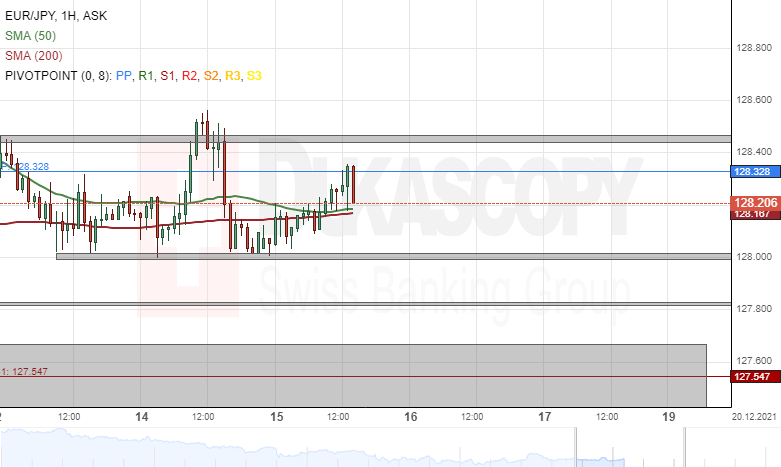

EUR/JPY analysis: Remains near 128.00

EUR/JPY

Despite a surge above the previous week's high levels, the EUR/JPY eventually retraced back to the support of the 128.00 level. On Wednesday morning, the pair had returned to trading between the 128.00 mark and the resistance of the 50 and 200-hour simple moving average near 128.20.

In the case that the rate declines below the 128.00 level, the EUR/JPY might find support first in the Friday low level at 127.80. Below the 127.80 level, note a strong support zone at 127.40/127.66.

On the other hand, a surge of the rate would have to pass the resistance of the 50 and 200-hour SMAs at 128.20, the weekly simple pivot point at 128.33 and the high levels near 128.45 and 128.55, before aiming at the 129.00 mark.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.