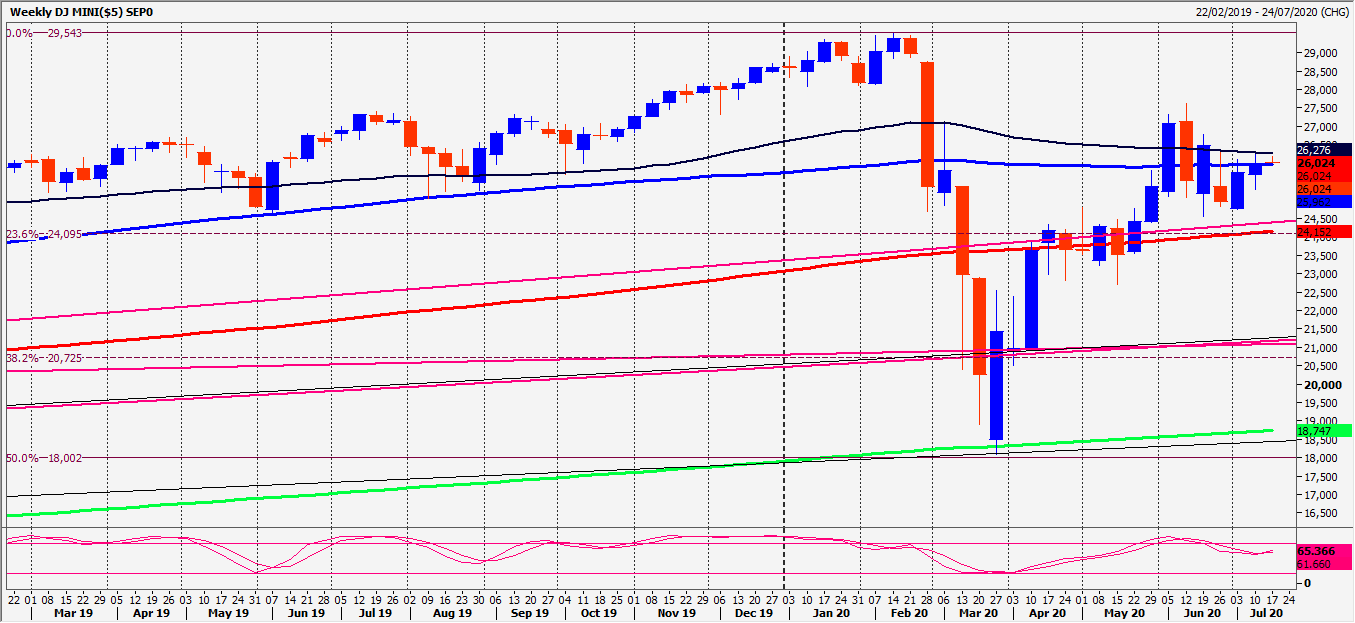

Emini Dow Jones: A break below 25700 targets support at 25400

Emini Dow Jones_Nasdaq

Emini Dow Jones September Futures shot higher through the 200 day moving average at26180/200 with shorts stopped above last week's high at 26280. We hit the next target of 26450/480, then unexpectedly crashed almost 600 points from 26524.

Nasdaq September Futures continued higher to test the big 11,000 number, reaching a newall time high 11058. Finally severely overbought conditions kicked in, as we crash 500 points,leaving an important negative candle. Bulls who bought since Thursday now trapped in losing positions & this should weigh on any recovery attempts today.

Daily Analysis

Emini Dow Jones hits the lower target of 25540/500 & is holding over night. Having spectacularly rejected the upper end of the 1 month range, we clearly remain in a difficult sideways trend. Holding first resistance at 26200/300 targets the best support for today at 25900/800. Longs need stops below 25700. A break below here targets support at 25400/300. Longs need stops below 25200.

First resistance at 26200/300 but above here allows a retest of 26500/525.

Nasdaq negative candle signals a neutral/negative outlook to ease severely overbought conditions. It is now risky to hold longs after what could be considered a short term sell signal. Holding first resistance at 10665/695 targets minor support at around 10560 & last week's mid week low at 10505 before strong support at 10430/410. Brave bulls, who feel theneed to buy the dip can try longs with stops below 10350. A break lower targets 10300/290 then support at 10220/200.

Shorts at first resistance at 10665/695 stop above 10760. A break higher targets resistance at 10870/900.

Trends

Weekly outlook is positive.

Daily outlook is positive.

Short Term outlook is neutral.

Author

Jason Sen

DayTradeIdeas.co.uk