EUR/NZD Ponders Range Breakout

EUR/NZD is probing a pivotal level as we venture towards the new year.

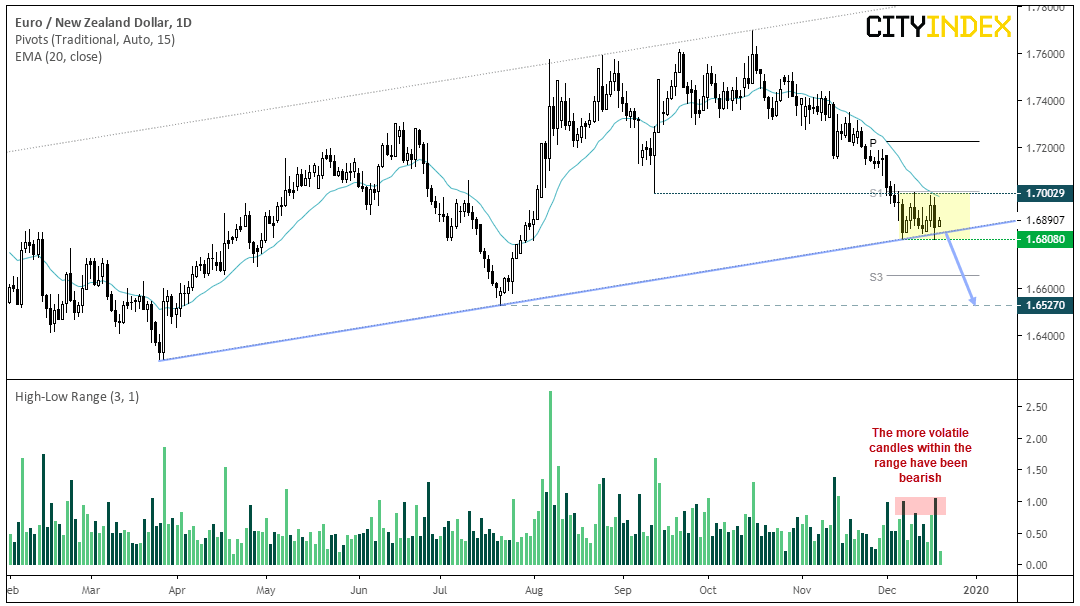

In the 6th December, EUR/NZD tested the March trendline and began to rebound. Given the general lack of pullbacks since the decline from 1.7700, it was plausible to expect a larger rebound than the one that occurred. Yet 9 sessions later, its probing the said trendline once more and could be building up for a break lower.

There’s a clear range between 1.6808 and 1.7003 which, once broken, could mark its next significant move. Yet given the more volatile candles within this range have been bearish, and the prior move was also a downtrend, a downside break is currently favoured. Furthermore, the 20-day eMA and monthly S1 are also capping as resistance. (The S2 has been removed as price action is currently ignoring it, therefor is of no significance to the analysis.)

-

Bias remains bearish below the 1.7003 high.

-

A break below 1.6808 (or 1.6000 for extra confirmation) assume the bearish breakout is underway. Another approach for bears to consider is fading into low volatile moves below 1.0700, in anticipation of an eventual breakdown.

-

The lows around 1.6530 make a viable target although the monthly S3 pivot around 1.6660 could also be considered (take note, the pivot levels will change in January).

-

A clear break above 1.7003 invalidates the near-term bearish bias.

Author

Matt Simpson, CFTe, MSTA

CityIndex

Matt Simpson is a certified technical analyst who combines charts and fundamentals to generate trading themes.