EUR/USD Analysis: Chances of an earlier Fed rate hike capped the post-US CPI recovery

- The post-US CPI USD selling prompted some short-covering move around EUR/USD on Wednesday.

- Hawkish FOMC meeting minutes helped limit the USD losses and capped the upside for the major.

- The lack of follow-through buying suggests that the recent bearish trend is still far from being over.

The EUR/USD pair witnessed a short-covering move on Wednesday and rallied around 70 pips from YTD lows touched in the previous day. The momentum was exclusively sponsored by a broad-based US dollar weakness, which witnessed a typical 'buy the rumour, sell the fact' kind of a reaction following the release of US consumer inflation figures. The headline US CPI rose 0.4% in September, lifting the yearly rate to 5.4%, both coming in slightly higher than market expectations. Investors, however, seem aligned with the Fed's transitory inflation narrative. This was evident from a further decline in the longer-dated US Treasury bond yields and exerted downward pressure on the greenback.

The momentum pushed the pair to over one-week tops during the Asian session on Thursday, though bulls struggled to capitalize on the move beyond the 1.1600 mark. The minutes of the FOMC monetary policy meeting held on September 21-22 revealed that the US central bank remains on track to begin tapering its bond purchases in 2021. Moreover, a growing number of policymakers were worried about the continuous rise in inflationary pressure. This, in turn, forced investors to bring forward the likely timing of a potential rate hike to September 2022 from December 2022 already priced in. Hawkish Fed expectations extended some support to the greenback and capped any further gains for the major.

That said, the risk-on impulse in the equity markets acted as a headwind for the safe-haven USD and should help limit any meaningful slide for the pair. The USD price dynamics will continue to play a key role in influencing the pair's intraday momentum amid absent relevant market-moving data from the Eurozone. Meanwhile, the US economic docket features the release of the Producer Price Index (PPI) and the usual Weekly Initial Jobless Claims. This, along with the US bond yields and scheduled speeches by influential FOMC members, will drive the USD demand and provide some impetus to the major.

Short-term technical outlook

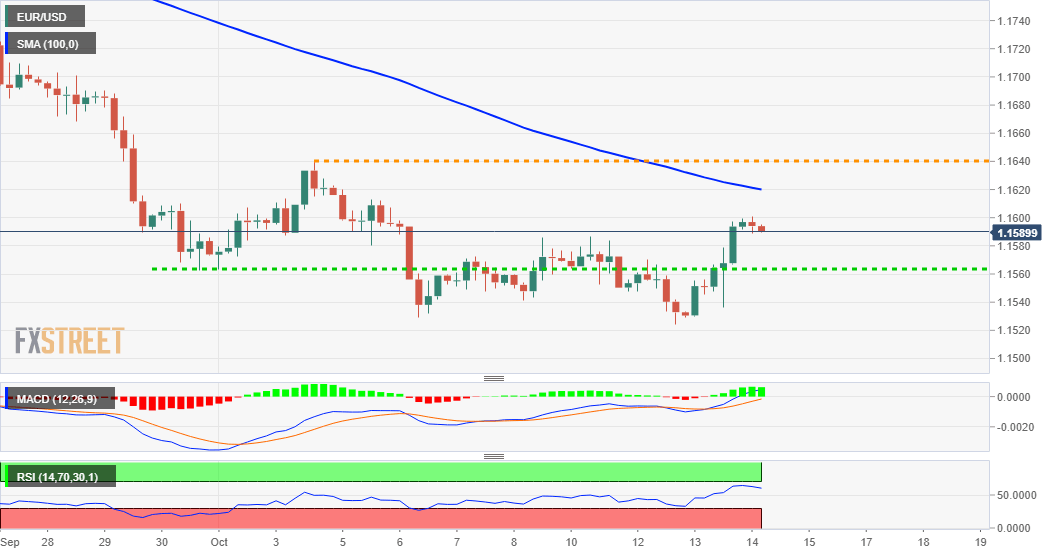

From a technical perspective, the pair’s inability to build on the overnight strong recovery move suggests that the recent bearish trend might still be far from being over. That said, acceptance above the 1.1600 round figure has the potential to lift the pair back towards monthly swing highs, around the 1.1640 region touched on September 4. Some follow-through buying should pave the way for a move beyond the 1.1665-70 intermediate hurdle, towards reclaiming the 1.1700 mark.

On the flip side, any meaningful pullback now seems to find decent support near mid-1.1500s. This is followed by YTD lows, around the 1.1525 region and the key 1.1500 psychological mark. Failure to defend the mentioned support levels will reaffirm the near-term bearish bias and prompt aggressive technical selling. The pair might then accelerate the downward trajectory towards testing the next relevant support near the 1.1430-25 region before eventually dropping to the 1.1400 level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.