Emini Dow Jones: First resistance at 25890

Emini Dow Jones – Nasdaq

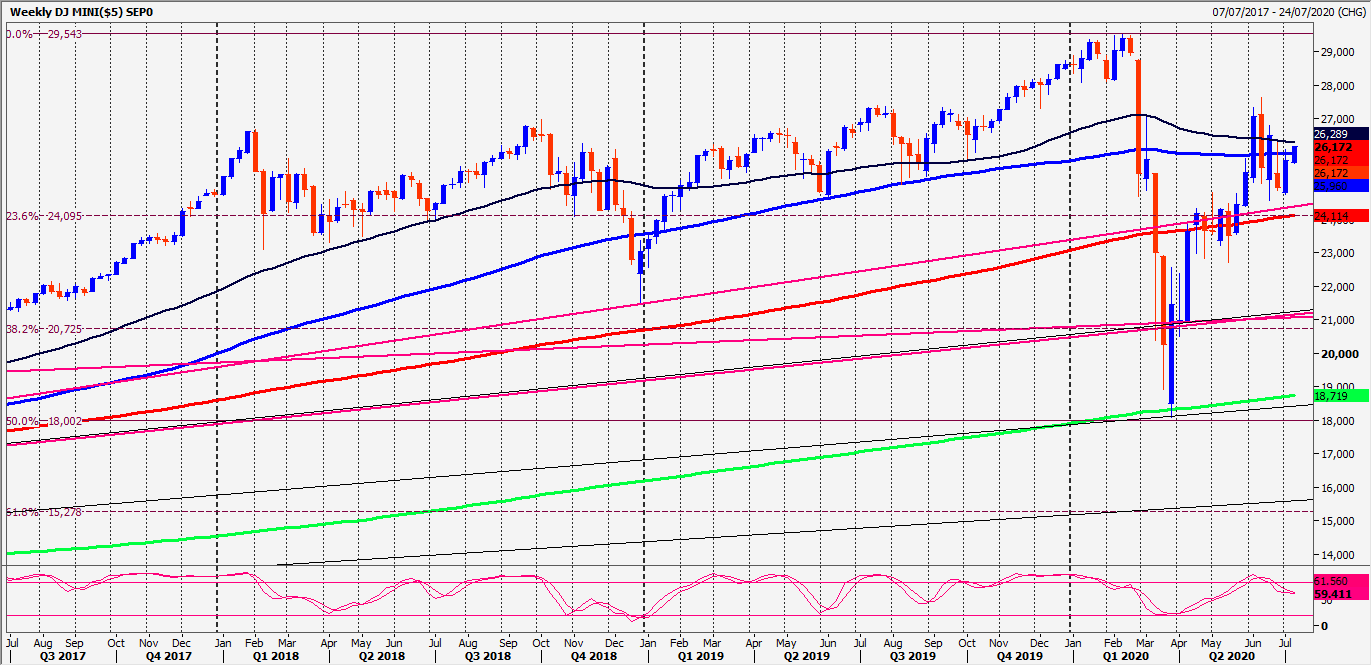

Emini Dow Jones September Futures sold off from the next target of 26250/290 as expected. We broke first support at 26060/040 to bounce just above 28810/790 & then topped exactly at 26060/040 on the bounce.

Nasdaq September Futures likely to have made a short term top in overbought conditions, but there's no sell signal. A consolidation possible in the days ahead as suggested yesterday. No surprise therefore to see us test & hold strong support at 10530/520.

Daily Analysis

Emini Dow Jones fell as far as 25741. Watch first resistance at 25890/920. Holding here retargets 25750/740 with first support at 25720/690. A break lower targets 25600, perhaps as far as 25520/500.

First resistance at 25890/920 but above 25980 allows a further recovery to 26080/100 before a retest of 26250/280.

Nasdaq bulls need prices to hold above 10550 for a recovery to 10600/610. Gains are likely to be limited But further gains can target 10650/670 with potential resistance at the new all time high at 10685/695, where we hit profit taking yesterday. Shorts still not a safe bet. A break above 10710 then next buy signal.

Best support at 10470/440. Try longs with stops below 10390. A break lower targets 10325/315.

Trends

Weekly outlook is positive.

Daily outlook is positive.

Short Term outlook is neutral.

Author

Jason Sen

DayTradeIdeas.co.uk