EUR/USD Analysis: Finds support near 23.6% Fibo. ahead of US ISM PMI and Fed’s Powell

- EUR/USD attracts fresh buying and stalls a two-day-old corrective slide from a multi-month top.

- Subdued USD demand helps offset Thursday’s softer Eurozone CPI and lends support to the pair.

- The US ISM Manufacturing PMI could provide some impetus ahead of Fed Chair Powell’s speech.

The EUR/USD pair regains positive traction on Friday and recovers a part of the previous day's weaker Eurozone inflation-led slump to over a one-week low. According to the flash estimates published by Eurostat on Thursday, the Eurozone Harmonised Index of Consumer Prices (HICP) decelerated more than anticipated, to 2.4% YoY in November from 2.9% in the previous month. Adding to this, the Core HICP increased by 3.6% on an annual basis during the reported month, down from October’s final print of 4.2% and missing market expectations for a 3.9% rise. The data tempted traders to bring forward their bets for the first rate cut by the European Central Bank (ECB) and weighed heavily on the shared currency. That said, ECB officials have said that it may be too early to reduce interest rates. This, along with subdued US Dollar (USD) price action, acts as a tailwind for spot prices through the early European session.

The US macro data released on Thursday indicated that inflation continued to moderate in October and a slowing labor market. In fact, the US Commerce Department reported that the Personal Consumption Expenditures (PCE) Price Index was unchanged in October. Over the 12 months, the index registered the smallest year-on-year increase since March 2021 and decelerated from 3.4% to 3.0% in October. Moreover, the core gauge – the Federal Reserve's (Fed) preferred measure of inflation – rose by a modest 0.2% in October and saw an annual rise of 3.5%. Another report showed that Jobless Claims rose to 218K last week and 1.93 million people were collecting unemployment benefits the week that ended November 18 – the most in two years. This gives the Fed more incentive to hold rates steady and perhaps start cutting in 2024, which keeps a lid on the recent USD recovery from a multi-month low set on Wednesday.

That said, New York Fed Bank President John Williams, along with San Francisco Fed President Mary Daly, pushed back against expectations for a quick pivot to rate cuts and left the door open to further tightening should the progress on inflation stall. This, along with the prevalent cautious market mood, acts as a tailwind for the safe-haven buck and might hold back traders from placing aggressive bullish bets around the EUR/USD pair. A private survey showed that business activity in China's manufacturing sector unexpectedly expanded in November. The official reading released a day before, however, indicated persistent weakness in the sector. Mixed economic signals from the world's second-largest economy weigh on investors' sentiment ahead of Fed Chair Jerome Powell's speech. Investors will look for more cues on interest rates, which will influence the USD price dynamics and provide some meaningful impetus to the major.

Heading into the key event risk, the release of the US ISM Manufacturing PMI could produce short-term trading opportunities around the EUR/USD pair. Nevertheless, spot prices, for now, seem to have snapped a two-day losing streak and stalled this week's retracement slide from the 1.1015 area, or the highest level since August 10.

Technical Outlook

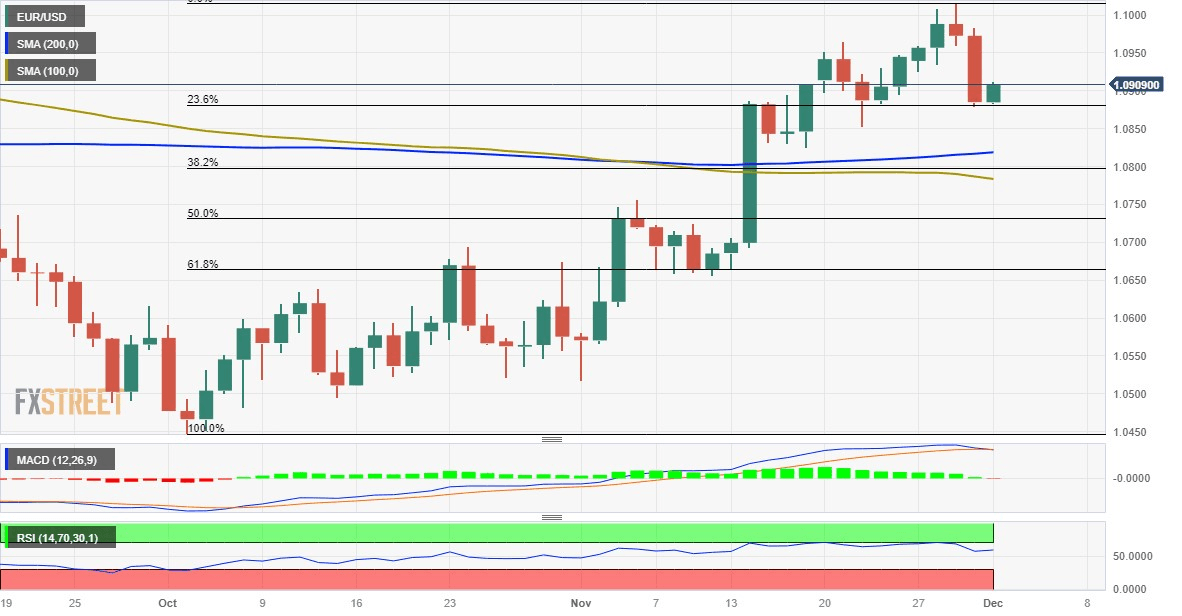

From a technical perspective, the EUR/USD pair managed to defend the 23.6% Fibonacci retracement level of the October-November rally. This, in turn, warrants some caution before positioning for a deeper corrective decline. Moreover, oscillators on the daily chart are holding in the positive territory, which favours bullish trades and suggests that the path of least resistance for spot prices remains to the upside.

That said, any subsequent move-up might now confront resistance near the 1.0945-1.0950 area. A sustained strength beyond should allow bulls to make a fresh attempt to conquer the 1.1000 psychological mark. Some follow-through buying could lift the EUR/USD pair towards the August monthly swing high, around the 1.1065 area, en route to the 1.1100 mark and the next relevant hurdle near the 1.1150 region (July 27 swing high).

On the flip side, the 1.0880-1.0875 zone (23.6% Fibo. level) might continue to offer some support, below which the EUR/USD pair could slide to 1.0820-1.0810 confluence. The latter comprises the 200-day Simple Moving Average (SMA) and the 38.2% Fibo. level, which is closely followed by the 100-day SMA, currently near the 1.0785 region. Failure to defend the said support levels could shift the near-term bias in favour of bearish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.