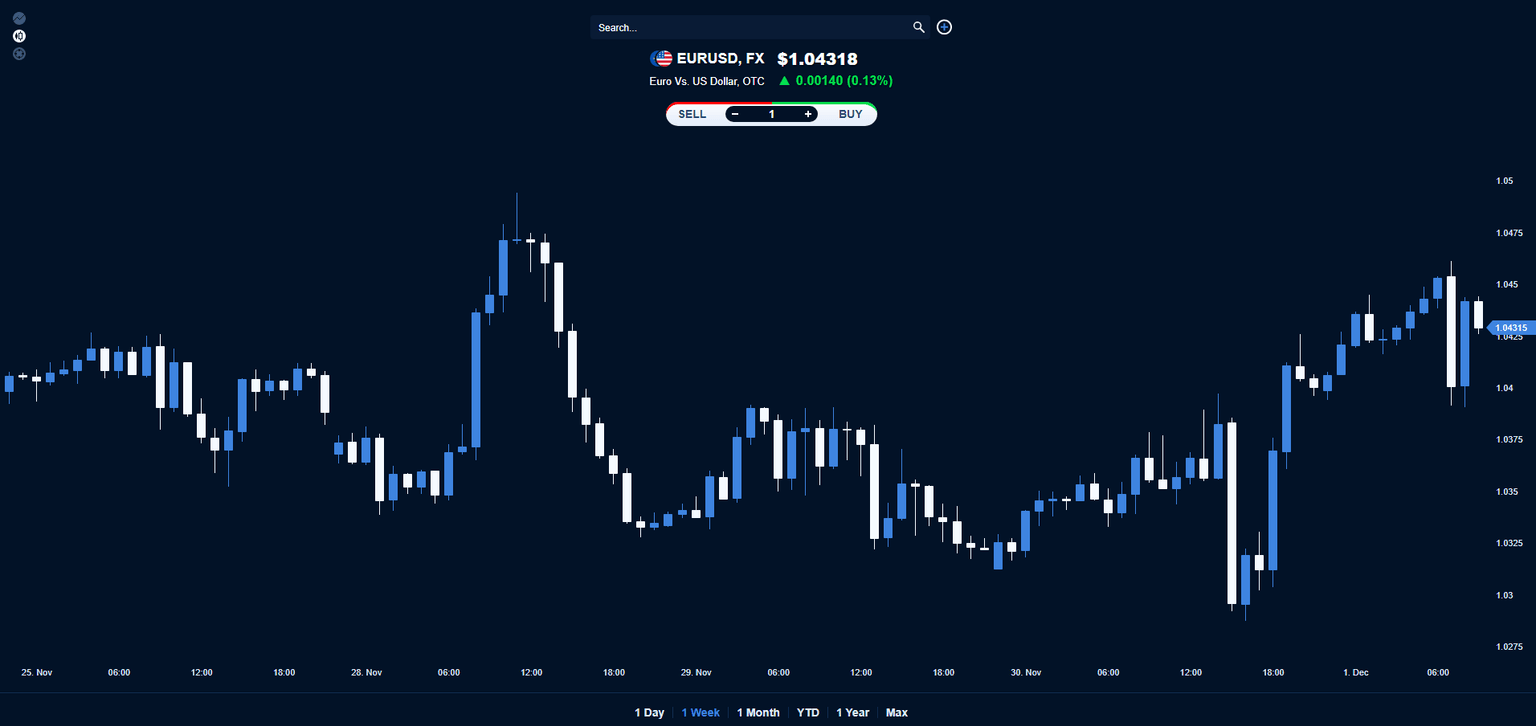

EUR/USD daily technical analysis: Could we see the major currency pair rising?

EUR/USD

Looking at EURUSD’s chart, we can see that the FX pair is traded just above its resistance level at around $1.0430 and after Jerome Powel’s speech last night where he indicated a slower pace of interest rate hikes, today we could expect the FX pair to rise towards the level of $1.05.

Author

AAATrade Team

AAATrade

The AAATrade Team has extensive experience in content writing for the financial industry. Stelios Nikolaou is the lead writer of the team, he currently works at AAATrade to provide research and content writing services.