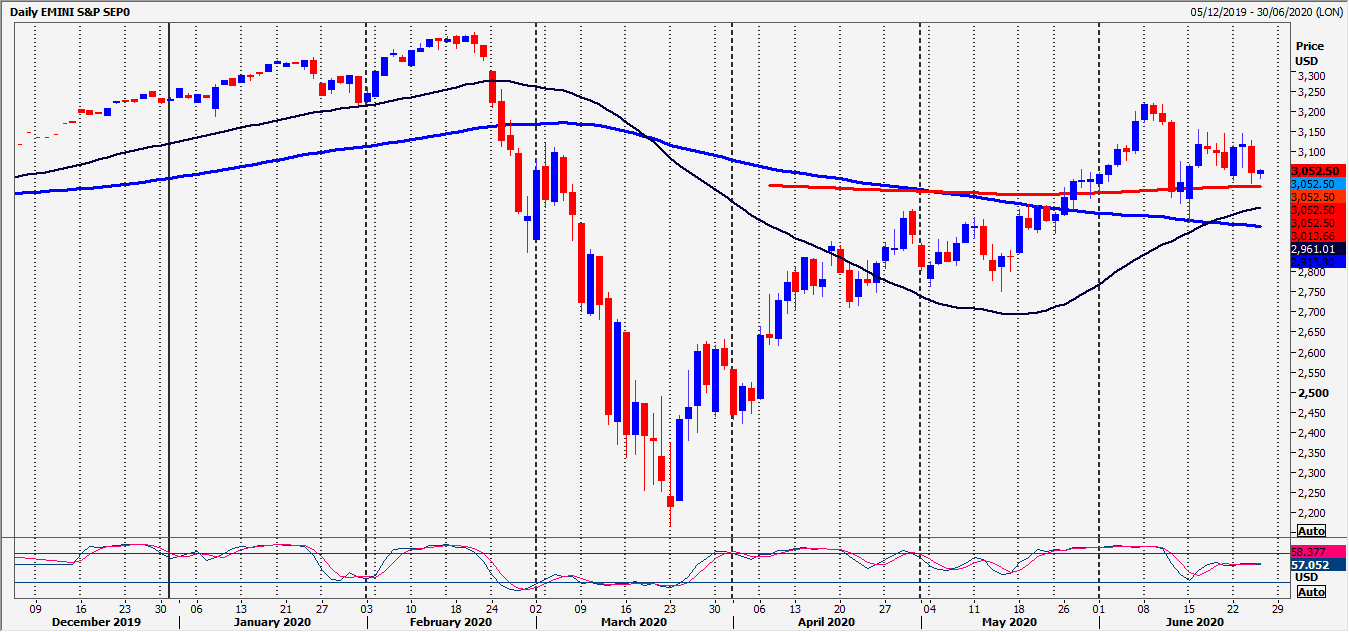

Emini SP 500: Minor resistance at 3060/70

Emini S&P September Futures broke 3110/00 & initially bounced from the first target of 3083/81, giving us a chance to short at 3100/10. We then collapsed hitting all targets of 3070/60, 3040, 3030 & 3025/23.

Nasdaq September Futures remain choppy. Longs at 10090/070 were stopped below 10030 but we hit the next target & buying opportunity at 9950/30 & bottomed exactly here. This level has offered more than 1 opportunity to turn a 100 tick profit, so obviously remains key to direction today.

Today's Analysis

Emini S&P minor resistance at 3060/70 on the bounce but try shorts at 3090/3100 with stops above 3110. A break higher targets 3125/28, perhaps as far as 3140/45.

Failure to beat 3060/70 sees a retest of 3025/23. On further losses look for 3015/11 perhaps as far as 3000/2995. We should meet strong support at 2982/78.

Nasdaq likely to remain choppy but longs at 9950/30 are working as a scalping level. First resistance at 10050/080. Shorts need stops above 10110. A break higher is a buy signal targeting 10155/165 & 10220/230 before a retest of 10285/295. A break higher in the bull trend target 10360/380 & 10440/460.

Longs at 9950/30 stop below 9890. This is a sell signal targeting 9840/30 & 9780/70, perhaps as far as 9730/20.

Trends

Weekly outlook is positive.

Daily outlook is positive.

Short Term outlook is neutral.

Author

Jason Sen

DayTradeIdeas.co.uk