Economic data continues to slow in the US

Highlights:

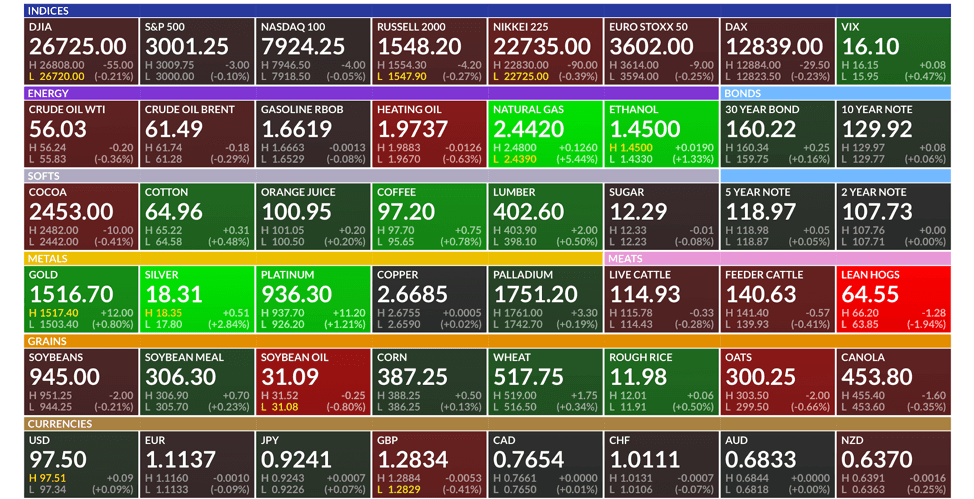

Market Summary: The global stock market (VT) was up 0.21% yesterday. The top performing broad stock market was the Nasdaq 100 (QQQ), finishing higher by 0.97%. Gold was also stronger on the day, closing up 0.71%. The worst performing segment of the market was transportation equities (IYT), which closed lower -0.49%.

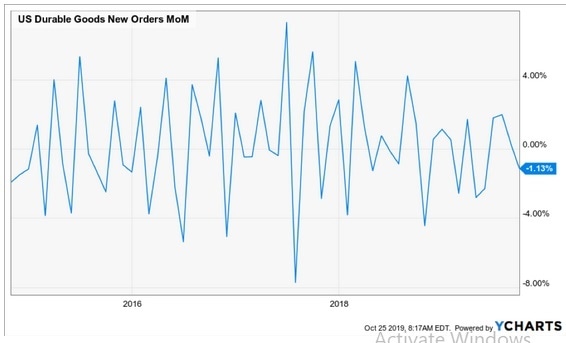

Durable Goods: Durable goods orders were down -1.13% month-over-month. The GM strike and Boeing debacle exacerbated the headline decline. Nevertheless, economic data continues to slow in the U.S.

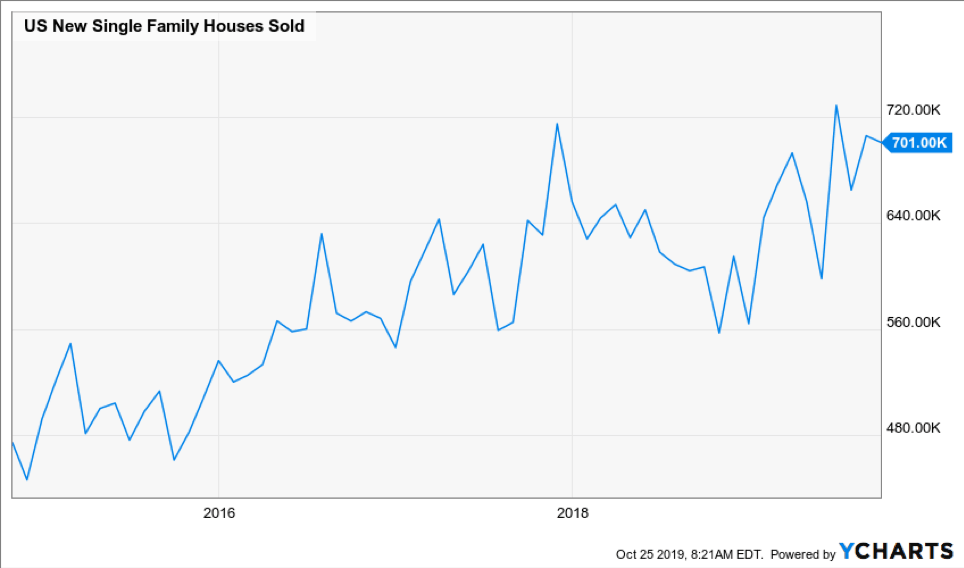

New Single-Family Homes Sold: New home sales were down -0.71% month-over-month. 701k homes were sold last month, down from 706k the month prior. Lower mortgage rates have helped home sales rebound from the sharp slowdown we saw in 2018.

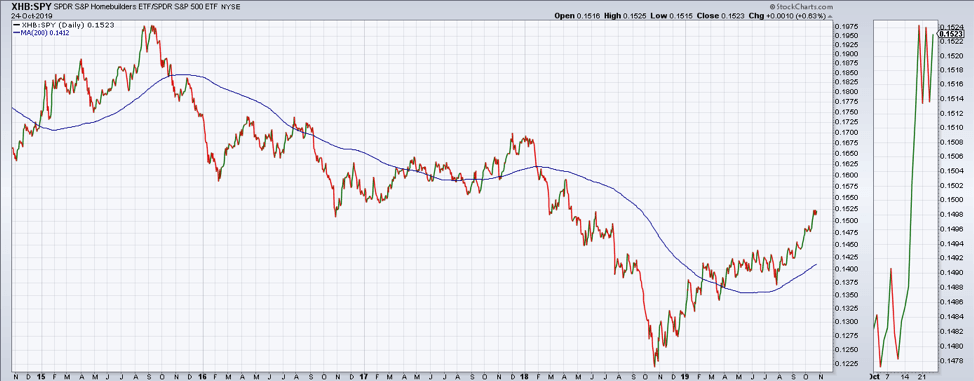

Homebuilders: The homebuilding sector (XHB) is in a strong positive trend relative to the broad market. Relative to the S&P 500, XHB was up 0.63% yesterday and is firmly above its 200-day moving average. A continued uptrend in homebuilders could suggest consumer strength and a potential rebound in U.S. economic activity.

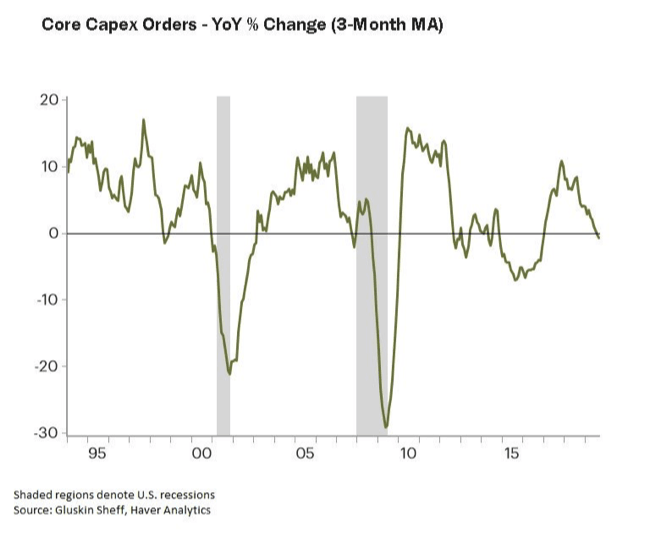

Chart of the Day: The three-month moving average of core capex orders are now down year-over-year. Hopefully a rebound will occur, and this is just a slowdown. If not, the decline in capex could suggest a contraction is on deck.

Futures Summary:

News from Bloomberg:

Indonesian investigators found scores of problems tied to last year's fatal Lion Air flight, from Boeing 737 Max design flaws to certification failures by U.S. regulators and pilot error. A day before the crash, pilots ignored a malfunctioning airspeed indicator and took off, people familiar said. Still, its proposed fix looks quite convincing and robust, India's aviation safety regulator said. Here's a guide to when the Max might fly again.

China fired back at Mike Pence's criticism on human rights, calling his speech "lies" and chiding him for ignoring U.S. problems like racism and wealth disparity. Pence yesterday criticized China's actions against protesters in Hong Kong while calling for greater engagement between the two countries. Hua Chunying, a spokeswoman for China's foreign ministry, blasted his "arrogance."

Jeff Bezos is about to relinquish the title of world's richest person to Bill Gates, as Amazon's stock tumbled in late trading after earnings. Shares dropped 8.1% to $1,637. At that price, Bezos would have a net worth of $102.8 billion, almost $5 billion behind Gates, according to the Bloomberg Billionaires Index. Bezos took the top spot from Gates in October 2017.

California is braced for more wildfires and possibly the biggest deliberate blackout yet. PG&E warned that millions face two days without power this weekend, when the strongest wind storm in years is expected to hit. One of its transmission lines went down minutes before a blaze was reported in the vineyards of Sonoma County that has scorched 16,000 acres and forced 2,000 people to flee.

U.S. stock futures edged up, shares in Europe fell and Asian shares were steady as earnings season gives investors a mixed picture of how corporations are coping with slowing growth in the global economy, trade tension and Brexit. The dollar fell. Treasuries and gold were steady. Oil declined.

Author

Clint Sorenson, CFA, CMT

WealthShield